$CSOP iEdge SREIT ETF US$(SRU.SI)$ $CSOP S-REITs INDEX ETF(SRT.SI)$

Over the past decade, REITs have emerged as one of the most popular investment vehicle for yield-hungry investors who are looking for stable passive income play in the local Singapore market.

High dividend – combined with a few other factors such as strong governance, liquidity and stability – have enhanced the attractiveness of such assets that appeal to many investors looking out.

This year, with the growing concern of rising interest rates due to inflationary expansion environment, will bring about an unprecedented test to these popular asset classes, who have grown tremendously and did very well under the circumstance of low interest rates for the most part of the last decade.

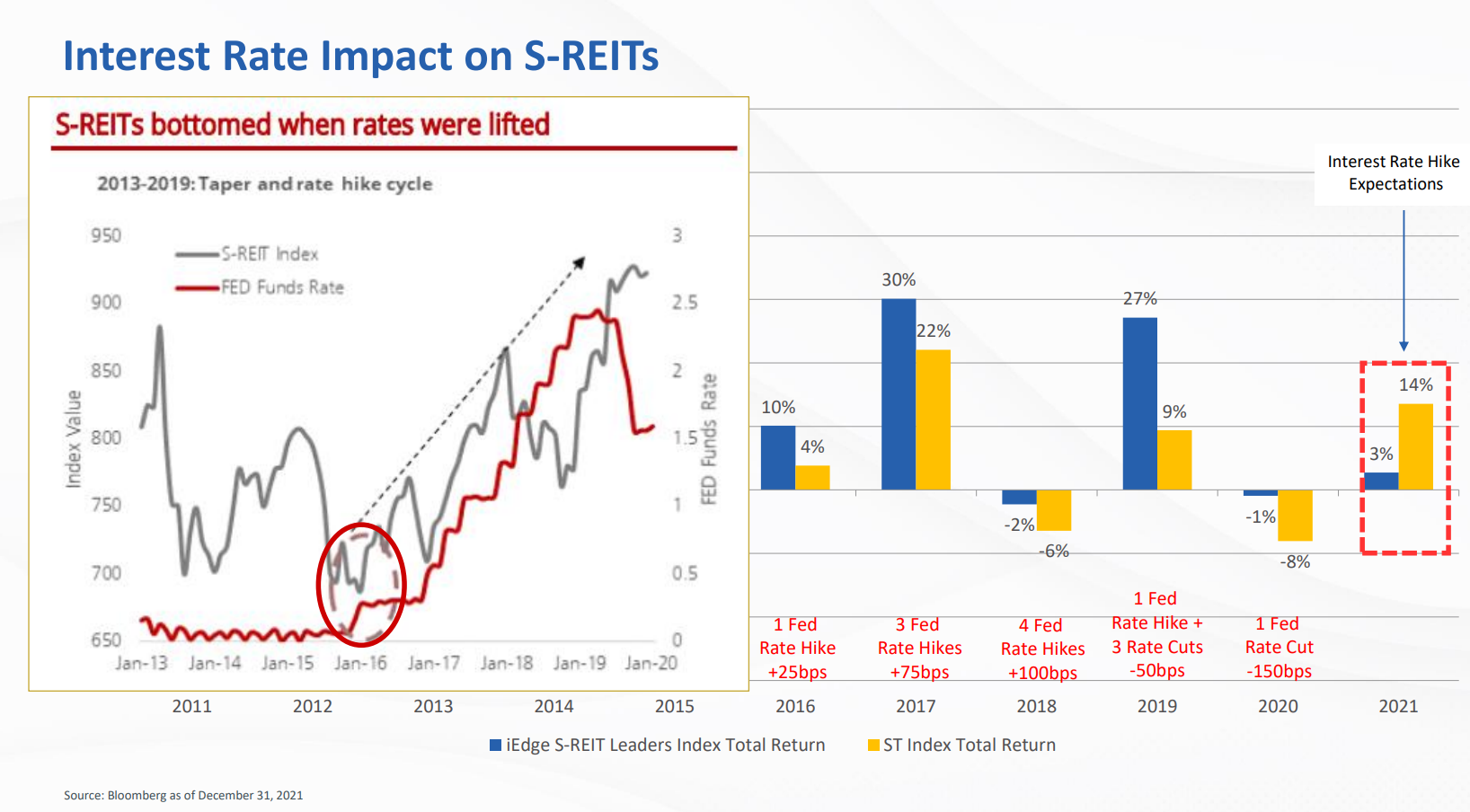

It is often asserted that REITs are not a suitable instrument to invest in during rising interest rate due to the higher cost of borrowing. However, an examination of past records show that this may not be always the case and contrary to belief, an inflationary environment might actually benefit the sector as investors look to hedge their investment in a strong asset that can rise with inflation.

