[For Hong Kong Investor Only]India’s growth outlook remains intact, and its resilience has been further reinforced during recent global turmoil, with India index outperforming other major markets and the INR holding steady against significant fluctuations of other currencies. The country’s economic growth is supported by key structural factors, including favourable demographics, improving infrastructure and robust domestic demand. Moreover, despite a weaker mandate of Modi, the policy predictability and macroeconomic stability are expected to continue benefiting the stock market.

The Global X India Select Top 10 ETF (3184 HK) enables access to high-growth potential through investments in leading Indian companies that represent the most significant sectors of the Indian economy.

A Defensive Play under Global Uncertainties

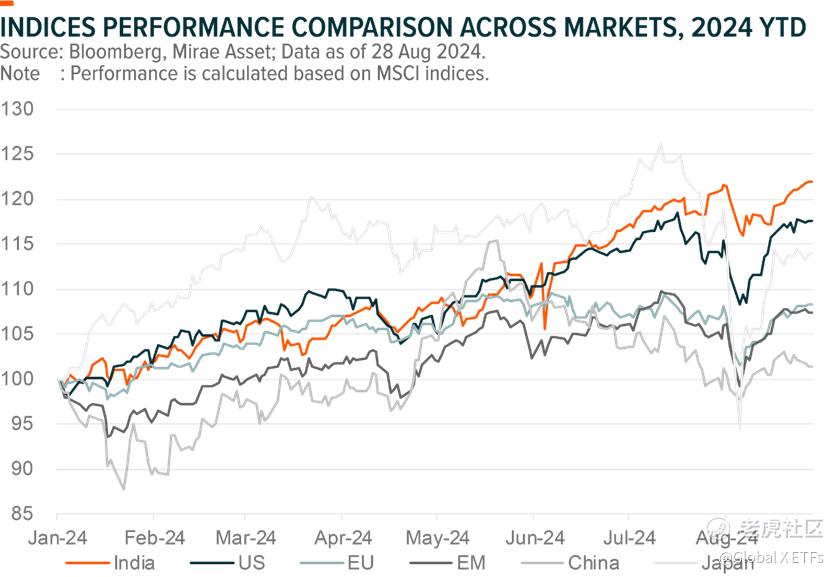

YTD, India market has maintained its outperformance, with the MSCI India index rising by 22%1, surpassing the performance of other major markets. This outperformance has held up well during the recent correction in early August.

The performance of the Indian market has exhibited a low correlation with emerging markets. India stands out as one of the most compelling growth stories within emerging markets and could serve as a defensive play amid concerns surrounding a potential hard landing in the US, uncertainties regarding trade tariffs on China, and escalating geopolitical tensions, notably in the Middle East.

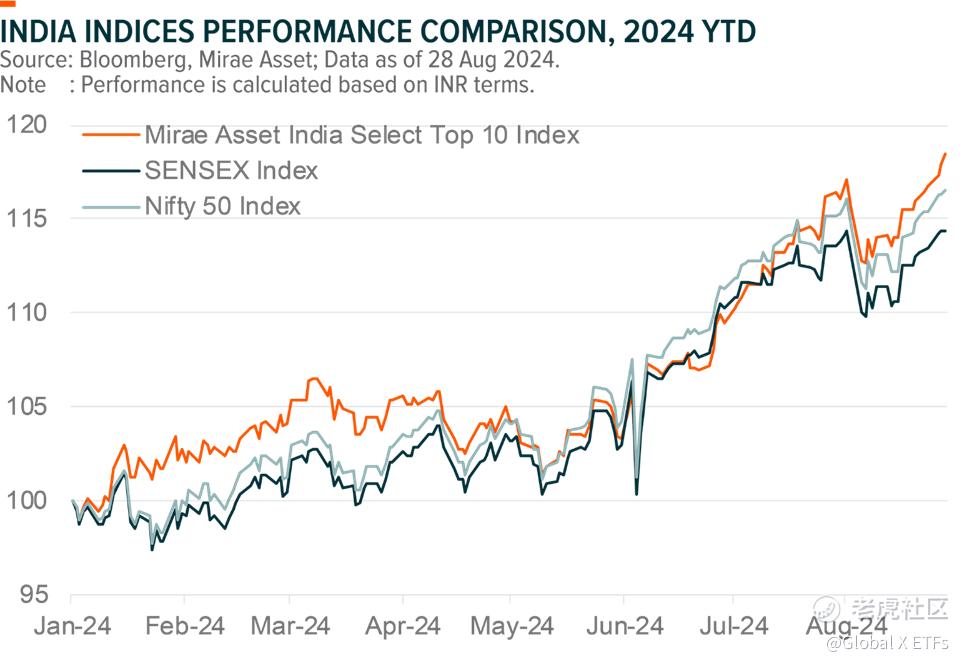

Comparing with popular indices in India, the underlying index of the Global X India Select Top 10 ETF (3184 HK) — the Mirae Asset India Select Top 10 Index — has outperformed both the Sensex and Nifty 50 YTD2. Our product offers investors exposure to a select group of leading Indian companies across crucial sectors of the Indian economy. Industry leaders benefit from favourable financing conditions, first-mover advantages, and competitive moats in our view.

