High Dividend Yield Strategy remains preferred by investors amid global market turbulence due to its resilient and defensive nature.

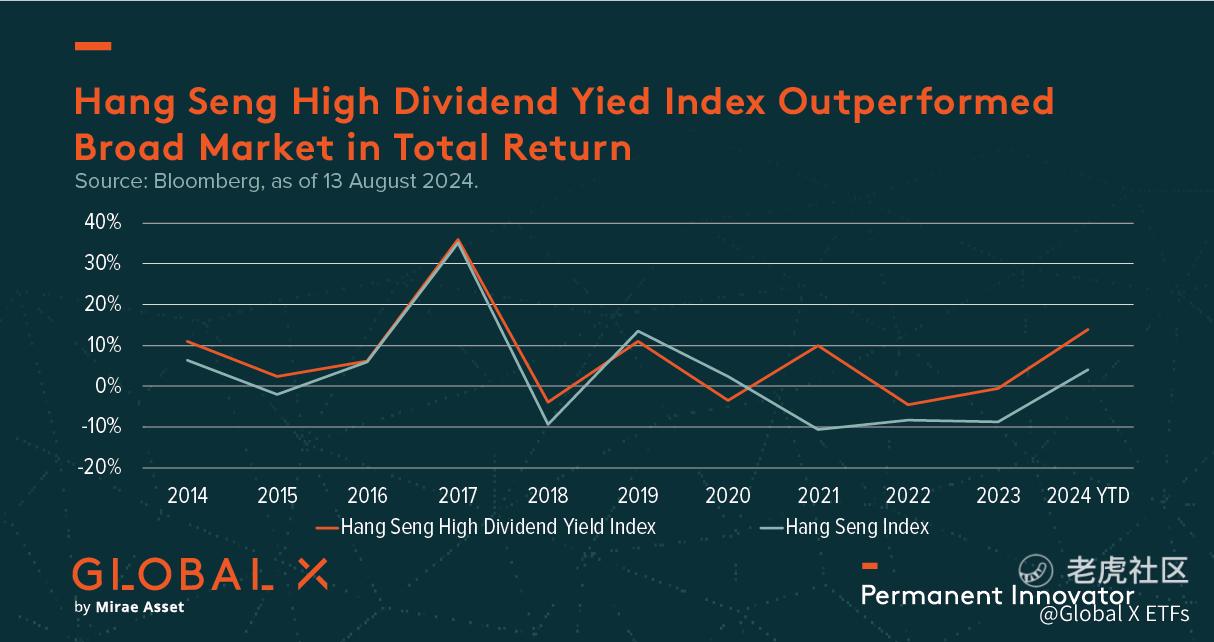

The Hang Seng High Dividend Yield Index demonstrated a YTD total return of 13.9%, whereas the broader market Hang Seng Index posted a YTD of only 4.1%, outperforming by 9.8%*. Compared to 10-year total return, HSHDYI also reached 64.1%, outperformed almost 40%, compared to HSI of 24.7% during the same period*.

The core to Hong Kong’s high dividend strategy’s defensive nature is low valuation. The HSHDYI currently trades at 5.8x 12m Forward PE, substantially lower than the Hang Seng Index of 8.1x, A-Share CSI 300 of 10.8x, offering relatively limited downside risks. In addition, the HSHDYI’s robust free cash flow yield of 17% offers higher sustainability of dividend yield^.

The Global X Hang Seng High Dividend Yield ETF (3110) $GX恒生高股息率(03110)$ is currently the only ETF tracking HSHDYI in Hong Kong. 3110’s annualized dividend yield stands at 8.24% (Note 1) and it aims to distribute semi-annually. (Dividend rate is not guaranteed and may be paid out of capital #)

Explore $GX恒生高股息率(03110)$ and its risk factors: https://www.globalxetfs.com.hk/funds/hang-seng-high-dividend-yield-etf/

*Source: Bloomberg, as of 13 Aug 2024.

^ Source: Bloomberg, as of 14 Aug 2024.

@Source: Bloomberg, Aug 2024.

Note 1: Annualized yield is calculated as follows: (dividends per share distributed in Sep 2023 and Mar 2024) / NAV per unit of the Fund on 29 Feb 2024.

# Whether or not distributions will be made by the Fund is at the discretion of the Manager taking into account various factors and its own distribution policy. The Manager may at its discretion pay dividend out of the capital or gross income of the fund. Payment of dividends out of capital to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the Fund’s capital may result in an immediate reduction of the NAV per Unit. Positive yield does not mean positive return.

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy / sell any security or other financial instrument. Investment involves risks. Past performance presented is not indicative of future performance. Investing in the fund may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, active/passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Investors should refer to the Fund's prospectus for details, including the risk factors. There is no assurance that dividends will be declared and paid in respect of the securities comprising the underlying index (the “Index”). Dividend payment rates in respect of such securities will depend on the performance of the companies or REITs of the constituent securities of the Index as well as factors beyond the control of the Manager including but not limited to, the dividend distribution policy of these companies or REITs.

There can be no assurance that the distribution yield of the Fund is the same as that of the Index. Issuer: Mirae Asset Global Investments (Hong Kong) Limited. This material has not been reviewed by the SFC.

精彩评论