Digital Core REIT (DCRU) is a new member in the field of S-REITs. It mainly focuses on investing a diversified portfolio of stable income-generating real estate assets worldwide.

Pure-play data centre Digital Core Reit offer of 13.4 million units to Singapore retail investors under its initial public offering (IPO) was around 16.1 times subscribed last Friday. The offer price was US$0.88 per share.

Key things to note about Digital Core REIT

Digital Core REIT has a high-quality portfolio made up of 10 data centres located in key strategic markets sponsored by industry-leader, Digital Realty (NYSE: DLR)

Location |

Number of Data Centres |

Size of Data Centres (SqF) |

Occupancy Rate (%) |

Valuation (US$ million) |

Northern Virginia |

3 |

494k |

100 |

629 |

Silicon Valley |

4 |

414k |

100 |

479 |

Toronto |

1 |

104k |

100 |

203 |

Los Angeles |

2 |

197k |

100 |

129 |

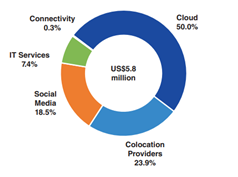

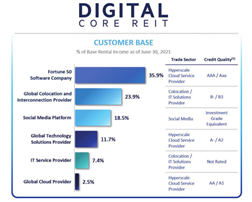

Occupants comprise stable, blue-chip companies, maintaining high credit ratings. They have been long-standing customers of the Sponsor. The chart below shows a brief breakdown of the different trade sectors of the Portfolio customers by Base Rental Income.

The REIT aims to offer Unitholders exclusive focus in the Data Centre Industry. It is backed by strong fundamental growth drivers which include enterprise adoption of hybrid IT, overall acceleration of digitization of the world and various industries, artificial intelligence and IoT.

- As stated in the prospectus, it has a projected distribution yield of 4.75% and DPU growth of 5.26% from 2022 to 2023, making up 10.01% in total return.

- Digital Realty is the largest owner and operator of data centres globally, providing an unparalleled growth opportunity with a pipeline of US$15bn. This helps to lay a financially strong foundation and potential growth of the REIT.

Even as Covid-19 hampered the growth of many industries, REITs with data centre assets have performed defensively amidst the stock market volatility. Several SGX listed REITs have averaged 20% returns in 2020. The adoption of digitization and remote work can help drive demand for data centre infrastructure. When the pandemic eases and life returns to normal, we can expect increased movement back into properties located in centralized areas or business districts, all of which are in ways reliant on data centres to manage business-critical data and applications.

精彩评论