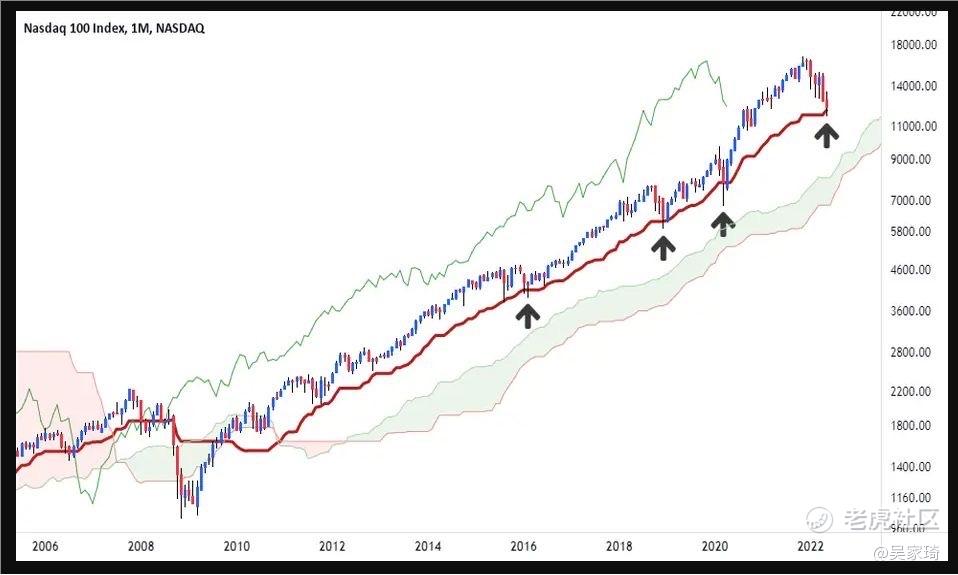

The following chart depict the Nasdaq 100 Index from 2006 until today. This time horizon was chosen to include the GFC crash. The technical indicator that was used is the Ichimoku Kinkō Hyō.

The Ichimoku Kijun sen throws up some very interesting insights:

1) The Kijun is simply the highest high to lowest low midpoint of the last 26 periods. In this case 26 periods refer to 26 months.

2) In the recovery phase after the 2008-2009 crash readings climbed above the Kijun sen in September 2009. After this occurance all subsequent corrections took support at the same line or slightly above it before the rally resumed.

3) Starting from febuary 2016, there were 4 occasions (including the current one) when the monthly candle broke the Kijun via a bearish candle, but not in a single instance was the close below the Kijun. Also, in every case, the very next candle was bullish!

Refering to the above insights:

1) We don't know how the month's close will look. It looks like Bulls have managed to hold some critical long term support level, for now

2) It has to be mentioned that there is of course no statistical significance in three monthly candles, but the recovery has been very similar each time

In addition to those technicals global valuations seem reasonable, small caps undervalued and even some high growth tech stocks only slighty overvalued. Asset managers are net short and the sentiment of retail investors is quite extreme. The media narrative is that the hawkish fed shift is causing a recession. Allthough that might be true the magnitude of this recession seems exaggerated. With inflation expectations going down recently the FED might have a reason to pause or slow down the current path of quantitative tightening.

In conclusion, look for a close above the Kijun, even if the monthly candle ends in the red. If the readings close below the the Kijun this month there could be additional downward pressure ahead. (Not my preferred scenario) Fundamentals and sentiment also seem very bullish. All data suggest: Long term investors should buy this dip now!

精彩评论