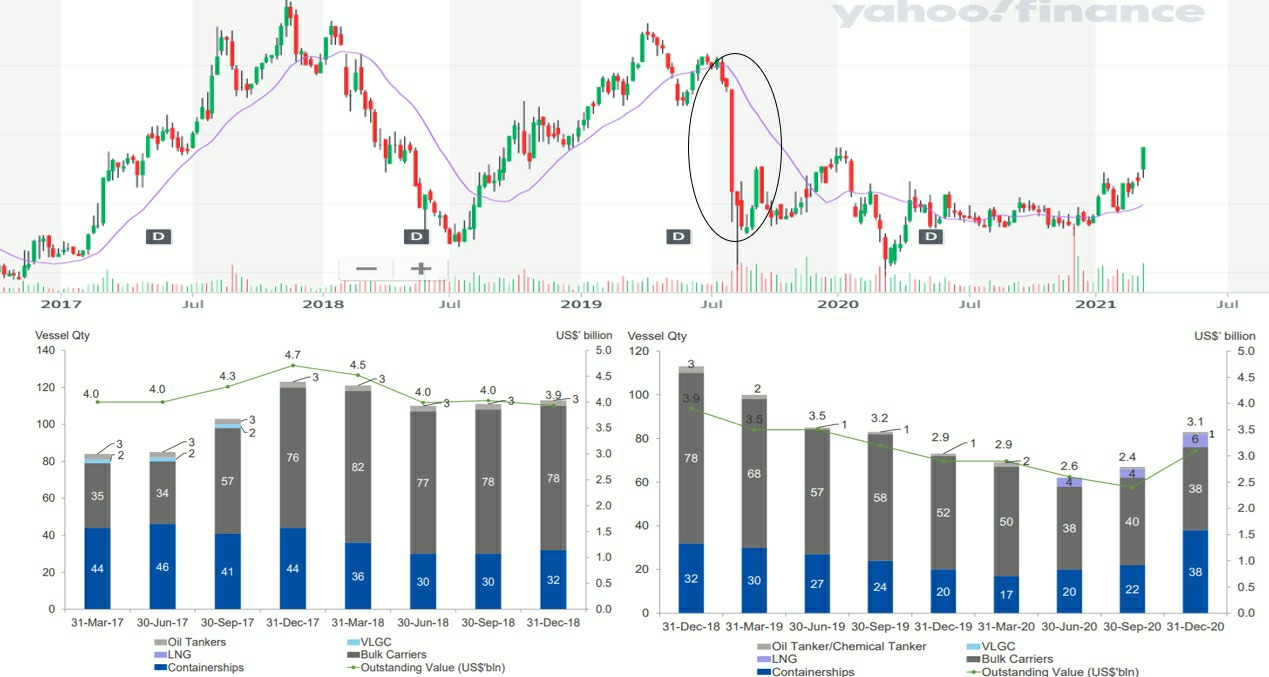

$YANGZIJIANG SHIPBLDG HLDGS LTD(BS6.SI)$ As at 31 Dec 2020, YZJ outstanding order bookwas about US 3.9billion. This is about the the same level as Sep 2017. As of 5 March, the new contract won was another US 3.04billion. This amounted to about US6.9 billion. This outstanding order book is the highest for the last 5 years. Perhaps more orders to come since now is just the first quarter of 2021

This inline with the overall economy recovery where shipping companies anticipate higher demand in the near future. As mentioned previously, YZJ is cyclical in nature. Hence, it will perform when the economy recover. Stock price will follow up and down.

Give Yangzijiang Shipbuilding sometimes, be patience and its share price should follow the economy up.

Risk involved :

1) Currency risk

Since contracts are in USD, excessive devaluation of USD will result in lower profit when translated into CNY. This may be hedged.

2) Operational risk (Price of Raw material)

Yzj is selective about the contracts to maintain margin.

3) Default risk (Debt investment)

About 37% of assets are debt investment.

4) Chinese stock embedded risk

The crash in Aug 2019 was due to the investigation of previous chairman but was released afterward. This was a one off event that unlikely to happen unless there is something hidden.

Exordinary risk is that covid19 continued and cannot be controlled (touchwood).

精彩评论