Take a look for instance during the last rate hike back in 2016 when the FED raised rate hike by 25 basis points. S-REITS investors were concerned over the impending rate hike news but the index actually well bottomed right before that. By the time the rate hike actually happened, it started going up soon after that and it even outperformed the STI index from 2016 to 2020.

Building up your own portfolio of individual REITs may yield several advantages when it comes to out-performing but it may also result in under-performance especially when the REITs or sectors that you have chosen are not doing well.

The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index (the “Index”).

The ETF has several unique characteristics which stand out in particular:

- Scale

- Liquidity

- Diversification

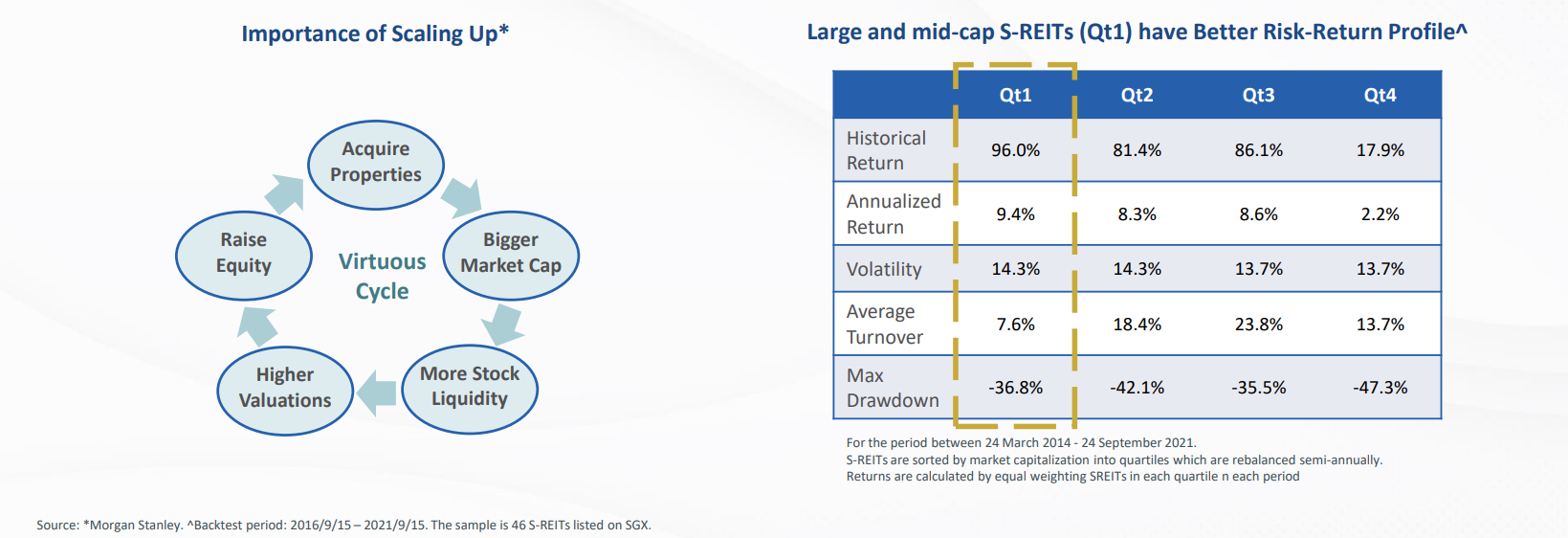

First, we look at the Scale Advantage.

Out of 42 REITs listed on Singapore Exchange, the index has 28 large and mid-cap S-REITs, which has at least a free-float market capitalisation of S$500 million.

Factor backtesting shows that historically large and mid-cap S-REITs tends to outperform the market as it is able to tap into opportunities such as reducing the cost of borrowings and growing through acquisitions which further increases the market pool cap of the index.

For instance, historical returns showed that large and mid-cap S-REITs in Quartile 1 have a better risk-return adjusted profile as compared to the small and mid-cap REITs.

