[For Hong Kong Investor Only] Covered call strategies can be used strategically in income-focused portfolios, or tactically for investors who believe the markets are unlikely to continue to rise.

Income: The additional income brought bycovered call strategies provide income-driven investors with a means by which to improve the yield on their existing portfolios while diversifying away some of the market risk that is typically inherent in traditional income-generating securities. They offer an opportunity to benefit from volatile markets.

Tactical: More tactical portfolios may find use cases for covered call strategies as well. Below, we show at a broad level how investors in covered call strategies could expect to fare in di¬fferent market environments.

BULL MARKET: An investor will likely underperform the market as they keep the option premium but forfeit some or all of the upside.

FLAT MARKET: The investor will likely outperform as the markets go nowhere, but the investor keeps the premium from selling the call option.

BEAR MARKET: The investor will likely outperform as they keep the premium received from selling the call option, which offsets some of the stock’s decline.

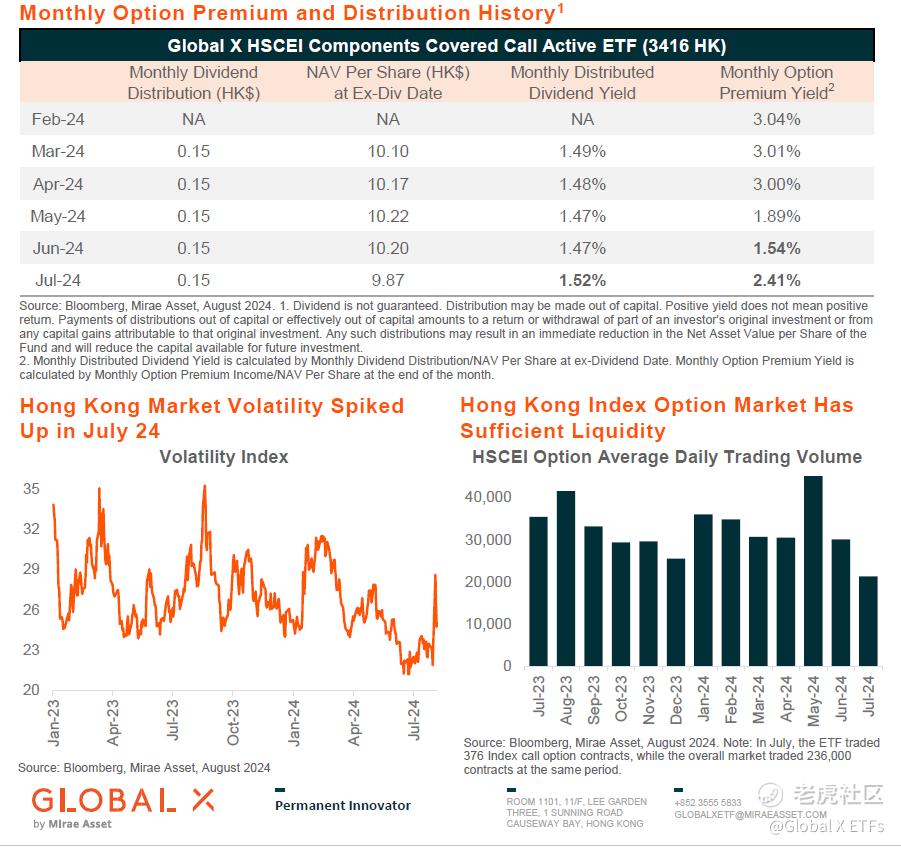

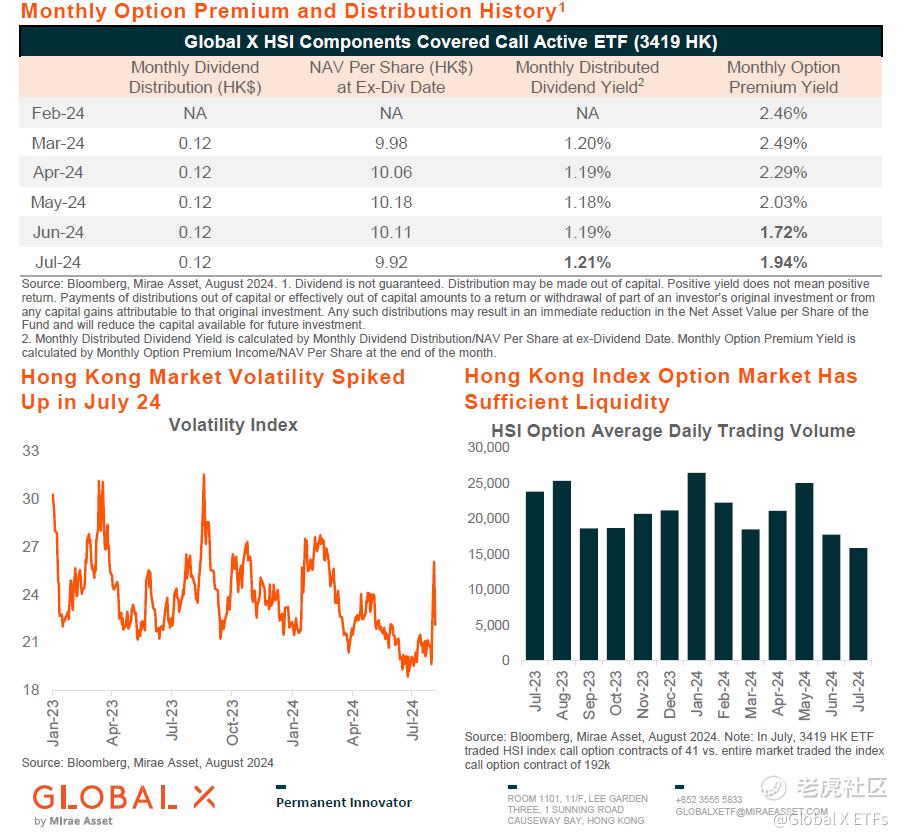

Global X HSCEI Components Covered Call Active ETF (3416) $A GX国指备兑(03416)$ /Global X HSI Components Covered Call Active ETF (3419) $A GX恒指备兑(03419)$

Learn more about them and their risk factors, please visit https://www.globalxetfs.com.hk/campaign/covered-call-etf/

-

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer, or recommendation to buy or sell any security or other financial instrument. Investment involves risks. Past performance is not indicative of future performance. Investing in the Covered Call Active ETF(s) may expose to risks (if applicable) including active investment management risk, futures contracts risk, margin requirement risk, failure of clearing house risk, concentration risk, securities lending transaction risks, currency risk, distributions paid out of capital or effectively out of capital risk, and trading risks..Investors should refer to the Fund's prospectus for details, including the risk factors. Issuer: Mirae Asset Global Investments (Hong Kong) Limited (Licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance). This material has not been reviewed by the Securities and Futures Commission. Copyright © 2024 Mirae Asset Global Investments. All rights reserved.

精彩评论