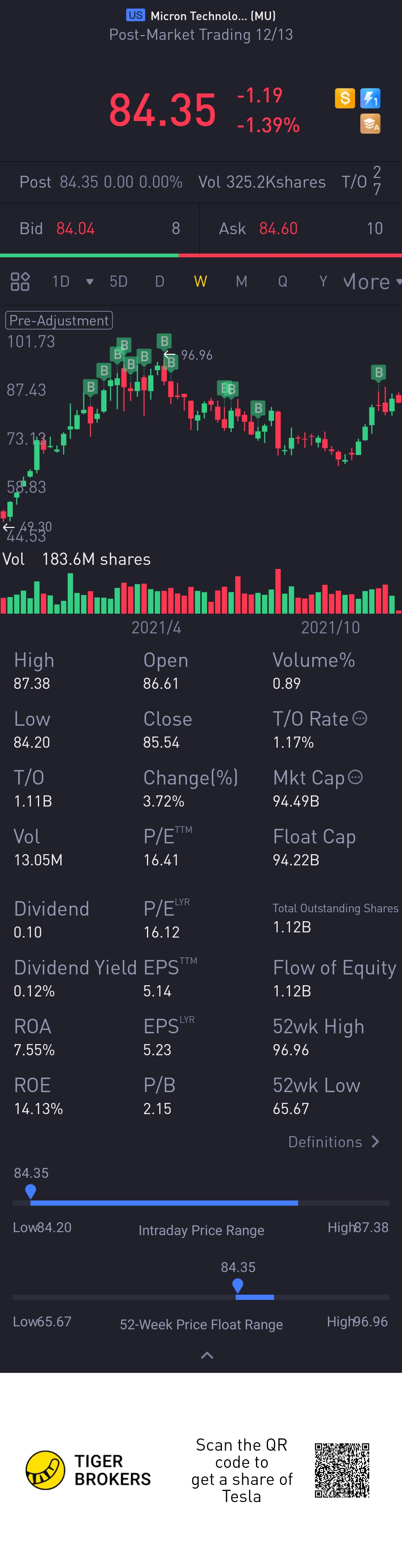

Micron share price took a hit yesterday, trading below $85. Overall market is worried about Fed rate movement. I felt the market did not really react to Omicron. Knowing that chip shortage continue to be the case in 2022, spot price of Nand and Dram both look stablizing, is this an opportunity to hop it the wagon?

