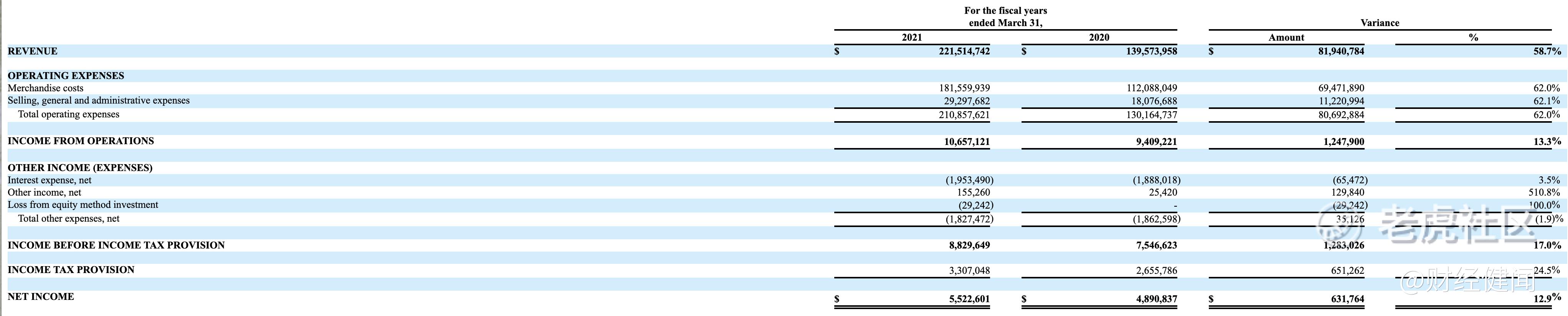

Yoshitsu Co., Ltd, a Japanese beauty and health products retailer and wholesaler, debuted on the Nasdaq Stock Exchange under the ticker symbol “TKLF” on Tuesday. The shares opened at $40.99, up 924% from the stock’s offer price. The stock closed at $31, soaring 700% higher for the first day of trading. The company has earned $221.51M in revenue and made a profit of $5.52M for the 12 months ended March 31st, 2021, despite the adverse impact caused by the COVID-19 pandemic on the retail industry.

Yoshitsu Co., Ltd issued 6,250,000 American Depositary Shares (“ADSs”) at a price to the public of $4.00 per ADS, which included 250,000 ADSs issued pursuant to the partial exercise of the underwriters’ over-allotment option. Each ADS represents one ordinary share of the company. The IPO enabled Yoshitsu to receive aggregate gross proceeds of $25M, before deducting underwriting discounts and other related expenses. Univest Securities, LLC acted as the sole book runner and Valuable Capital Ltd. acted as a co-manager to the offering.

Headquartered in Tokyo, Japan, Yoshitsu Co., Ltd is a retailer and wholesaler of Japanese beauty and health products, as well as other products. The company offers approximately 12,400 stock keeping units (“SKUs”) of beauty products, including cosmetics, skin care, fragrance, and body care, among others, 3,600 SKUs of health products, including over-the-counter (“OTC”) drugs, nutritional supplements, and medical supplies and devices, and 7,900 SKUs of other products, including home goods, food, and alcoholic beverages.

The company sells its products through directly-operated physical stores, online stores, and franchise stores to retail and wholesale customers in Japan, China, the U.S., Canada, and the U.K. Even though China market has contributed to more than half of its revenue for the past two years, Yoshitsu attaches importance to balance in different markets. The Director of Yoshitsu, Mr. Sen Uehara, said, “China is one of the indispensable markets, but we aim to diversify our development in different markets. In the future, we plan to expand the sales markets in Canada, the United States, Europe, and East Asia.”

Due to the pandemic, the global supply chains issue has become one of the biggest challenges in 2021, spawning shortages, price hikes, and maritime traffic jams that could be seen from space. However, the sourcing issue does not trouble Yoshitsu that much. The company has established long-term relationships with over 90 suppliers, consisting primarily of cosmetics and pharmaceutical companies and distributors, including many well-known Japanese brands, such as Shiseido, Sato, Kao, and Kosé. The extensive network of suppliers ensures the global supply chains issue does not materially affect Yoshitsu’s business or the results of the operations.

Nevertheless, the shipping fee has inevitably increased. “With the sales raising from 10.7 billion yen in 2019 to 23.4 billion yen in 2021, we’ve witnessed the shipping fee went up from 890 million yen to 1.9 billion yen,” Uehara said, adding, “The sales packing fare rate was up from 1.72% to 4.26%, about 2.5 times up. We’ve already reduced distribution costs by shipping all at once instead of shipping multiple times where the basic charge of the delivery company has increased by 3 or 4 times.”

According to its SEC filings, the current management team is comprised of highly-skilled and dedicated professionals who have wide ranging experience in retail, services, management, business development, and marketing. The representative director, Mr. Mei Kanayama, has 10 years of experience in retail and wholesale of Japanese beauty and health products. The director, Mr. Sen Uehara, has 14 years of experience in management. The senior management team believe they are able to leverage the capabilities of this broader work force to facilitate their ongoing and long-term relationships that are key to the retail and wholesale businesses.

Due to the growing popularity of online shopping, e-commerce has been growing rapidly in recent years. As a result, the company has steady growth, despite the spreading pandemic. The total revenue increased by $81.94M or 58.7%, from $139.57M for the fiscal year ended March 31st, 2020 to $221.51M for the fiscal year ended March 31st, 2021. The gross profit increased by $12.47M, or 45.4%, from $27.49M to $39.95M; the company also reported a net income of $5.52M and $4.89M for the fiscal year ended March 31st, 2021 and 2020, respectively.

The SEC form F-1 shows that net proceeds from the IPO will be used for opening new directly-operated physical stores and adding franchise stores, brand marketing, improving distribution centers and logistics systems, and talent acquisition and retention.

精彩评论