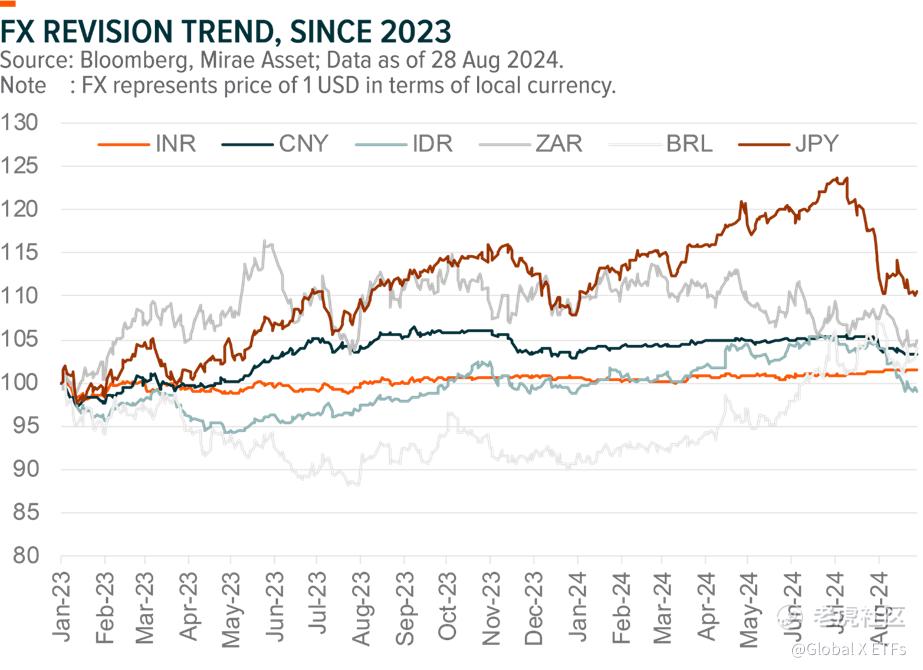

The Indian Rupee (INR) has also demonstrated a stable trend YTD, experiencing a modest depreciation of 1%3, in contrast to the fluctuations observed in other currencies. Notably, there has been a recent surge in FX volatility, especially concerning the JPY. A cheap yet stable INR can favour both India’s equities and exports.

Update on Key Contributors of India Select Top 10 ETF (3184 HK)

Infosys and Sun Pharma have been standout performers among our holdings over the past three months. Both companies delivered robust earnings in 1QFY25 and have a rosy outlook for the entire year.

Infosys (INFO IN): Infosys 1QFY25 results was a clear beat post 5 challenging quarters. The solid performance showcased growth across most segments, margin expansion, and solid deal momentum. Revenue was up 3.6%/2.5% QoQ/YoY to US$4,714mn in constant currency (CC) terms. BFSI stood out with an impressive 8% QoQ growth. OPM also saw a healthy expansion of 100bps QoQ to 21.1%, primarily attributed to Project Maximus.4

Large deal win momentum remains robust, with the total contract value (TCV) of large deals on a net new basis amounting to US$2.4bn, bolstering the outlook for FY25. The company has raised its revenue CC growth guidance for FY25 from the earlier range of 1-3% to 3-4%. This lifted FY25 guidance primarily factors inorganic growth. Management’s positive remarks on the recovery of the North American BFSI sector have shed light on potential additional upgrades.5

Sun Pharmaceutical Indus (SUNP IN): 1Q revenue reached INR126.5bn, up 6% YoY. This increase was primarily propelled by robust sales in India (+16.4% YoY), partially offset by sluggish US sales (-1% YoY). The EBITDA margins stood strong at 28.9%, up 103/311bps YoY/QoQ. The strong EBITDA beat was attributed to higher GPM supported by a favourable product mix and reduced R&D costs.6

Sun Pharma achieved US FDA approval for Leqselvi (deuruxolitinib 8mg tablet) on July 25 for treating severe alopecia areata in adults, potentially boosting specialty sales beyond its flagship brand, Ilumya. The growth prospects for the company’s key brands, including Ilumya, Winlevi, and Cequa, look promising due to improved access in payor channels. Moreover, Sun Pharma has six R&D assets in its specialty pipeline, with anticipated data readouts for three drugs expected within the next 12-18 months.7

1 Source: Bloomberg; August 2024. 2 Source: Bloomberg; August 2024. 3 Source: Bloomberg; August 2024. 4 Source: Infosys; July 2024. 5 Source: Infosys; July 2024. 6 Source: Sun Pharma; July 2024. 7 Source: Sun Pharma; July 2024.

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy or sell any security or other financial instrument. Certain of the statements in this material are our expectations and forward-looking statements. Such expectations, views and opinions may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Investment involves risks. Investing in the Equity ETF(s) may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, active / passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Past performance information presented is not indicative of future performance. Investors should refer to the fund’s offering document for further details, including the risk factors. Issuer: Mirae Asset Global Investments (Hong Kong) Limited (Licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance). This material has not been reviewed by the SFC.

Copyright © 2024 Mirae Asset Global Investments. All rights reserved.

精彩评论