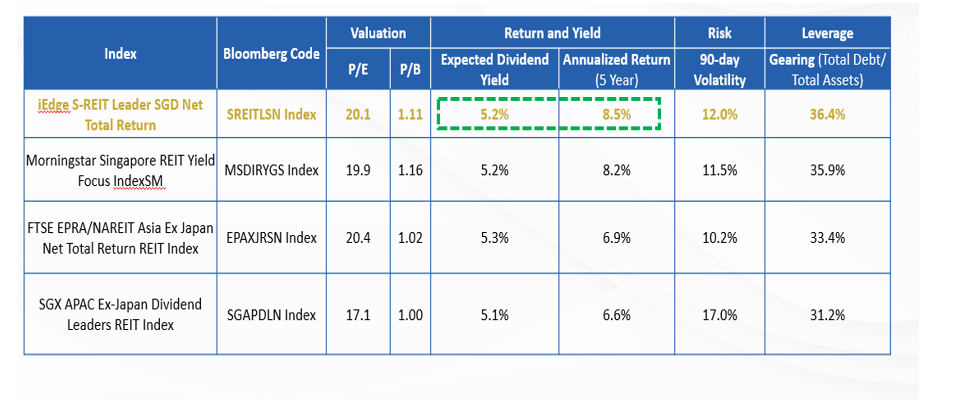

Furthermore, the Index’s weighted average leverage ratio is also at a comfortable gearing level of slightly more than 36%, which is well below the MAS regulatory cap at 50%. This allows further room for the REITs in the portfolio to grow through acquiring more properties.

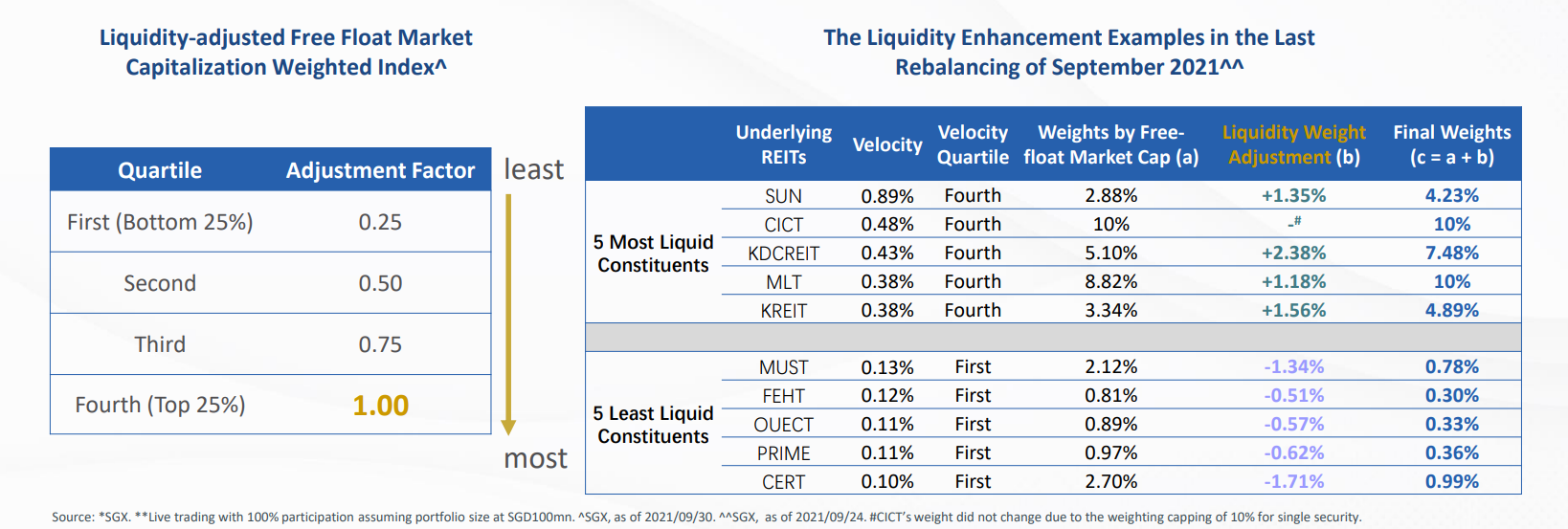

The second factor is strong liquidity advantage.

The Index includes REITs with the highest turnover in SGX.

Contrary to many traditional indices where larger market capitalised constituents are assigned with higher weights, the iEdge S-REITs Leaders Index allocate and rebalance its constituents based on the averaged daily traded velocity (DTV) calculated over the last 6 months.

During each index rebalancing exercise and a liquidity enhancement is performed where constituents within each quartile are assigned an adjustment factor on their respective free-float market capitalization and averaged DTV. Higher liquid REITs are assigned a higher weighting while lower liquid REITs are assigned a lower weighting factor.

