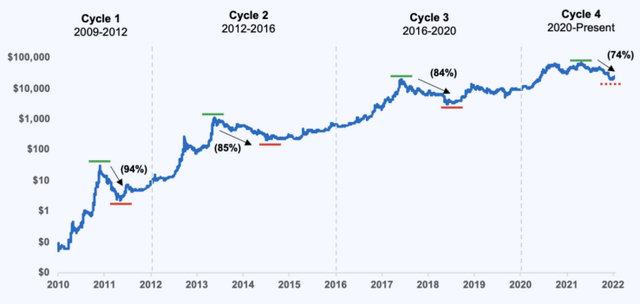

Among broader market participants, sentiment surrounding the crypto space is near a two-year low. Bitcoin (BTC-USD) is down 70% in U.S. dollar terms from its highs a year ago and currently sits just 10% above its 52-week low of $17,700. Coinbase (NASDAQ:NASDAQ:COIN), the leading U.S. digital asset marketplace, has suffered with this year's correction and is also down substantially, off near 80% from its 2021 IPO. In June CEO Brian Armstrong announced an 18% reduction in team members and the company's all-important retail trading revenues likely hit a fresh 18-month low in the recent third quarter.

So... is the time to build a contrarian position in Coinbase approaching? Bitcoin and crypto prices have been strongly cyclical in the past and the company actually has a mantra:

It's never as good as it seems, and it's never as bad as it seems.

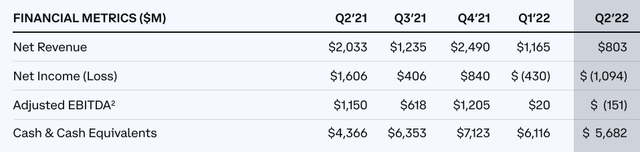

Source:Second Quarter 2022 Shareholder Letter, 8/9/2022

The article below looks at the trends in Coinbase's revenue composition, expense structure, and profitability and agrees with the "never as bad as it seems" position. Just as an introduction to this idea, consider the loss in the most recently reported second quarter. The adjusted EBITDA of negative $151 million is relatively small compared to the top-line history, such as the $5.8 billion in TTM revenues. The loss is also small relative to the balance sheet strength, with Coinbase's substantialnetcash position currently over $2.5 billion.

The article also tries to consider a valuation for the tech and administrative buildout the company has amassed by looking at the revenue and earnings story compared to enterprise value. Also covered are two primary risks Coinbase faces. Interestingly, these aren't competition related but rather the general health of the crypto sector including regulatory concerns and the broader macro environment.

Despite Downturn, Q2 Volume Over $200b

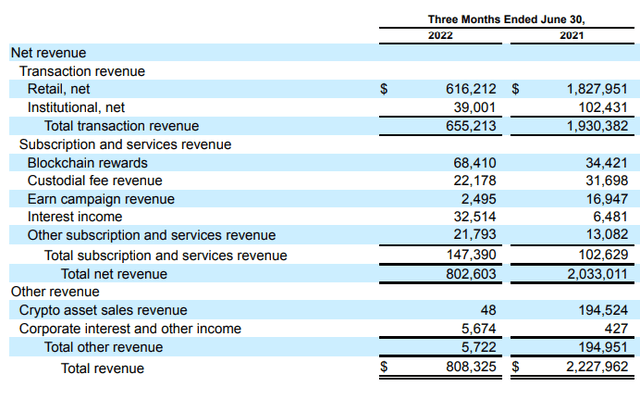

Though revenue sources are evolving, retail transaction revenue is the mainstay of Coinbase's business. During the height of last year's retail mania, 82% of total revenues came from retail transaction fees. Over the past year, this share only decreased to 77% of the total. This component will remain the key metric and profit center for the company.

The chart above, with both Q2 2021 and 2022 shown, provides a good picture of the revenue composition and revenue trends. As discussed above, transaction revenue remains the cornerstone of Coinbase's business. And the steep decline in revenues was driven by a fall in trading volume from $462 billion in Q2'21 to $217 billion in Q2'22. For reference, transaction revenue as a percent of volume was .3% in Q2'22 compared to .42% of Q2'21 volume. This is indicative of mild but meaningful competitive pressures.

Note that the blockchain rewards category, which is staking based revenues, has overtaken institutional based transaction revenue as the second largest revenue center. Staking is an important product offering and key growth driver across other revenue segments. But in absolute terms, direct staking based revenues remain small. Also, Coinbase considers itself the principal in staking transactions and reports blockchain rewards earned on a gross rather than a net basis. So these dollars are somewhat overstated relative to the transaction segment.

The fall in revenues over the past year is severe, however when zooming out the current situation does not appear as dire. If one looks back to the second quarter of 2020 before the recent bull-run market, total quarterly trading volume has grown from $28 billion to the current, "depressed" $217 billion. Further, over these two years, monthly transacting users have grown from 1.5 million to 9.0 million.

So there remains a solid base of trading volume and users. Importantly, the longer-term, secular growth in trading volume likely returns if the current correction in crypto again proves to be cyclical. The next section discuses how much the current trading volume and its revenues compare to the cost structure.

