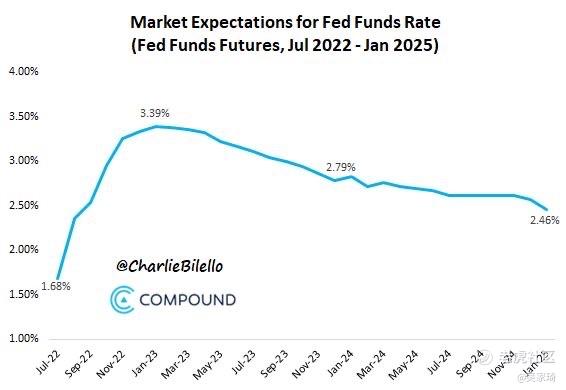

The Market is currently pricing in continued Fed rate hikes through year end (to 3.25%-3.50%) but then a sharp reversal in policy with rate cuts already in 2023.

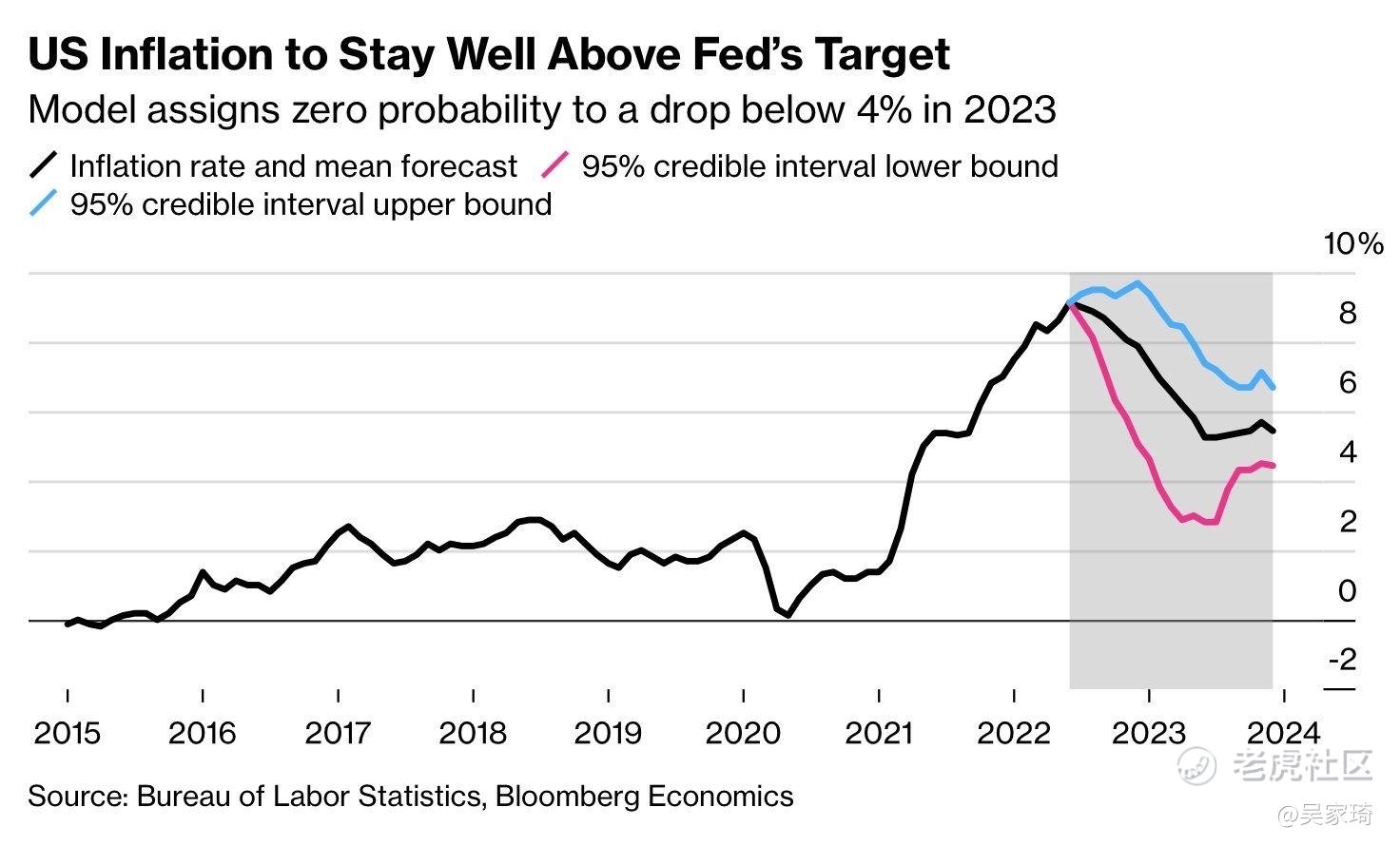

"US inflation may be close to a peak, but it's very likely to stay above 8% through year-end.

Bloomberg Economics' model assigns zero probability to a drop below 4% in 2023.'

Sure, at some point we'll see peak inflation, but that doesn't mean inflation will fall below 4% or suddenly, miraculously, return to around 2%.

The market is expecting inflation of 4-6%, so what's to stop the Fed from raising rates to 4.5-5% instead of the 3.25-3.50% expected now?

精彩评论