Boiling In Someone's Hot Air

08/13/2018, Mon , Cloudy, Air Perfect

Summary:The bleeding Turkey finally dragged down global markets. Now we have two main themes now.

Euro Session:

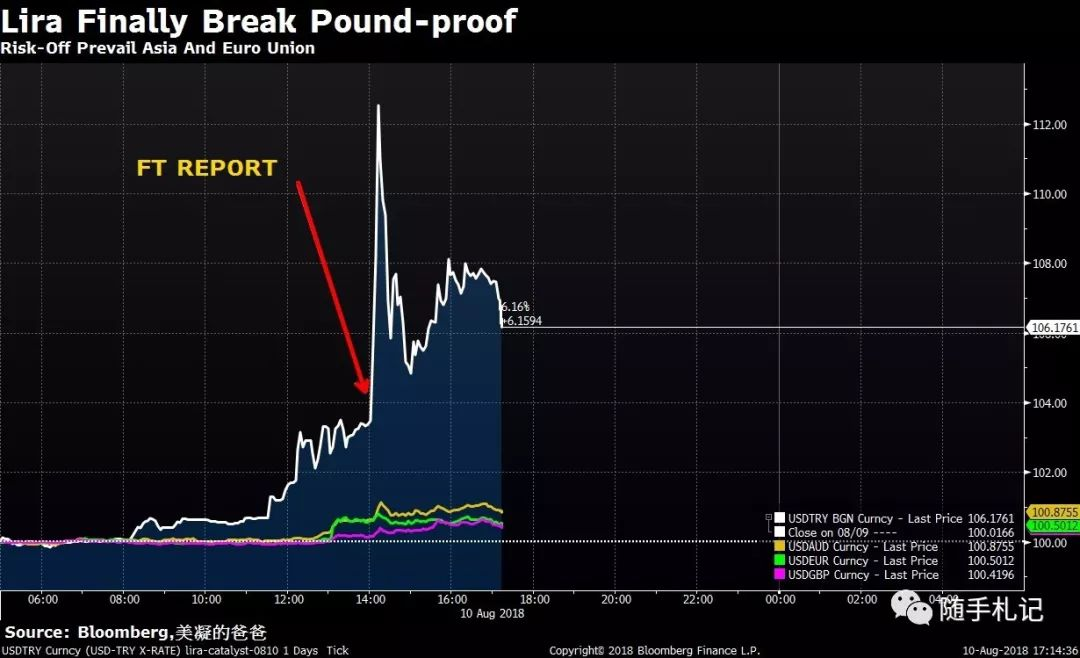

In the early morning of most euro countries, USDTRY fell sharply again and successfully triggered a series of reactions. EUR fell sharply followed by GBP and AUD while JPY was relatively stable among G7. It was reported that ECB said concerned on BBVA(Spain), UniCredit(Italy) and BNP(France) as particularly exposed to Turkish lira plunge, which acted as the catalyst. The risk-of sentiment soon prevailed across Asia with most equity indexes fell into red. Then UST was boosted 3 bps higher from NY closed level.

Turkey foreign liability is around 118bn, the mediocre level in the EM universe. BUT naturally the largest holding of TRY portfolio assets are Euro area investors (42%) followed by US (32%). So it could pretty easy to understand such a scenario. What's following in EU session was the regular things, such as core rates lower (10yr bund -3bp), spread between core and periphery wider and equity lower, EU equities gapped lower, even the Dow Jones mini was down 0.5%. Turkey enjoyed China-like levels of growth in past 16 years, but it ran one of the world’s largest deficits because its expansion was fueled by foreign debt. Now with the unwinding of QE and US sanction, the fragileness of its economy building too much of hotels and shopping malls finally get burst.

2:45, France IP came in better than expectation. After three consecutive monthly declines, industrial production recovered in June on the back of a sharp rebound in refinery output. 4:30, UK Q2 GDP growth came in at 0.4%, in line with the consensus expectation and the MPC's forecast. While this is reassuring following Q1's weather-related weakness, growth remains subdued.

Economy data:

2:45, France June IP 0.6% mom vs 0.5% mom, 1.7% yoy vs 1.4% yoy

4:00, Italy June trade surplus 5.07bn, surplus vs EU at EU 1.52bn.

4:30, UK Q2 GDP 0.4% qoq vs 0.4%, prior 0.2%; 1.3% yoy vs 1.3% yoy, prior 1.2%.

