09.13.2018 Wed, Sunny, Air Polluted

Summary:意大利和欧元区工业产值数据不佳一度导致欧元和英镑反弹夭折,但是欧盟再次对英国脱欧协议让步使得欧洲资产再次上涨。美国有意重启贸易谈判的消息使得美国资产获得支撑。美元则有所走弱,但美债缩量新发引起抢购,而似乎欧洲的大问题要来了。

Euro Session:

Asia markets traded heavily with A share down for the 6th straight session, $Asia on the defensive, while UST yields held at 2.97%. Trade uncertainty continues to weigh on the regional outlook with report that US and Japan could resume trade talk on Sep 21 after Abe addressed he shall try to visit China in October on trade issues. In my gut, Japan is likely to accede to a free-trade agreement with US since its king's living place is within the 5 minutes range of F35.

EU equities opened in green following their US counterparts while EGBs mixed. It's supposed to be relatively quiet session since no tier-1 data on schedule after most main rates rallied in the previous session. A lot of noise about today's ECB meeting hit the tape. One of the reports said ECB could slightly revise down economy growth projection reflecting weaker external demand due to the expanding downside risk while the inflation expectation was left intact. The double miss of ITA and EMU July IP justified this kind of news which also dragged down most EGBs rates. It seems the latest vogue at least across Asia and Europe could be stagflation.

On the front of the big 3 concern EU facing, 1)Barnier warned "Britain shouldn't have excessive optimism on European red lines." the day before yesterday , Downing street hit back with saying " READY TO DROP CHEQUERS IF EU REJECTS " with whisper spreading on some Tory Brexiter plotting coup again May. The real breaking news came out at 12:50 :EU said to begin redrafting Irish Brexit protocol to appease UK. Then EUR and GBP flied. 2)Italian foreign affairs minister echoed recent comments from other officials that the M5S-League government is “determined to pass a sound budget that will stem market speculation”. FinMin Tria noted the 2019 budget will aim not to worsen the structural deficit (i.e. fiscal neutral). 3)US and EU were said to reach partial agreement before Nov.

Economy data:

4:00, ITA July IP SA -1.8% vs -0.3%, prior 0.5% revised down to 0.3%

ITA July IP WDA -1.3% yoy vs 1.6%, prior 1.7% revised down to 1.4%

5:00, EMU July IP -0.8% mom vs -0.5%, prior -0.7% revised down to -0.8%.

-0.1% yoy vs 1% , prior 2.5% revised down to 2.3%.

US Session:

Shortly after 11:00, It was reported Mnuchin said to propose new round of China trade talks. US equities and CNH was thrilled at this news. But obviously Equities were pretty cautious about this. Last time Mnuchin got involved, he and the 'truce' he mentioned got slapped down pretty hard by Trump. But at the moment of New York closed , Kudlow confirmed this news.

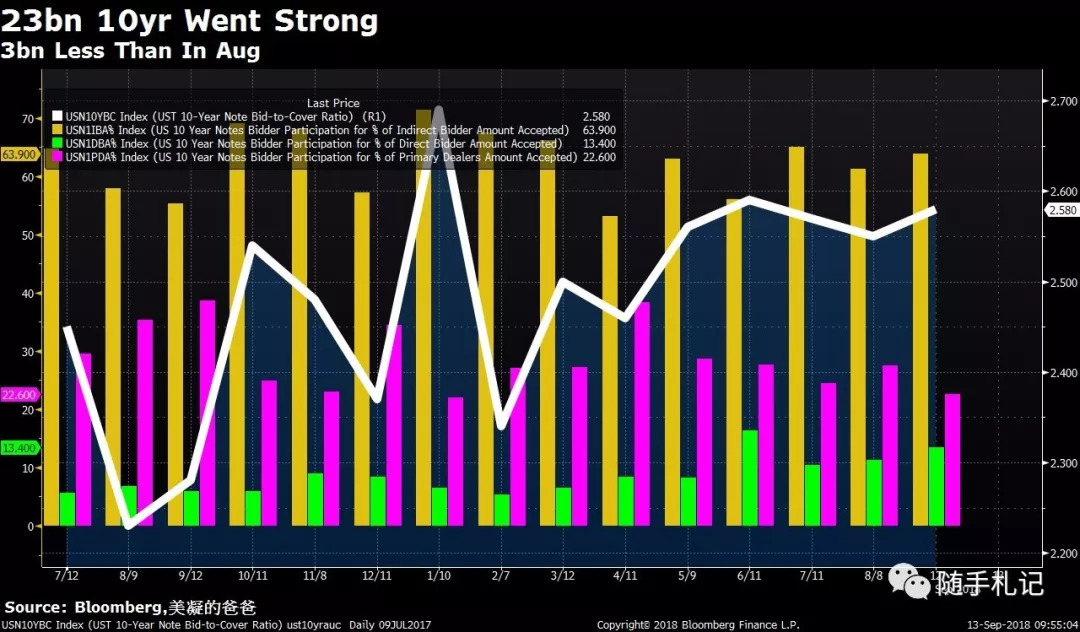

As to rate, UST was constrained in a tight range across the curve with 2s10s bull flattened by half a bp. At 8:30, the miss of PPI supported the UST price for a while and faded soon. At 1:00. US Treasury auctioned $23bn 10yr notes at a high yield of 2.957%, coming 0.7bp through the WI 1:00 level. Buyside participation was strong. Direct bidder award of 13.4% was the highest since June and indirect bidder award of 63.9% also exceeded the 6-auction average. Primary dealers took just 22.6% of the issue, lowest since January. Bid to cover was 2.58x, just slightly above average. What's strongly notable is the 10 yr supply in AUG was 26bn!This could be a strong leading indicator US fiscal deficit is improving. But if it was due to the debt ceiling , that could be another story. I CAN NOT FIND ANY CLUE NOW. If you have, please share with me .

