Watch the Hour Tick by

09/10/2018, Moni, Sunny, Air Perfect

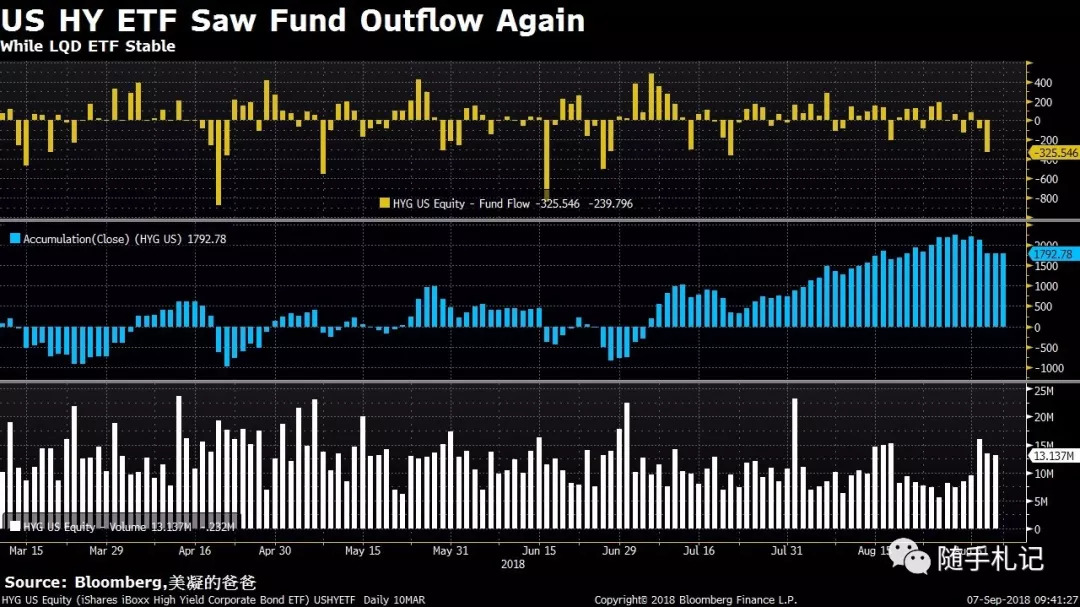

Summary:贸易战阴影拖累欧美股市,日元受益大涨,各主要国家利率受压。本周美国HY ETF大量资金流出,下周美国国债新发,市场关注贸易问题后续发展以及地中海态势发展。

Euro Session:

EM turmoil moderated across most of Asia. USTs little changed from New York Closed levels. Range was only as tight as 3 tick with cash 10s holding around 2.90% for another day. Asian bourses followed US Counterparts lower as EM stress continues with A share got pretty nervous about the possibility of the 25% tariff on 200bn goods with strong intent to test the recent low in Aug.

Both EU equities and EGBS opened flat except BTP was under strong purchasing power. The pause of EM bleeding did boosted the sentiment with the market taking no news as good news as to Italy. Both EUR and GBP performed resiliently to a decent extent.

Quite a lot of noise around Brexit without disturbing the market too much., such as "GERMAN CSU CALLS ON EU NEGOTIATORS TO AVOID A HARD BREXIT","Key Macron ally tells Business Insider that France will not compromise in Brexit talks".

Economy data:

No

US Session:

UST ended the US session 3bps richer at 2.87% from Beijing off-work. 5s30s half a steeper at 31 basis points. As stated in this notes, there is very heavy new issue in this month. And before the 8:30 data print, corporate issuance announcements helped the curve briefly steepen. ADP missed at 163k vs. 200k and initial jobless claims fell in line at 203k. The soft print caused the market to rally led by the belly as the curve flattened back into the equity open. All the main indexes gapped lower followed by their EU counterparts as the market awaiting developments on the tariff front as the public comment period for the proposed additional 200bn.

Shortly after, Factory Orders printed at -0.8% while durable goods fell in line at -1.7%, but the prints did little to stir the market. Around 11:00, Williams hit the tape with some dovish commentary signaling a possible pause to rate hikes. Treasuries rallied off the statement and equities sold off for the rest of the morning. Nasdaq struggled a second day. But after the EU equities closed, US equities recouped some losses led by Indu with VIX jumped higher for the second day. Tech and Energy were the biggest losers.

Other news, Fed’s Evans said the FOMC should increase interest rates to neutral and “likely a bit beyond”. Trump hint " the next trade war could be against Japan".

Economy data:

US Aug. ADP 163k vs. 200k, with July revised from 219k to 217k.

US Aug. ISM Non-Manufacturing 58.5 vs 56.8, prior 55.7

US Q2 final Nonn-farm Productivity 2.9%, preli 3.0% q/q, with Unit Labor Costs revised to -1.0% from -0.9%.

US Weekly Jobless Claims 203k vs. 213k

US Aug. final Markit ISM Services PMI 54.8 , preli 55.2.

US Jul. Factory Orders -0.8% m/m vs. -0.6%

Canada July Building Permits were -0.1% m/m vs. +1.0% expected.

Key Data And Events Ahead:

DEU, FRA IP, FRA manufacturing production

ITA retail sales

EMU Q2 GDP final

US August NFP

Rosengren, Mester and Kaplan speaks

Comments:

What Williams actually want to express is to explain why the Fed does not need to accelerate from the current "gradual" pace of rate hikes. Price and wage inflation pressures are not pushing them to move more aggressively. He describes the current environment as "goldilocks". But the market did interpret this a bit in a dovish direction. The HY ETF saw fund outflow again this week and the new supply of 35bn 3yr/23bn 10yr/15bn 30yr next week, can you smell something which is going on? Highly tension in the Mediterranean Sea now. The density of warship there is comparable with that at the gulf war. The last fort those who are against Assad are holding up is the key entrance for oil and LNG into the mainland of Europe. As a humble trader , I used to be a complete layman to geography-politics. But now I have a strong feeling there is bound to be something happen within next 7 days from this weekend on. Do you have the feeling they are doing whatever they can to press down rates, especially in the long end? What is the title of today's notes about is to sit down and wait for that moment quietly and patiently.

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月13日,ECB议息

9月18日,EU A50会议

9月18-20日,半岛峰会

9月20日,EU非正式峰会,日本LDP选举

9月26日,FOMC

9月,日本LDP选举,半岛峰会在平壤

9月27日,意大利提交财政预算案

10月16日,EU A50会议

10月25日,ECB议息

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 4003 !

$(AAPL)$$(AMZN)$

精彩评论