UK June IP 0.4% mom vs 0.3% mom; June trade deficit 11.4bn vs 11.95bn.

US Session:

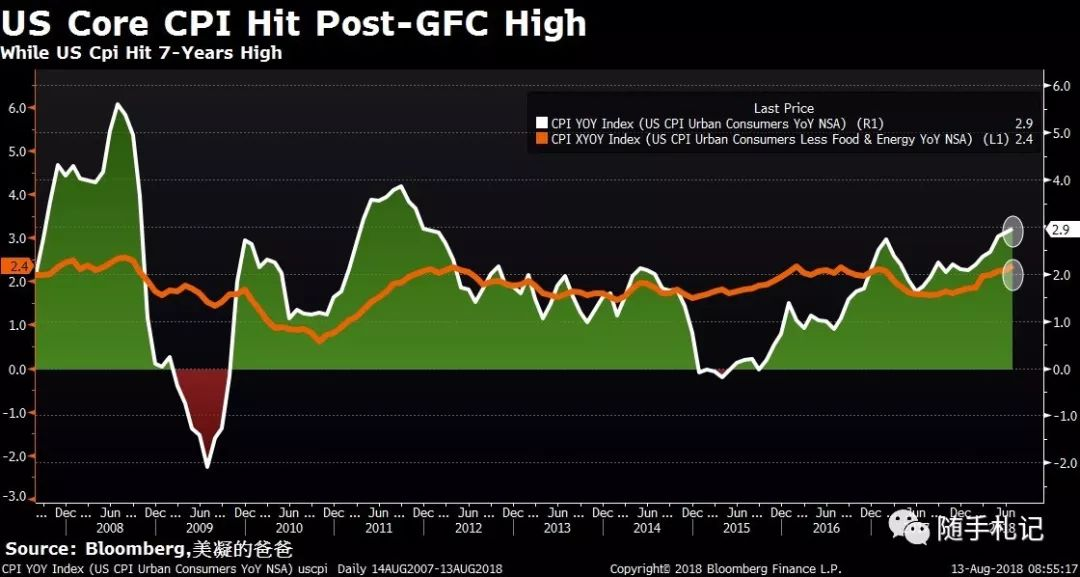

US session was overwhelmed by the risk off sentiment. At 8:30, CPI came in line with expectation while core gave 0.1% upside surprise, and made the post-GFC high. The 10yr UST only hesitated for a while and then went on rallying. Erdogan's speech and his son-in-law's declaration of carrying out tight monetary and fiscal policy both failed to reassure investor’s confidence in Lira. As a result, US equities gapped lower and 10s once touched 2.8515% low (TY 119-23+) before gradually come back to 2.873 in later session. As to FX, USD could be the big winner, EUR decreased another big digi coupled with GBP.

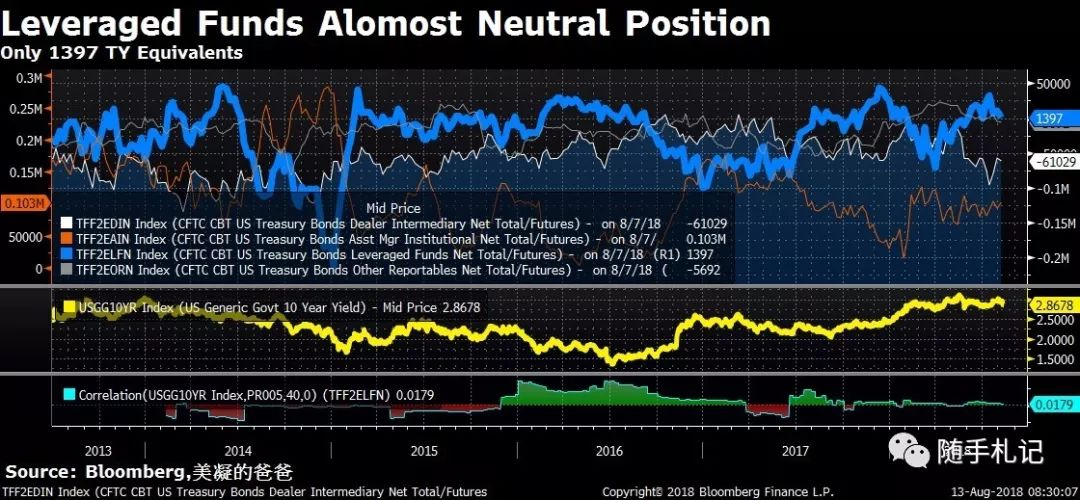

CFTC released all kinds of positions as usual. We can clearly see speculators remained bearish on Treasury **res over the week ending on Tuesday, August 07. They boosted their 10yr net short position reached 5years-high, while the gap between front and long end ever wider.