Such unique feature made the Index and the ETF more robust and smarter as it captures investors’ high interest in the underlying REITs and reflects trending sector rotation.

Therefore it helps investors to gain exposure in relevant sectors in that better represents market conditions.

The third characteristics is the Diversification Advantage.

The Index is well diversified to include not only the popular REITs sectors such as retail and office, but also emerging REITs benefiting from the “New Economy” with the evolution of rising industry sectors in the logistic, warehousing and data centre REITs. To cap off the diversification advantage, it also has allocation in the resilient healthcare sectors as well as the cyclical hospitality sectors.

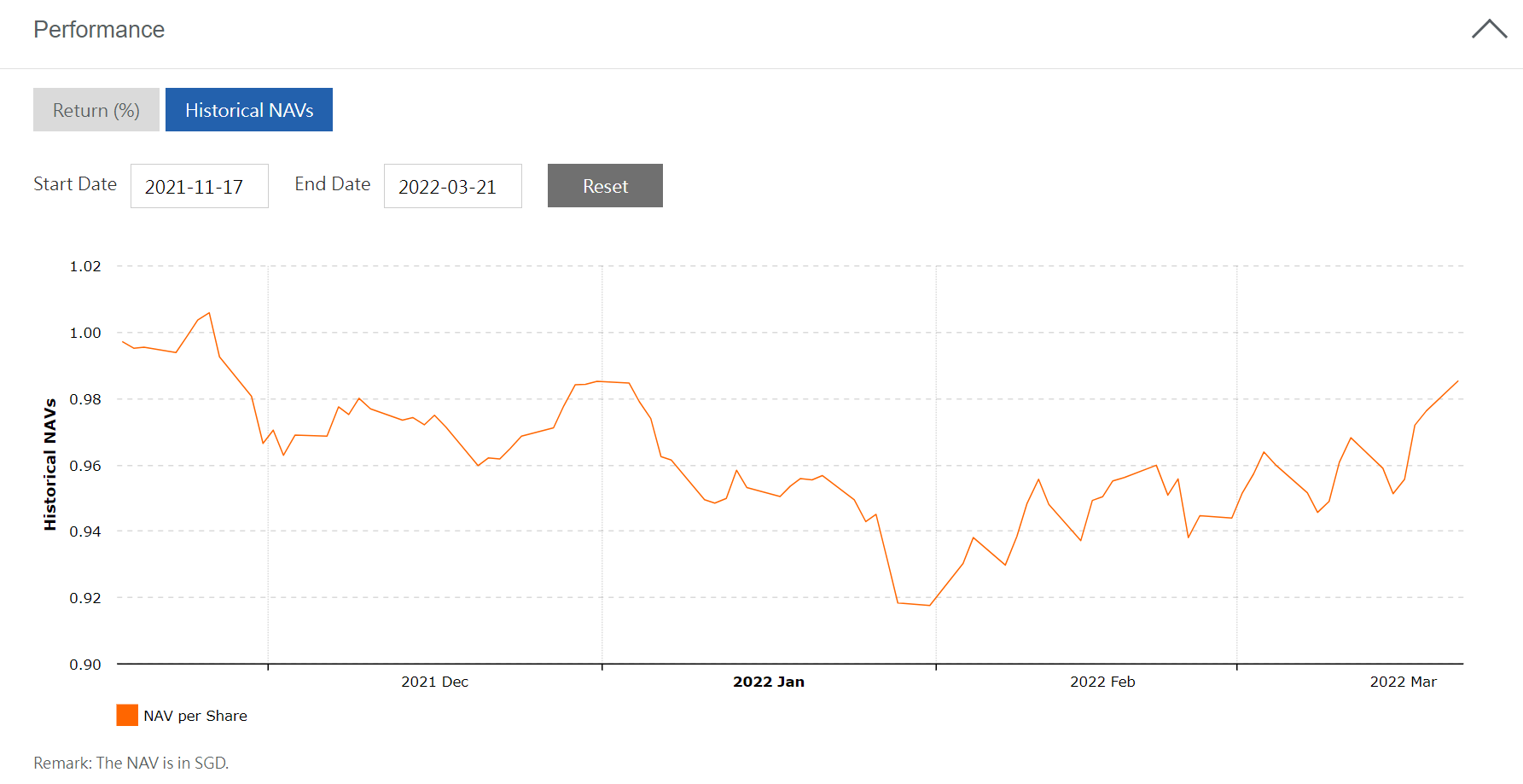

How The ETF performs since listing

Since the listing back in November, the performance of the ETF has been rather stable, given the risk-off environment we have due to rising interest rates, inflation as well as the war between Ukraine and Russia.

