I thought there is a chance for bargain hunting to buy into Manulife, with global market meltdown due to Fed interest as well as Omicron factor.

But somehow today, Singapore market started well. In fact Manulife reit is up slightly. I was hoping for a drop closer and maybe below the placement price. Really suprising.

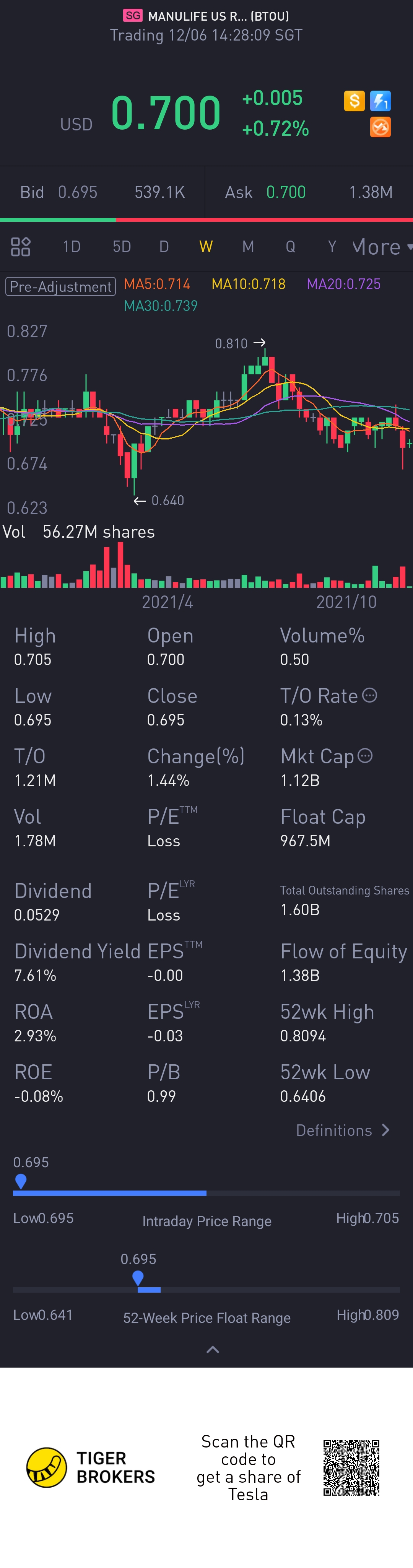

Share again on some performance number for this Reits and its portfolio.

On the yield front, historical dividend is at around 7% which is attractive.

Share more background on this reit, Manulife US REIT is a Singapore listed REIT established with the investment strategy principally to invest, directly or indirectly, in a portfolio of income-producing office real estate in key markets in the United States, as well as real estate-related assets.

Recently MANULIFE US REIT announced private placement closed about 2 times covered and was priced at US$0.649 per new unit.

The issue price was at the lowest end of the indicated price range of US$0.649 to US$0.676 when the proposed placement was announced on Nov 30. This is a discount from current price.

It represents an 8-9 per cent discount to the volume-weighted average price of US$0.7124 per unit and 5.9 per cent discount to the adjusted VWAP of US$0.6898 per unit.

A total of 154,084,000 new units will be issued under the private placement, and trading of the new units on the SGX is expected to commence on Dec 9 at 9 am.

In the update, the manager said about US$93.5 million or 93.5 per cent of the estimated US$100 million of gross proceeds will go towards financing part of the total acquisition cost of 3 properties in Arizona and Oregon, US.

The remaining amount of approximately US$6.5 million or 6.5 per cent of gross proceeds will go towards paying the estimated fees and expenses.

Personally I do not have any position, but certainly considering@Tiger Stars

精彩评论