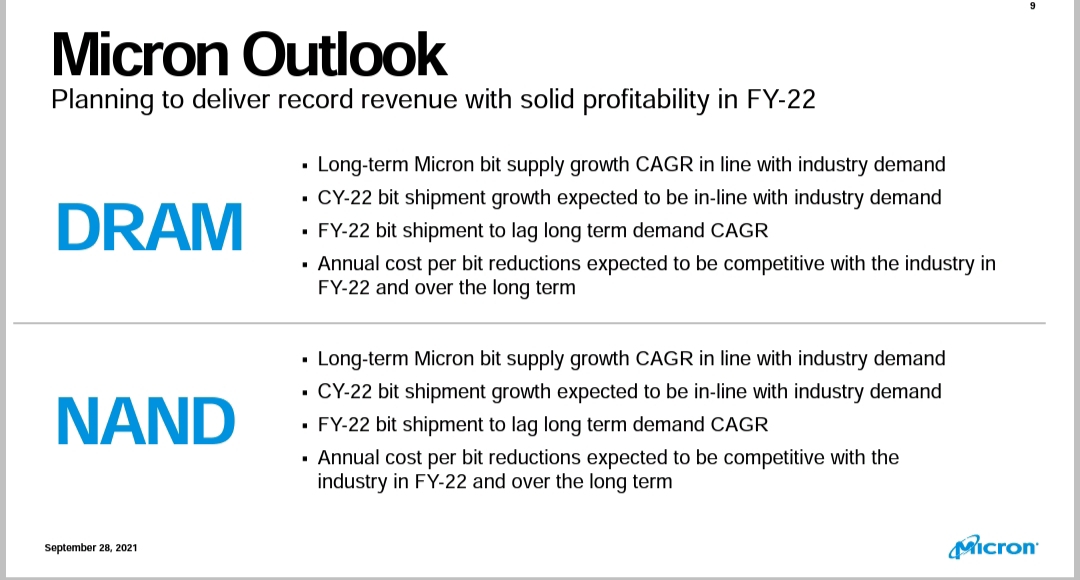

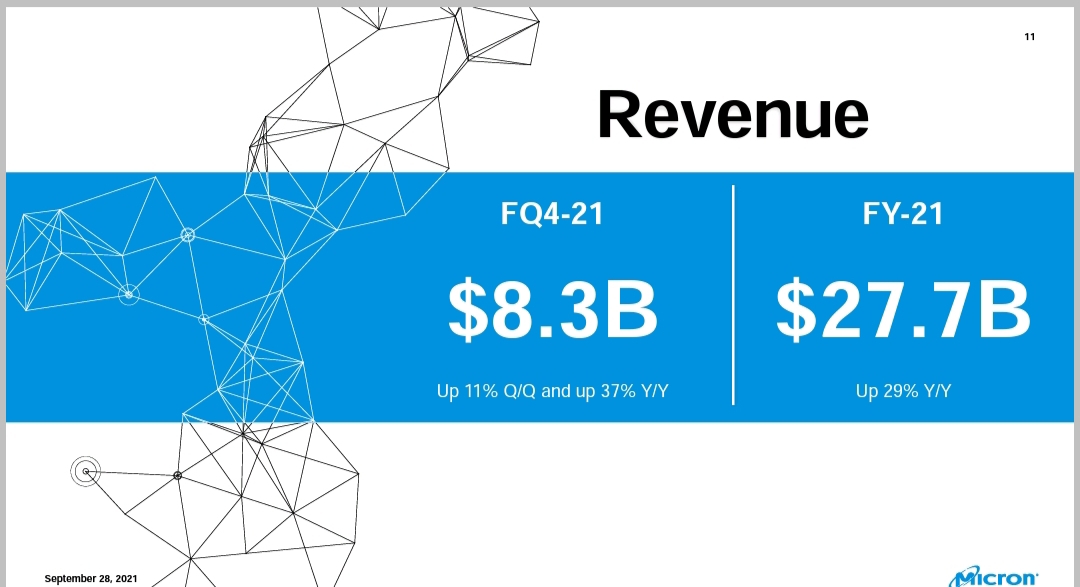

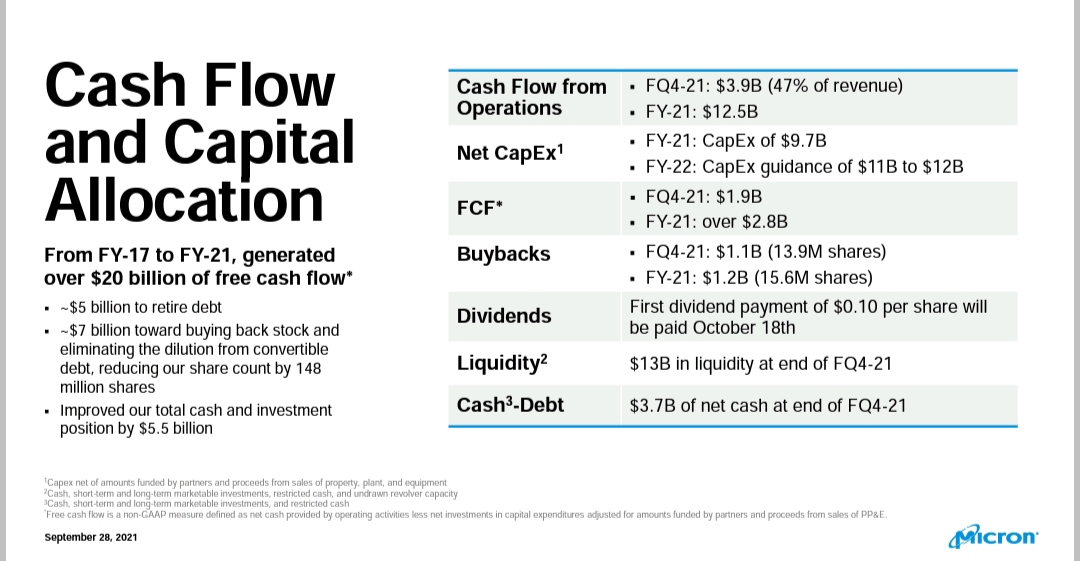

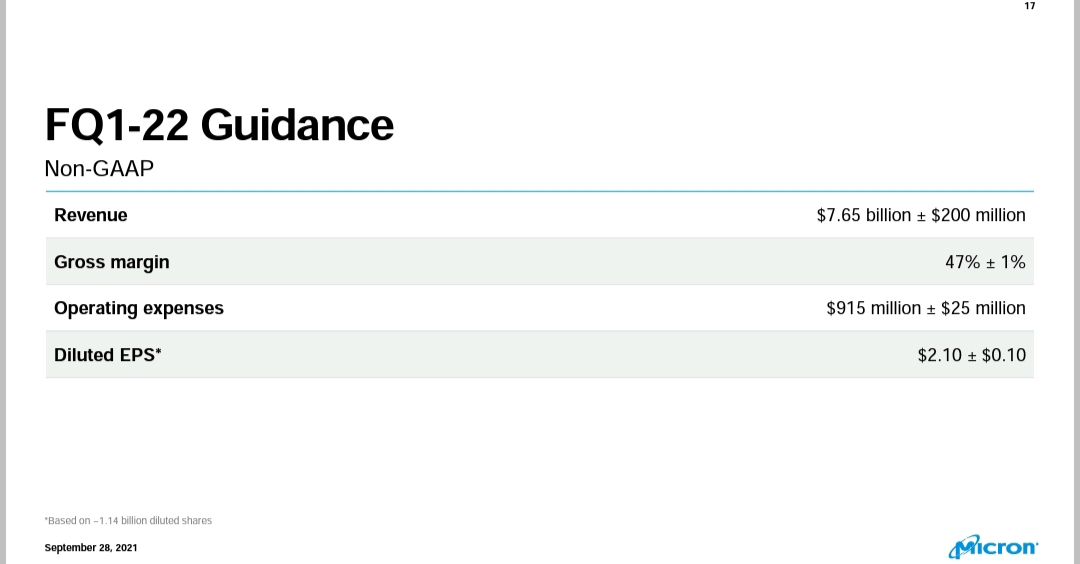

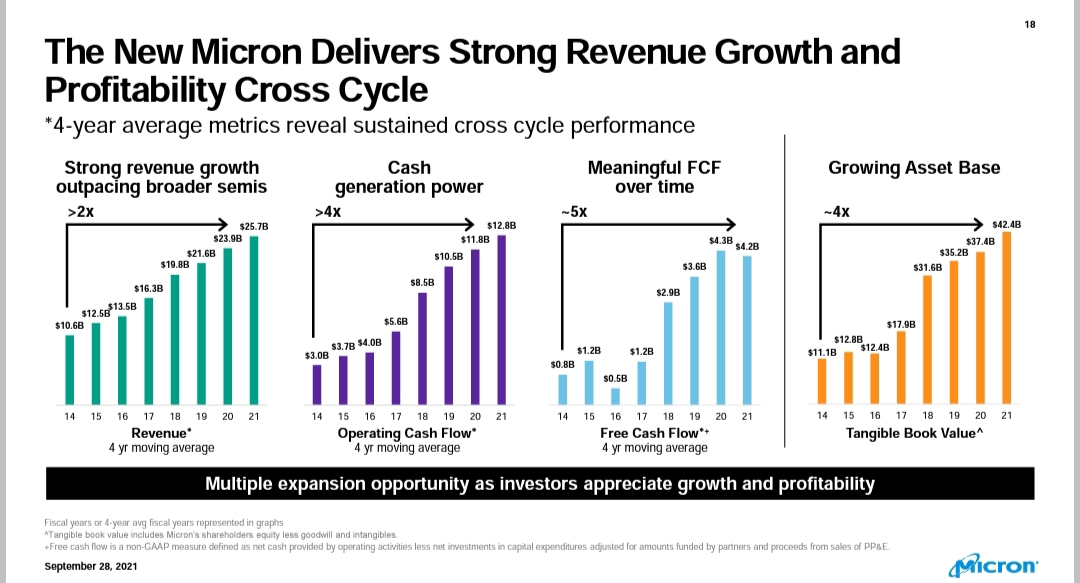

Some background and also include Micron guidance of Q1'22 back in September. Also some recap of the Sept report.

Micron Technology is a world leader in innovative memory and storage solutions that accelerate the transformation of information into intelligence, inspiring the world to learn, communicate, and advance faster than ever.

It produces computer memory and computer data storage including dynamic random-access memory, flash memory, and USB flash drives. It is headquartered in Boise, Idaho.

Extracted from news, for the current quarter, Micron expects to earn an adjusted $2.10 a share on sales of $7.65 billion. But Wall Street was modeling Micron earnings of $2.53 a share on sales of $8.54 billion in its fiscal first quarter. In the year-earlier period, Micron earned 78 cents a share on sales of $5.77 billion

Personally I am vested in Micron. No plan to add more as current position is a big portion of my portfolio. But its an opportunity if you are interested in Semiconductor manufacturer stock and yet to vest.

[smile] @Tiger Stars

精彩评论