Regular readers know how much attention I pay attention to LFs positions. All in all, they just sparred their long positions to neutral stage with no contribution to the history high short position of the speculators as a whole.

Economy data:

8:30,US July core and headline CPI were both +0.2% m/m, in line with consensus. Headline y/y was 2.9%, as expected, while core y/y was slightly above at 2.4%, vs. consensus of 2.3%.

Canada July employment 54.1k vs. 17k.

Key Data And Events Ahead:

US : import price index (which may receive a bit more attention than usual due to recent trade focus), Empire manufacturing, advance retail sales, industrial production, housing starts, the leading index, and the UMich survey to end the week.

Europe: GE preliminary Q2 GDP, ZEW, FR IT CPI and FR IP

UK: employment , inflation, retail sales later on

Canada: CPI

Comments:

We have two main clue dominating the market with Turkey issues. As stated above, It is not only European loaned to this country, US also has a big share. It should always be the guys to kneel down who lend out money! As to trade, basically US-EU deal just handshake without timeline. Europe was able to at least agree for small concessions (e.g. EU imports soy beans and liquid natural gas from US – which could be produced cheap by US). Yet, symbolic win is good enough for Trump. As to liquidity, While we continues the rhetoric of wishing to rebalance economy away from being investment-led, more or less we go back to the tried-and-tested method of government-sponsored fixed asset investment now. But frankly speaking, signs of pain have not clearly visible in US. Markets may be choppy but US economy is doing great.

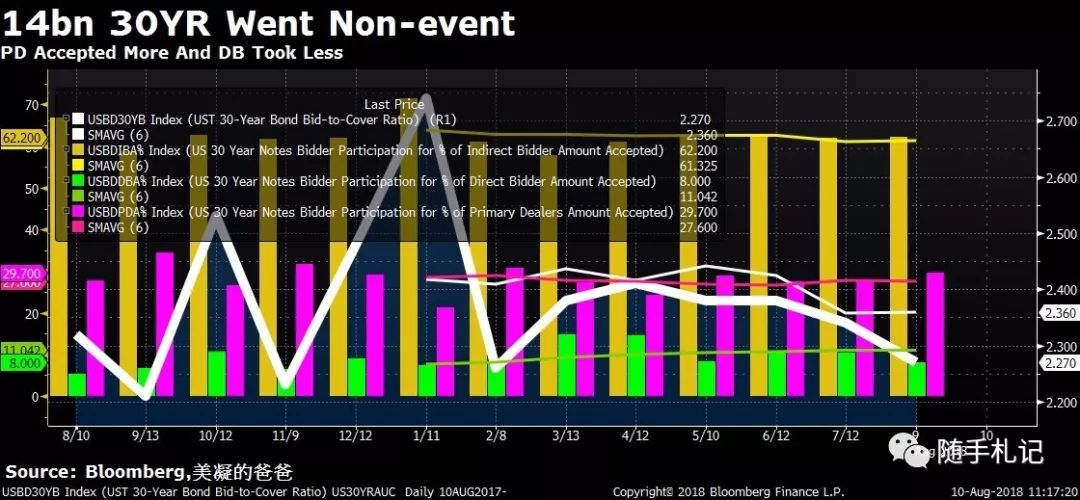

PS: 1. Once US slap new sanction on Russia, it could an opportunity for us. 2. the 14bn 30yr auction went well last Friday morning.

欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

8月17日,公众200bn清单提交书面请求截止日

8月20-23日,200bn听证会

8月25日,Jackson Hole 研讨会

9月3日,第二批A股纳入MSCI

9月5日,200bn听证会后申诉材料提交截止日

9月13日,ECB议息

9月26日,FOMC

9月,日本LDP选举

9月27日,意大利提交财政预算案

10月25日,ECB议息

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵

12月13日,ECB议息

12月20日,FOMC

12月22日,改革开放40周年

2019年3月29日,脱欧谈判截止

Disclaimer:This material was prepared in private name and out of party time hobby,definately based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 3930 !

$(.IXIC)$,$(.INX)$, $(.DJI)$$(000001.SH)$$(399001)$$(HSI)$

精彩评论