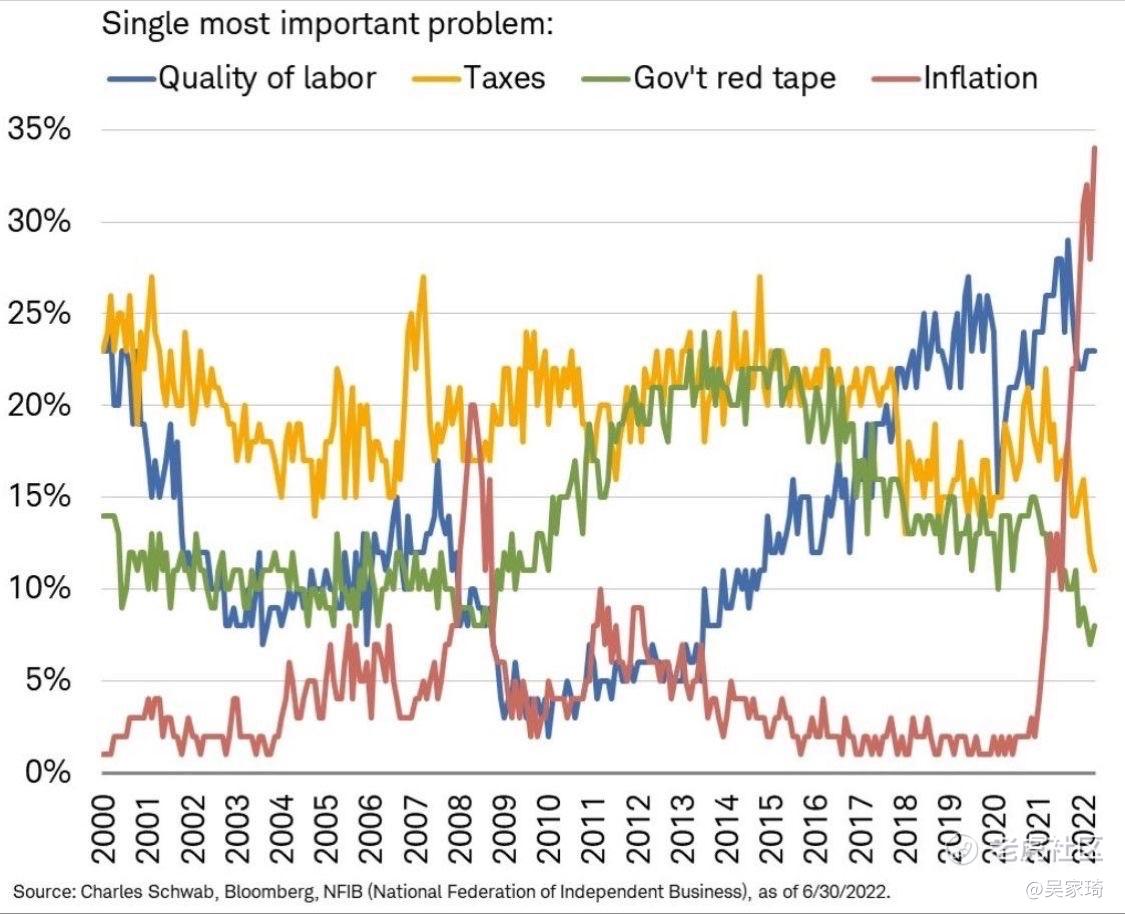

Highlights the swings of small business concerns is illustrative of how CEOs must face a constant blend of challenges across cycles …. now, inflation and labor is at the top of the Hot List … at times, it is taxes or government.

But … there are always taxes and government … what is unusual is the extended economic growth and tight labor supply during inflation ….

The goal is to avoid stagflation.

Perhaps labor rebalancing will be a lagging indicator following the income diluting effects of inflation …. And if this is the case naturally as firms do slow hiring, if there is anticipated energy (or even caps globally), and labor rebalancing then how far should the government banks go to “force” price stability?

Of course in monetary policy, banks in the large economies can act, but the emerging economies may not be able to in synch; and have the “little fires” to deal with noted by El-Erian.

Perhaps it is time for a Grand Plan of a more robust nature …. In the past there was the Marshall Plan, Bretton Woods, and the NGOS - IMF, WORLD BANK, etc

Where is fiscal policy ? Where are the bright minds?

Where is the pro active input by corporates ? Or government and corporates ?

Corporates can contribute to inflation in their own ways … just in time inventory is powerful when it works; and inflation stimulating when supply chains bottleneck.

It may be a new era of capitalism in the works.

精彩评论