Coinbase's Risks

Increasing competition is not my primary concern for Coinbase. Coinbase is the leader in providing custody to institutions and a leading institutional broker. While institutional transaction revenues are only a small portion of total revenues, institutional customers serve an important reputational function. And this leading market position serves to bolster trust and underpin growth in the high margin, retail users overtime.

Further, Coinbase is one of the longest-running exchanges where customer funds have not been lost to a security breach. Despite a common narrative among detractors and some media, there is no record of blocking client withdrawals, recalling their loans or changing their access to credit. Also of note, Coinbase has prominent partnerships with BlackRock (BLK), Meta Platforms (META) and Google (GOOGL).

And though the exchange is a point of centralization, Coinbase and Armstrong recently received some praise from uber crypto insider Vitalik Buterin. When speaking about Ethereum (ETH-USD) and its new staking regime, Buterin mentioned Armstrong's stand against transaction censorship and called the Coinbase team "good members of the ecosystem".

Taking the above together, attracting and maintaining retail customers should not be a major concern for the most trusted U.S. digital asset marketplace. And monthly transacting users are expected to stay above 7 million this year.

Interest Rates

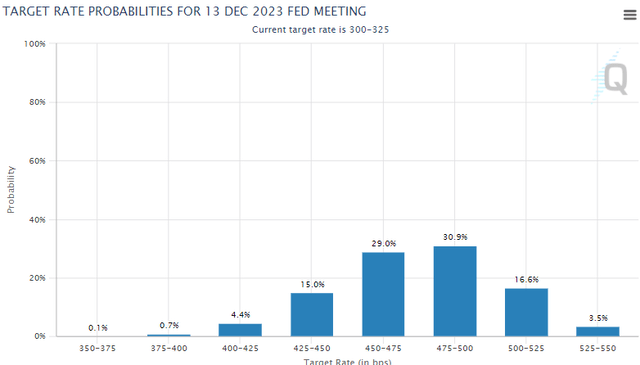

More concerning for Coinbase is the current macro environment. Since May I have been surprised by the Fed's multiple strong policy moves to raise rates rapidly. The Fed has also begun to meaningfully unwind its balance sheet in an effort to check entrenched and spreading energy inflation. My assessment after each new policy tightening was that markets were appropriately pricing the terminal fed funds rate and even that expectations of further tightening were overly pessimistic and hawkish.

This general idea would have meant that the interest rate sensitive crypto and tech sector assets were at a turning point and their correction was near its end. Obviously to date this notion has proved incorrect. Even looking forward, there is no real indication of a policy pivot by the Fed. And outside of modest reversal in energy prices, last week'sSeptember CPIshowed entrenched, across the board price growth worsening.

The FOMC'slast Summary of Economic Projectionshas the yearend 2023 target rate for the federal funds at 4.75-5.0%. This is inline with market expectations, as seen the the graphic just below. Also of note,futures markets currently pointto the peak in the rate between 5.0-5.25% at the March or May meeting.

Until these rate expectations show substantial moderation, it is difficult to advocate adding to digital asset allocations, including Coinbase, outside of dollar cost averaging plans.

Coinbase Valuation and Conclusion

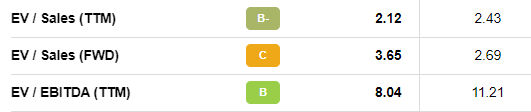

Until the Q3-Q4 numbers are in and Coinbase laps the stronger 2021 revenues, EV to Sales and EV to EBITDA will appear strong from a TTM perspective. So the data below is primary presented just as evidence that the company does not have the typically high valuation and multiples of a tech company with a prior year IPO. Coinbase actually had a $3.15 billion 2021 EBITDA and its business model is now well proven in a crypto bull market.

Note the "C" rating above inCoinbase's Factor Gradesfor the EV to Forward Sales metric. For an idea of how this valuation metric is trending, consider that there were over $1.2 billion in revenues in Q3'21 and my estimate for the coming third quarter report is for only $680 million in revenues. Of course, the market is forward looking and has already corrected the share price for the Q3 collapse.

Looking to the November 3rd earnings report, the adjusted EBITDA should be similar to the $150 million loss in Q2. Transaction volume could be off $50 billion compared to Q2, yielding $150 million less in associated revenues. But cuts to advertising and lower restructuring costs should mostly offset the fall.

The above loss is large but sustainable. Recall from the balance sheet discussion above, Coinbase has a net cash position near $2.5 billion, over $6 billion in near money assets and no debt principial due until 2026. Here again, despite a common narrative, the company is well positioned to navigate the current crypto cold snap with its fortress current ratio. Importantly, the company can continue to meaningfully invest $.5 billion in its technology platform and administration tools each quarter.

Looking ahead we have the FOMC meeting on November 1st and 2nd, just prior to the Q3 earnings conference call on the 3rd. Though there will not be a Summary of Economic Projections released until the December meeting, expect some color on the outlook from Chair Powell.

At some point, as the stance of monetary policy tightens further, it will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.

Chair Powell’s Press Conference, federalreserve.gov, 8/21/22, p. 4

Until the Fedspeak shifts away from the inflation focus or indicates the assessment period Powell mentioned above, digital assets and Coinbase are likely stuck at current levels. So though Coinbase is strongly positioned, I am maintaining my hold rating while following interest rate expectations and Coinbase's ability to manage its $500 million EBITDA loss guardrail.

精彩评论