Comparing this to the performance of individual REITs for the same periods, you can see that the ETF exhibits resilient performance.

- Mapletree Logistics Trust: $1.95 (17 Nov) -> $1.84 (21 Mar)

- Mapletree Commercial Trust: $2.13 (17 Nov) -> $1.90 (21 Mar)

- Suntec REIT: $1.52 (17 Nov) -> $1.70 (21 Mar)

- Capitaland Integrated Commercial Trust: $2.18 (17 Nov) -> $2.24 (21 Mar)

- CSOP S-REIT ETF: $1 (17 Nov) -> $0.985 (21 Mar)

Corporate Actions:

Some of you may be curious about what will be the impact in case there are any corporate actions from the REITs inside the portfolio.

Taking right issues, for example, the index will only apply the necessary adjustments (increase in the shares outstanding and a corresponding increase in market capitalization). Further to this, given the dilution from the new shares issued at discount, SGX will apply a price adjustment on the ex-date when the subscription price is at a discount to the last traded price before the ex-date. In the meantime, the ETF portfolio will also take the rights issues at preferable rights offer price to ensure the ETF clients are not disadvantageous due to these corporate actions.

Tracking Error

The CSOP iEdge S-REIT Leaders Index ETF exhibits minimal tracking error, which is very important for an ETF.

For instance, if an index is up by 5%, you would also want your ETF to go up similarly likewise by a similar percentage points as closely as possible.

In the case of this ETF, it is adopting a replication strategy to minimize the tracking error. Using this strategy, the manager will invest in substantially all the index securities with the same weightings as the index.

Expense Ratio Fees:

As a good rule of thumb, an ETF should not command an expense ratio fees of more than 1%.

The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 0.5% and a total expense ratio of 0.6%, which is capped and would be deducted annually as fees.

Singapore REITs - A Reopening Story:

The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies – SGD and USD.

You can find the ETF denominated in SGD under the ticker symbol SRT while the ETF denominated in USD under the ticker symbol SRU.

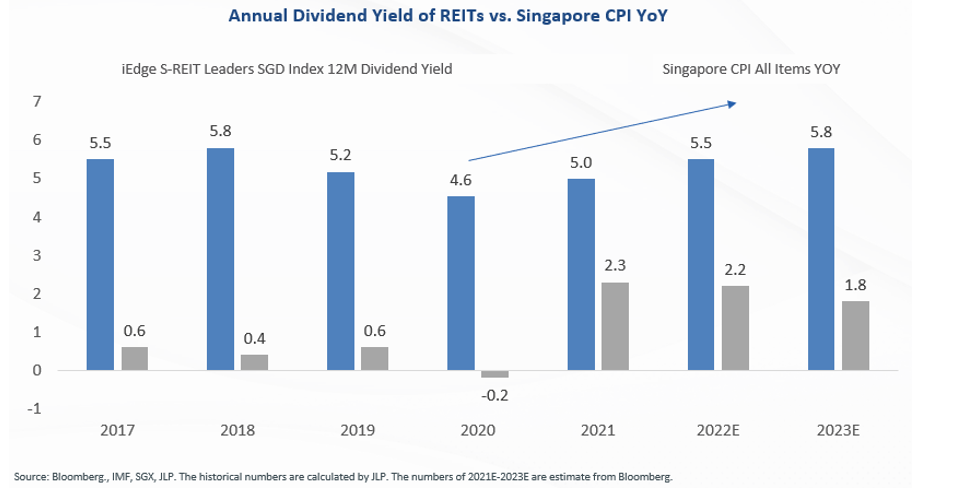

According to Bloomberg consensus and estimates, the iEdge S-REITs Leader Index is expected to correlate closely with the rise of inflation and projected to grow its dividend yield from 5.0% in 2021 to 5.5% in 2022 to 5.8% in 2023.

Yield is not the only story.

Combining all the benefits of having a portfolio of large and mid-cap S-REITs offer investors higher potential of capital appreciation. According to backtesting of last 5 years, the annualised total return of iEdge S-REITs Leaders Index has an outperformance against its peers.

If you are looking for an established sponsor, well diversified REITs, good scale and liquidity advantage , an increasing stable yield, higher potential of capital appreciation, you may consider this ETF as one of your next choices.

精彩评论