The Energy crunch in Europe

1) Energy induced Recession = lower EUR

2) Recession Risk = higher credit spreads and peripheral spreads = lower portfolio inflows

3) Higher cost of manufacturing, shortage of key supply chain materials increase inflation pressure and growth pressure

4) Factory shutdowns = potential higher unemployment

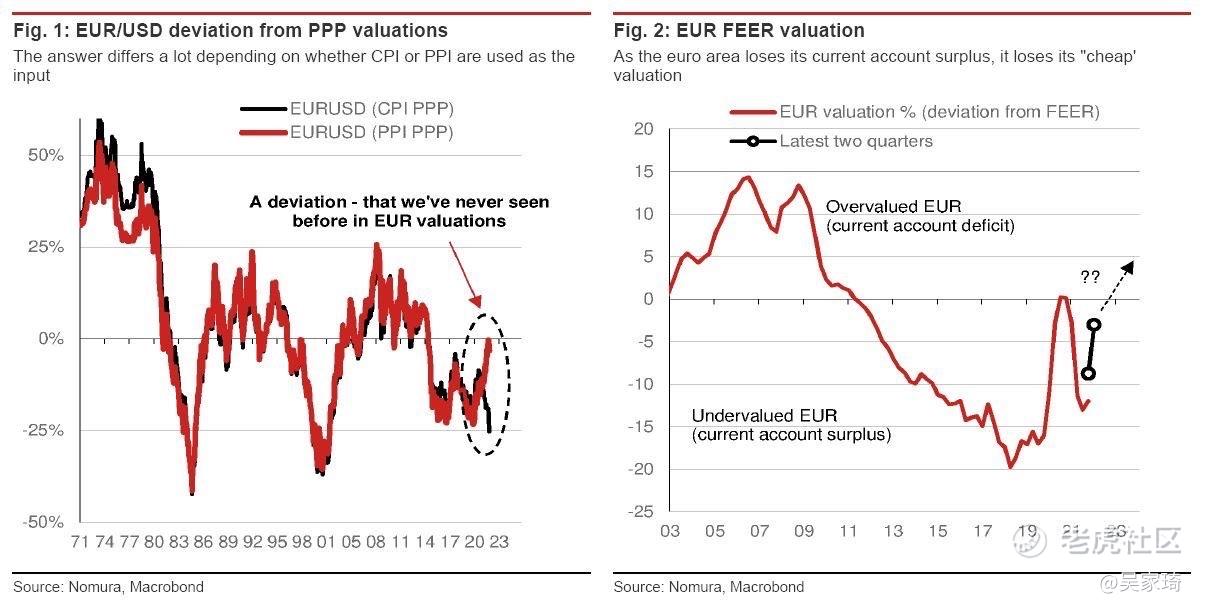

Essentially the Euro area's cost of energy is 3-4 times higher than that of the US and this key disadvantage for Euro manufacturing requires a weaker currency

ECB can make all the noise they want on FX but with 214bps priced over 2yrs already - not really much they can speak up.

Is USD parity Around the corner?

精彩评论