As to Fed, BULLARD: YIELD CURVE INVERSION WOULD LIKELY UP RECESSION RISK. Fed's Brainard says shorter-run neutral interest rate likely to move higher. Fed Beige Book cites some evidence of firms delaying capex decisions.

Other news, Trump signs EO (EXECUTIVE ORDER) on sanctions for election meddling. The order would put the CIA, the National Security Agency, theDepartment of Homeland Security and the Office of the Director of National Intelligence in charge of determining whether meddling has taken place.

Economy data:

US August PPI was -0.1% m/m, +2.8% y/y vs. expected +0.2% m/m, +3.2% y/y.

Key Data And Events Ahead:

USA: Fed's Bostic speaks, CPI (Aug), Monthly budget statement (Aug), Initial jobless claims, Bloomberg consumer comfort; 15bn 30yr auction(18bn in AUG)

CAN: New housing price index (Jul);

EMU: ECB rate decision;

UK:BOE rate decision, RICS House price balance (Aug);

DEU: HICP (Aug F);

FRA: HICP (Aug F);

JPN: PPI (Aug), Machine orders (Jul);

Comments:

EU's trouble always looks endless. Italian industrial output fell more than expected in July, further complicating the government's efforts to square its populist program with economic realities. Italian leaders have started the key rounds of work on the 2019 budget with a struggle over the size of the deficit needed to implement tax cuts and income support for the poor. The European Commission in Brussels predicts Italian growth of 1.3 percent this year and 1.1 percent in 2019, the slowest pace in the currency bloc. Then, what's the big trouble ahead of EU? According to the poll host by local media, President approval ratings at the same time of presidency exhibited as below:

Macron: 25%

Hollande: 27%

Sarkozy: 42%

Chirac: 55%

France has the highest percentage of civil service to his population among EU. One big issue of Macron's policy is to cut off the scale of this kind of group saving money for fixed capital investment which contribute second most to FRA Q2 GDP. With such a low approval rate, he could do something beyond the market complacent imagination of double M. The nearest trigger could be the Italy budget by the month end. We have heard some chasm between Macron and Merkel on EU united fiscal plan while Merkel compromised more than Macron did. Once this gap goes public (I do hope not) , you can always imagine how hard EU assets can get hit. Besides, too much tones on dollar weaken side could be very interesting. Just remember the old adage "to truly stab somebody in the back , you have to be 100% behind them"

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月13日,ECB议息,APPLE新手机发布

9月18日,EU A50会议

9月18-20日,半岛峰会

9月20日,EU非正式峰会,日本LDP选举

9月21日,美日可能举行贸易谈判

9月26日,FOMC

9月27日,意大利提交财政预算案

9月30日,美加贸易谈判截止日

10月14日,IMF峰会

10月15-19日,美国财政部关于货币政策半年报告

10月16日,EU A50会议

10月25日,ECB议息

10月26日,s&p评判意大利评级

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

11月13日,美欧特别峰会

11月15日,亚太峰会

11月30,G20峰会

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Appendix:his t overnight

0912 1834 “The President has absolutely demonstrated no wrongdoing whatsoever & that the Special Counsel has no evidence of any wrongdoing. In other words, it’s time to end this Witch Hunt.” @LouDobbs Russian “collusion” was just an excuse by the Democrats for having lost the Election!

0912 1854 We got A Pluses for our recent hurricane work in Texas and Florida (and did an unappreciated great job in Puerto Rico, even though an inaccessible island with very poor electricity and a totally incompetent Mayor of San Juan). We are ready for the big one that is coming!

0912 1859 Hurricane Florence is looking even bigger than anticipated. It will be arriving soon. FEMA, First Responders and Law Enforcement are supplied and ready. Be safe!

0912 2159 Hurricane Florence may now be dipping a bit south and hitting a portion of the Great State of Georgia. Be ready, be prepared!

0912 2209 “I can say, as it relates to the Senate Intelligence Committee Investigation, that we have NO hard evidence of Collusion.” Richard Burr (R-NC) Senate Intelligence Committee, Chairman

0913 0039 It is imperative that everyone follow local evacuation orders. This storm is extremely dangerous. Be SAFE! #HurricaneFlorence https://t.co/94Ue4e26PD https://t.co/KvF54CwomW

0913 0719 #HurricaneFlorence https://t.co/mP7icn0Yzl https://t.co/jOdKT02rbH

0913 0724 Tonight, it was my great honor to host a Congressional Medal of Honor Society Reception at the @WhiteHouse! https://t.co/75JQiVtnUT

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 4020 !

精彩评论