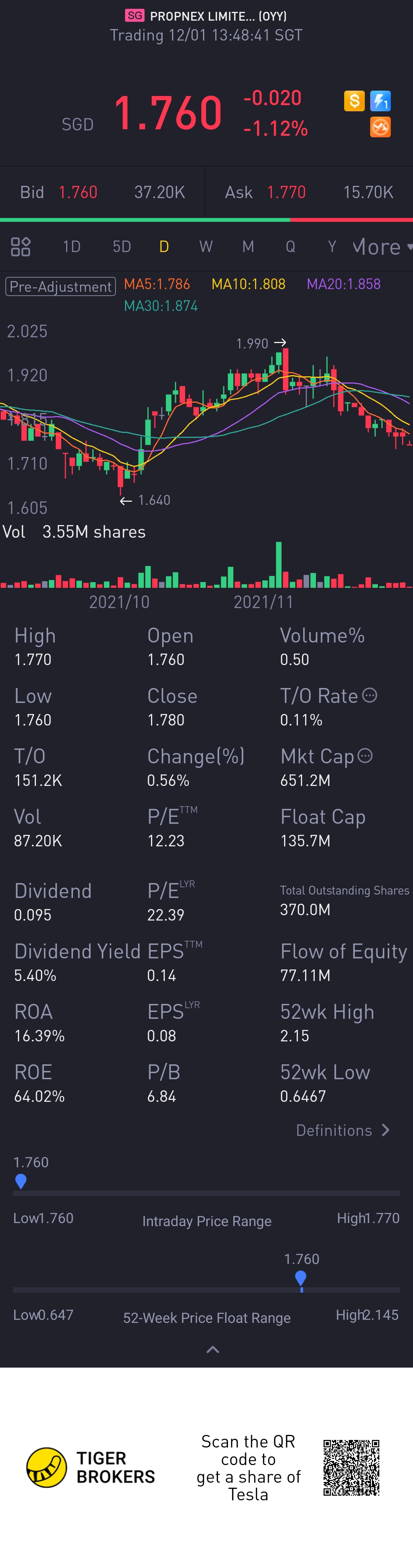

$PROPNEX LIMITED(OYY.SI)$Was never really a fan of this stock since ipo. But the performance and dividend yield has far exceed my expectation. I have to say, i missed the boat. Just that I am not sure if its still good to go in now. And if yes, with the Omicron fear, now could be a good time.

As property prices continue to climb, and transaction also on the raise, Propnex seem to have good outlook for next year. And dividend yield is at about 5%.

Some introduction of the company.

Propnex Realty Pte. Ltd. operates as a real estate agency. The Company offers business strategies, consultation, training, marketing support, and technological innovations for real estate sector, as well as provides buying, selling, and renting of properties. Propnex Realty serves customers in Singapore, Indonesia, and Malaysia.

The Group’s revenue for the quarter was mainly driven by higher commission income from agency services of approximately S$67.5 million and from project marketing services of approximately S$48.9 million. This was a result of a higher number of transactions completed in 3Q2021 following improvements in both the Covid-19 situation and the economy. And with pricing increase, commission also will raise.

The three key market segments of new launches, private resale and HDB resale saw strong growth year-on-year growth in 3Q2021. Notably, 3Q2021 was one of the quarters with highest number of private resale transactions over the past ten years, with 5,362 units changing hands. The last time when resale volume exceeded 5,000 units was in the second quarter of 2010. Recent housing continue to show positive trend. Prime area HDB continue to break record pricing. New launches sale are all doing well. Very healthy demand.

According to data from the Urban Redevelopment Authority, overall private home prices continued to climb for the sixth consecutive quarter in 3Q2021, and was up 7.5% year-on-year. The HDB resale price index of 150.6 in 3Q2021 surpassed the previous peak in the second quarter of 2013 which had an index of 149.4. These were attained despite the tighter Covid-19 safe management measures under the Phase 2 Heightened Alert in July and August 2021.

More important, the company continued to be debt free, and its balance sheet remained healthy@Tiger Stars

Thanks for reading

精彩评论