[For Hong Kong Investor Only]

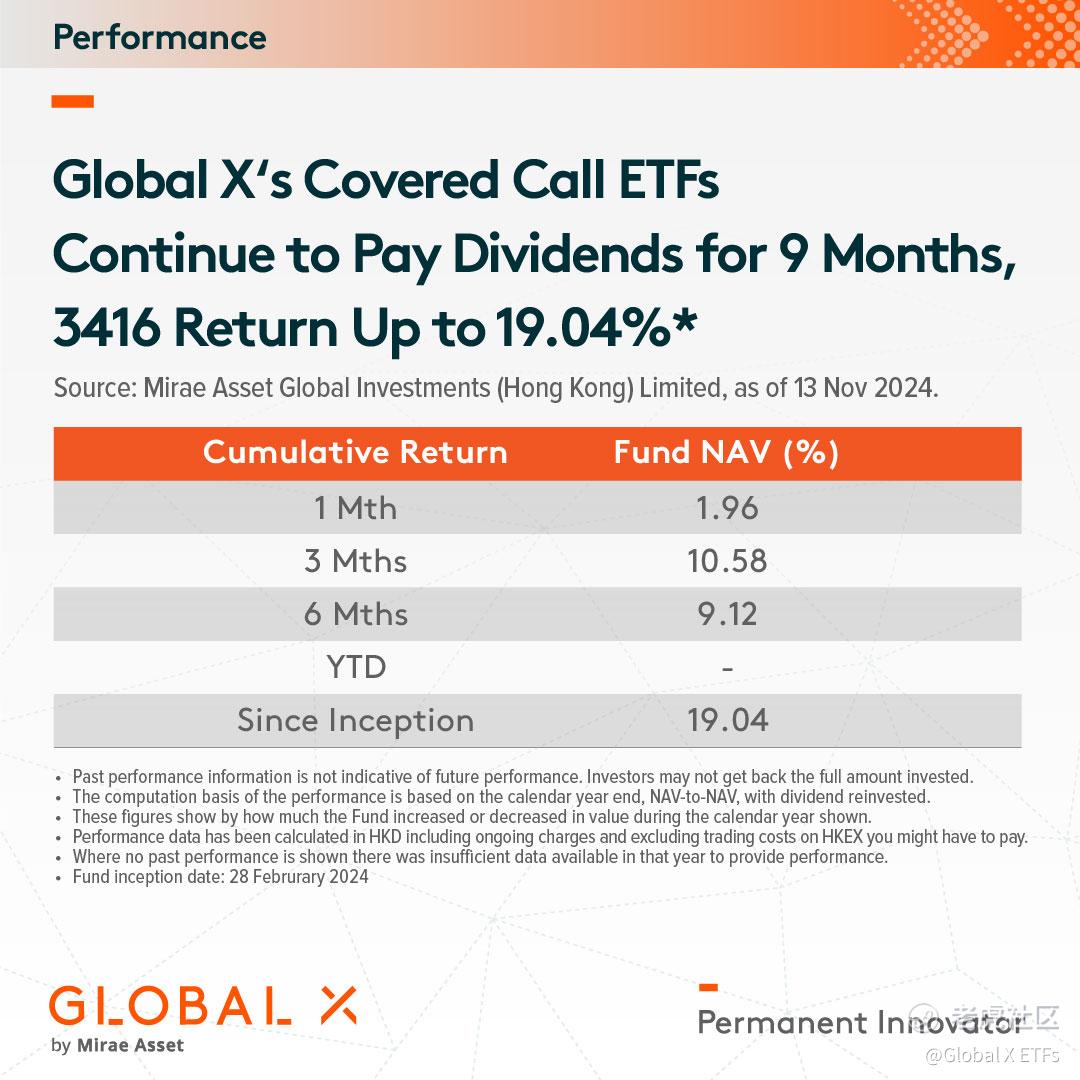

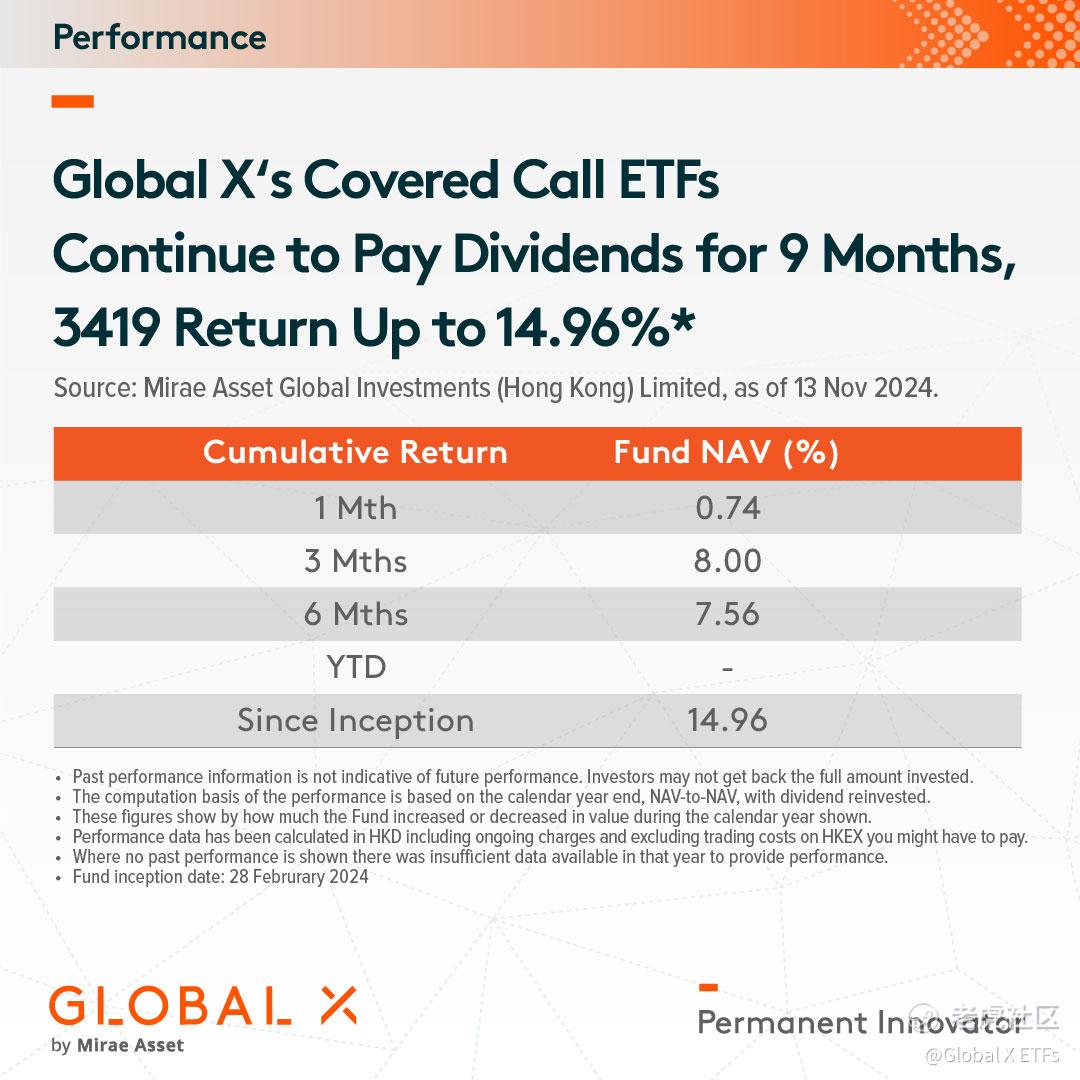

The Global X HSCEI Components Covered Call Active ETF (3416) has achieved a 19.04% return* since its launch, while the Global X HSI Components Covered Call Active ETF (3419) has achieved a return of 14.96%*.

These two ETFs employs a covered call option strategy, generating option premium income by selling call option contracts. They have maintained distribution for 9 consecutive months*. This not only brings continuous cash flow returns to investors#, but also fully demonstrates the outstanding operational capabilities of the fund management team.

Regardless of the changing market environment, the ETFs have always provided investors with a relatively reliable source of income to help them achieve their financial goals.

- Ex-Dividend Date: Nov 29, 2024. This means that if you hold our ETFs before this date, you may have the opportunity to enjoy monthly dividend payments (Distribution is at the discretion of the Manager. Dividend rate is not guaranteed. Distributions may be made out of capital) *.

- Dividend Payment Date: Dec 5, 2024.

For more information, including the fund's prospectus, please visit https://www.globalxetfs.com.hk/campaign/covered-call-etf/

*Positive yield does not mean positive return. Covered call writing can limit the upside potential of the underlying security. Payments of distributions out of capital or effectively out of capital amounts to a return or withdrawal of part of an investor's original investment or from any capital gains attributable to that original investment. Any such distributions may result in an immediate reduction in the Net Asset Value per Share of the Fund and will reduce the capital available for future investment. Fund Inception Date: Feb 28, 2024. Source: Mirae Asset, Nov 13, 2024.

#While Covered call writing limits potential gains of the underlying security, it provides a relatively stable option premium income for investors.

-

This document contains the opinions of Mirae Asset Global Investments (Hong Kong) Limited (“MAGIHK”) and is intended for your use only.

It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument and shall not constitute any form of regulated financial advice, legal, tax or other regulated service. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. MAGIHK makes no representation as to their accuracy or completeness and therefore do not accept any liability for a loss arising from the use of this document.

Investment involves risk. Forecasts, past information and estimates have certain inherent limitations. Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these opinions are suitable for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Past performance information presented is not indicative of future performance. Before making any investment decision, investors should read the fund’s offering document for further details including the risk factors.

Investing in the Covered Call Active ETF may expose to risks (if applicable) including active investment management risk, futures contracts risk, margin requirement risk, failure of clearing house risk, concentration risk, securities lending transaction risks, currency risk, distributions paid out of capital or effectively out of capital risk, and trading risks.

Investors should ensure they fully understand the risks associated with the applicable investment and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice if in doubt.

Issuer: Mirae Asset Global Investments (Hong Kong) Limited (Licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance). This document has not been reviewed by the Securities and Futures Commission or the applicable regulator in the jurisdiction which this article is posted and no part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of MAGI HK.

Copyright © 2024 Mirae Asset Global Investments. All rights reserved.

精彩评论