号外:本期内容音频版已上架小宇宙。

本周财报季亮点内容 TL;DR HOKA 维持高增速母公司股价创历史新高 李宁三季度营收放缓股价跌至两年内最低 Life Time 健身房现金流压力激增

风险提示:文中提及的公司并不是投资建议,投资有风险,入市需谨慎。

HOKA 维持高增速母公司股价创历史新高

HOKA 母公司 Deckers Outdoor 本周发布财报[1],营收同比增长超过 20%,同时管理层调高全年营收指引到 40 亿美元。Deckers 其下营收贡献最大的两个牌子分别是 UGG 和 HOKA。在上个季度 UGG 北美营收增长放缓,而最新财报显示,这部分业务重回增长,营收同比增长 28%。同时 HOKA 继续维持高速增长,营收同比增加 27% 。对比当前的宏观环境以及整个行业都处于去库存周期,Deckers 的这份财报还是非常炸裂的。财报发布当天,股价跳涨一度超过 20%,创历史新高,公司市值也超过了 150 亿美元。

单看 HOKA 这部分,季度营收 4.2 亿美元,和竞争对手昂跑算是旗鼓相当(昂跑上个季度总营收 4.4 亿美元)。为什么 HOKA 增长这么猛?一方面是产品辨识度强:HOKA 最初的两位创始人来自萨洛蒙,有越野跑运动背景,他们最初的产品设计理念也是聚焦越野跑场景,希望通过又大又厚的鞋垫来提升越野跑场景的跑步舒适度。同时,这种“踩屎感”也命中了需要长时间站立的医生人群以及对于跑步脚感有要求的大体重人群。再加上各路明星的“带货”,助推了 HOKA 在美国市场的流行。

另外,HOKA 在销售渠道方面也非常重视经销商渠道,这部分品牌营收占总营收超过 60%。和昂跑类似,HOKA 也享受了 Nike 去经销商化这个趋势下的经销商“红利”。同时,HOKA 严格控制产品的售价,主打全价销售策略。虽然每双鞋单价动辄人民币上千元,却很少出现降价打折的情况。管理层在最新的财报电话会议里也强调,他们接下来的策略是有选择的避开打折季,并为接下来的全价新品做准备。

Yes. And I think, Jon, just to add on that is, this aligns with the strategy that we've laid out. So this is not a change. As we've said the importance of controlling the marketplace, product in the marketplace, maintaining full price selling, continuing to build brand awareness aligns with our full year outlook. And so we're continuing operate on that with no change on that front. As you can see by Q2 performance, seeing still good growth with the HOKA brand and really impressed with what we continue to deliver. But we're going to be tight on marketplace management, and that's our strategy, and that's what's paying off.

另外,HOKA 过往全名是 HOKA ONE ONE(发音 HOKA o-nay o-nay),是毛利语中“飞越大地”的意思。不过在品牌发音上容易引起误解和错读,公司从 2021 年起在产品以及市场宣传上,直接选择 HOKA 作为简化版的品牌名。

李宁三季度营收放缓股价跌至两年内最低

本周李宁发布了他们第三季度的销售数据情况[2],上个季度曾经聊到,李宁增长出现“增收不增利”的现象,这个季度不但未见改善,而且营收增速也降下来了,从 10%-20% 变成中单位数。除了线下直营渠道以外,经销商和电商渠道都出现增速放缓的情况。对比上周刚刚发布最新销售数据的安踏和特步,营收增速在三家公司中垫底。

公司 | 三季度营收同比增长 |

|---|---|

安踏 | 高单位数增长 |

特步 | 高双位数增长 |

李宁 | 中单位数增长 |

据海通国际最新研报显示,影响李宁营收增长的一大因素是库存问题,自去年年底起李宁的篮球鞋和跑鞋有窜货情况,部分经销商为了尽快收回现金流,低价销售货品,对线下经销商和电商正价货品表现有较大影响。研报透露目前李宁公司更关注经营质量,短中期优先处理折扣和库存问题,不强调量的增长。同时加大力度处理线上线下窜货行为,有堵有疏,控制货源,梳理与经销商关系,主要措施是三季度末起降低对经销商的出货压力,匹配经销商动销和进货水平,将对经销商收入贡献有一定影响。因此,管理层下调全年收入低于双位数, 利润率可能不会改善。

除了短期库存问题以外,李宁更大的问题可能来自单品牌战略叠加国潮热度下降。上周安踏发布了他们三年规划,其中包括其下四大子品牌以及始祖鸟旗下各品牌矩阵覆盖各种细分场景。而李宁这边在细分市场的布局相对来说偏弱,与控股公司非凡领越旗下品牌的联动效应也还不够清晰。

综合上述问题影响,李宁在公布营收数据当日股价大跌 20%,跌至两年内新低。与 Deckers Outdoor 形成鲜明对比,看来不光是消费复苏趋势呈现 K 型趋势,上市公司股价也分叉了…

