$Palantir Technologies Inc.(PLTR)$ , another falling knife?

Just last week we saw few companies share price dropped >10% after reporting earnings. PLTR is one of them.

The first sentence in the Accompanying Remarks “Our business grew significantly last year.”

PLTR generated $1.54 billion revenue in 2021, a growth of 41% year over the year. Q4 2021 revenue of $432.867mil, when compared to $322.091mil in Q4 2020, was a 34% growth.

We can see the overall commercial revenue growth is accelerating from 19% in Q1 2021 to 47% in Q4 2021. Their U.S. commercial customers count was increase drastically from 17 to 80, and PLTR “believe there is significant opportunity ahead”.

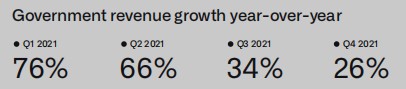

Though the government business revenue growth rate is kind of slowing down,this should not be worrying. As previously PLTR business was critiqued to be too concentrated in government.

Non-U.S. commercial performance is lagged behind the U.S. Commercial, but with what PLTR achieved in 2021 and going to do in 2022, we can expect accelerating non-U.S. commercial growth:

- In 2021, they had closed some substantial deals,like Merck KGaA and Peugeot in Europe, Hyundai Heavy Industries in South Korea

- In 2022, they intend to adopt a hiring plan for non-U.S. commercial business that is similarly aggressive to the one implemented for U.S. commercial business in 2021.

Another matter that had always been haunting investor is the dilution of shares related to stock-based compensation. This was brought to the CEO in the latest earning call. And this is the answer from CEO Alex: “This is a company built for bad times. Bad times means strong finances internally. And that means at some point, you have to be GAAP profitable.You can't be GAAP profitable if you're diluting people or what -- correctly, your stock-based comp is totally -- is not in conformity with other companies. So, you're seeing a normalization. This will change. It will change in the relatively near future.”

One more thing I see as a plus is the path to GAAP profitability.

GAAP Operating Margin is improving from (49%) in Q4 2020 to (14%) in Q4 2021. PLTR ended 2021 with cash from operations of $334 million, representing a 22% margin and adjusted free cash flow of $424 million, representing a 28% margin.

Lastly, PLTR is providing and will continue to provide guidance of 30% or greater revenue growth for this year and the next three years at each earnings call.

After this Q4 report, I think PLTR just needs some more time to prove its success.

精彩评论