It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Visa$Visa(V)$ . While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

How Quickly Is Visa Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Visa grew its EPS by 9.4% per year. That's a pretty good rate, if the company can sustain it.

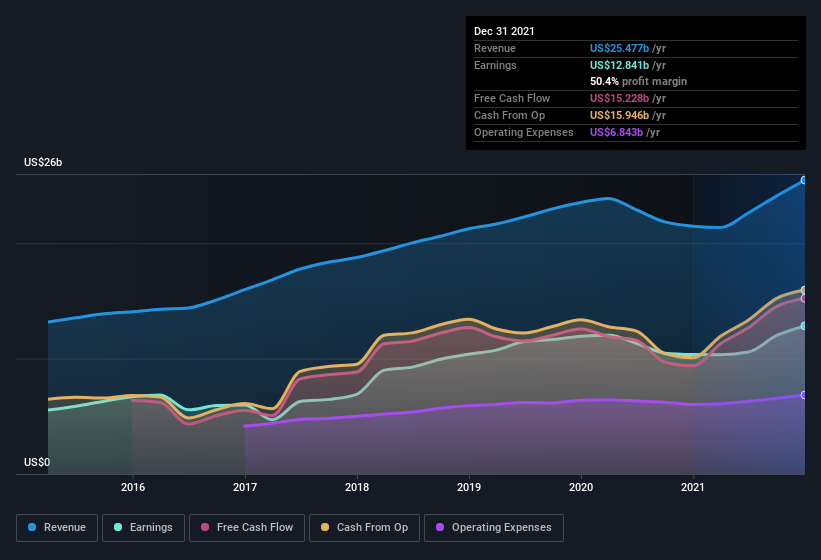

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Visa maintained stable EBIT margins over the last year, all while growing revenue 19% to US$25b. That's progress. In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Are Visa Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$453b company like Visa$Visa(V)$ . But we do take comfort from the fact that they are investors in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$227m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Visa To Your Watchlist?

As I already mentioned, Visa is a growing business, which is what I like to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on.

source: SIMPLY WALLST

精彩评论