9 March 2021.

Late December last year 2020, i predicted that rech stocks were over-valued. And that we would see a short term correction in growth stocks. Money has to be parked somewhere. And hence expected a sector rotation (away from gowth into traditional assets) and country rotation (away from US and Europe into China). I also expected a support for USD and Gold. But 1 thing i did wrong was to hoard cash in SGD. i should have converted all to USD.

As such i was hoarding cash, awaiting for this opportunity. At the point of writing, my portfolio consisted many income stocks. What was missing was a growth components.

Fast forward today, interest yield is rising and the US is moving on with its 1.9billion in stimulus. So the big question, where would stocks go from here?

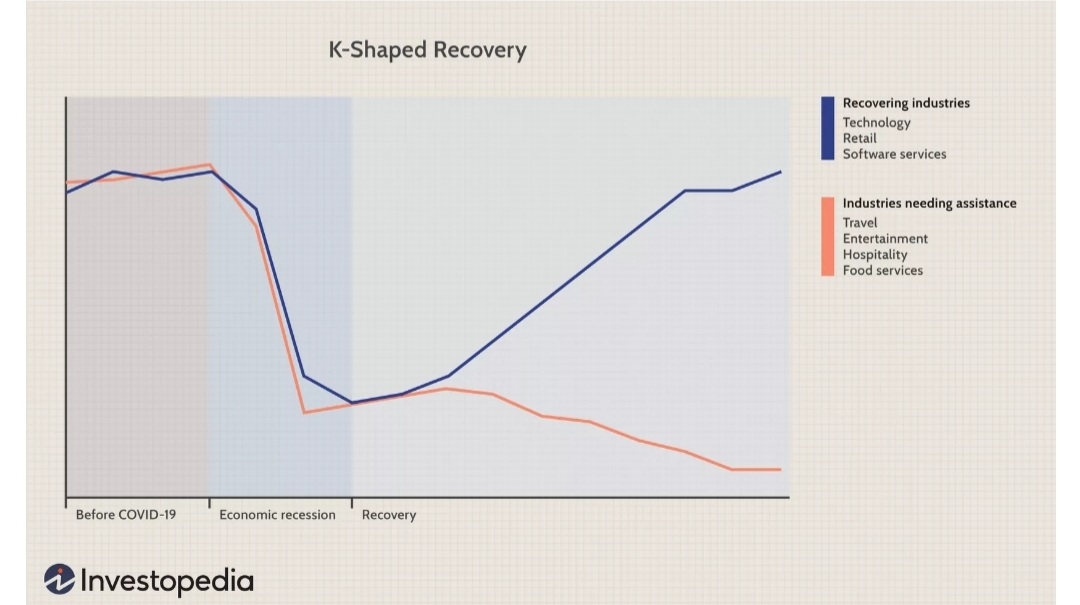

Recall late last year, everyone was talking about a K-Shape recovery? In my opinion, that is what is happening. A convergance of the K-Shape recovery. Looking at the charts image, and taking reference to correlation of Nasdaq, dow jones and spx in the past few years, below are my thoughts.

1. High interest will continue to affect high growth companies through higher borrowing cost and higher discounting of earnings. Blue line in the chart should decrease (go down).

2. Increase in stimulus will conitnue to help consumer spending and livelihood of the common folks. Orange line would increase (go up).

3. Both lines will continue until they converge.

4. Looking back the past decade, US stock has been on a consistent growth. Regardless if they are growth or non-growth stocks. Eventually, as the economy goes back to full recovery, my opinion is that the stocks will continue to climb at a gradual trajectory.

So what am i doing now?

Im continuing to accumulate growth companies and ignoring the noise in the market. I do not believe this will be the only correction this year. Instead i see market would be range bound for 2021 as i expected since december 2020. I think the real back to normality would be 2022. At that point, it would also be clearer to evaluate companies based on fundamentals. So if you are a long term investor like me, each short term correction should be an opportunity for you.

Disclaimer: The above message is solely my opinion and does not constitute as any form of investment advice.

精彩评论