Before I start, I need to reiterate the disclaimer that my article is by no means a trade advice to follow. I am just sharing my trade experience as an example to those who might be interested in Options trading. I am also not responsible if anything goes wrong with your trades after reading my article. Any information you would like to clarify, you can comment below. ![[Cool]](https://c1.itigergrowtha.com/community/assets/media/emoji_005_deyi.481846cc.png)

I have to mention that I am a first-timer using Options trading here.

And I did with BUY calls of $Apple(AAPL)$and $Novavax(NVAX)$

Reason very simple, to me these are the violatile stocks that can rise with good news (sometimes with no significant news).. and they also can fall at the same time.

As I have normal shares of AAPL & NVAX, getting Option BUY calls is another hedge against the tides of falling share prices, as I can buy them cheap & reap in profits when the Option price rises, without having to sell my normal shares for long-term investment.

The BUY call just needs to be done at the right timing. (I will usually look out for the next dip of the share price, monitoring especially almost the end of the trading day just to be sure, then I'll process it. That should also be the moment when the Option price of the BUY call gets cheaper, as with buying normal shares).

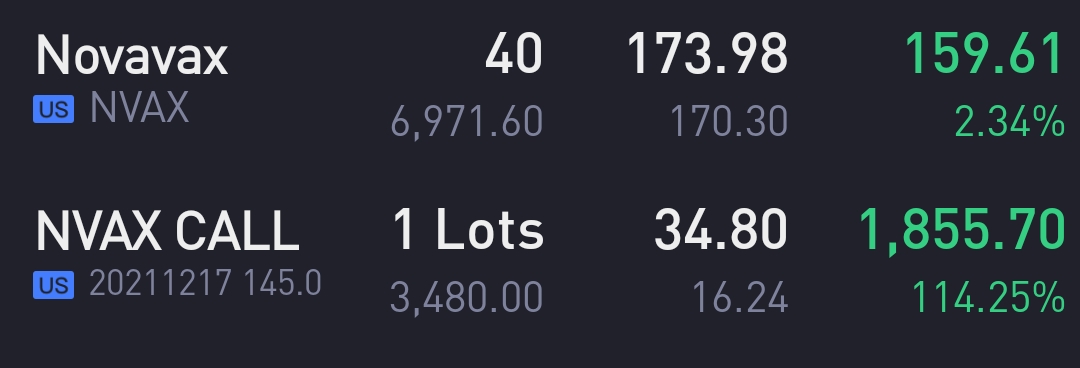

The screenshots below will show better comparisons between my normal shares purchase & Options BUY call.

At the point of my purchase for AAPL call, AAPL was down to around $163, however I intend to see it rise in the near term. Hence, I selected the nearest strike price at $165.

I also selected the one with expiry on 21 January 2022. I know it should rise near-term. Just to be on the safe side though, I chose an expiry date which is further away from December.

Next, because the BUY Call Bid & Ask price is $6.35 & $6.40 respectively, and I wanted to quickly put in my purchase.. so I entered my trade at $6.36 just before the market closed for the day.

As you can see my screenshot above, the cost for each Option share is 6.39, after factoring in $0.0299 Tiger's commission per Option share.

So with just 1 BUY Call Option (1 Option=100 shares) the premium is in fact much lower as compared to buying normal shares.

Right now, I can't afford to buy 100 normal shares of AAPL. $163 x 100 means $16,300!

I only have 29 shares (Minus the 1 free AAPL given by Tiger) bought at $146.01 each, bringing my total cost to $4234.29

But my AAPL BUY call just costs $6.39 per share of Option.

Besides, having Options can fetch me multiple times more profit than buying normal shares! (This can be seen better with my example of Novavax below):

So now do you get a better idea of Options BUY Call? [smile]

For those who have already been through Options trading, feel free to comment below your experience as well so others can learn better!

精彩评论