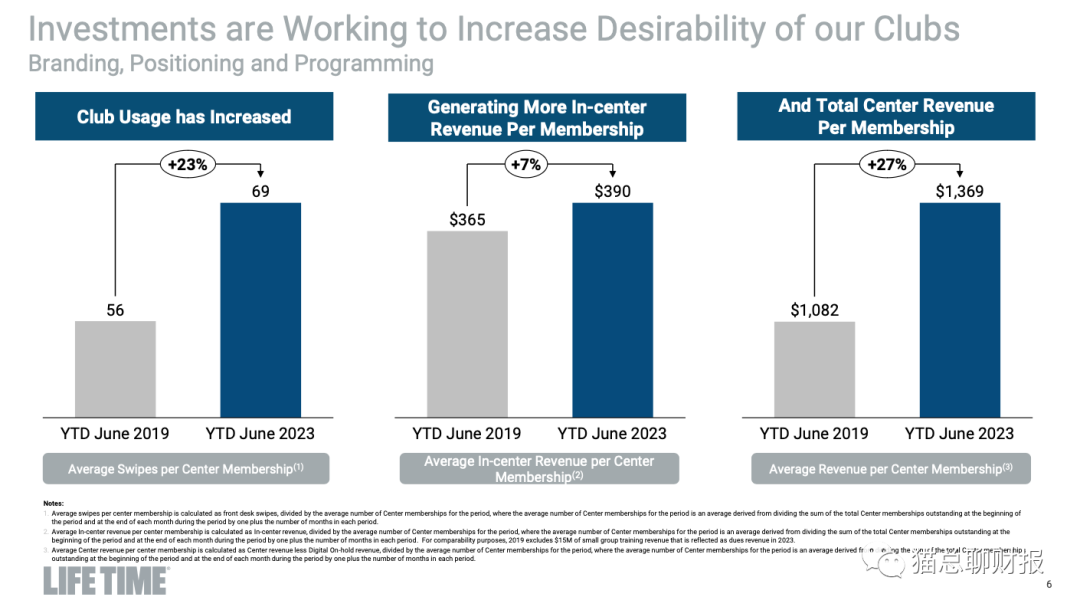

Life Time 健身房现金流压力激增

Life Time 本周公布了他们最新的财务数据[3],营收同比增长 17.9%,但是净利润从去年同期的 2470 万美元大幅萎缩到 790 万美元,跌幅高达 68%。领导层解释原因主要是因为 SLB 部分的收入大幅缩水。

Net income declined $16.8 million to $7.9 million, primarily due to gain from sale-leasebacks of $48.6 million in the prior year period and a loss from a sale-leaseback transaction in the current year period of $12.7 million, partially offset by improved business performance in the current year period.

上个季度曾经提到,Life Time 由于经营模式上属于“重资产运营模式”,开新店增长所需要的资金量非常大,单靠会费收入不够,还需要通过其他途径融资。他们通过贷款建好大型健身房之后会打包卖出去,然后再租回来运营(Sale Leaseback,SLB),如果建成的项目无法成功出售,会遇到较大的现金流压力。这个季度刚好这里出了问题。因为美联储持续加息,无风险利率持续上行,公司的 SLB 融资成本也跟着提升到公司无法接受的程度。管理层表示未来一段时间将暂缓新的售后回租交易,直到市场条件转好。

At this point, we're waiting for some sale-leasebacks and LOIs to come in, and they have been delayed. So the folks that have been -- we've been in discussion to send those. They are still planning to send something, we're still waiting to get those. However, as I mentioned to you, clearly, at this point, the #1 priority of the company is not sale-leaseback, it's not anything else, it's to actually deliver free cash flow positive after all of the capital we need for maintenance CapEx, interest as well as all of our growth capital from internally generated cash flow and deliver double-digit growth. That's the exact position we want to be in when the sale-leaseback market is attractive, we will do more sale leasebacks.At this point, we don't need them. So we will treat them exactly as they should. If they are within the -- these are 20- to 25-year initial terms with 2025-year options, they are very, very long-term transactions. And so, we're not going to do a long-term transaction because of a short-term blip on the interest rates.

为了缓解现金流压力,公司管理层表示当前重点是通过自有现金流实现增长。他们计划未来通过“轻资产”方式实现增长。即接手其他租户退出的资产,以及与地主合作改造资产。

So your question of how this asset-light is coming, we're buying stuff for -- we're buying buildings today for less than the cost of just land. These are older clubs, and then we put the money into remodeling them. They're going to be 100,000 square feet facility for significantly less capital than we would have done if we had gone from ground up. So -- and/or sometimes landlords who have had other tenants who have not performed. They're taking those assets away and they're coming to us.The fact that we treated all the landlords -- and I've been saying this repeatedly -- absolutely properly during the time that people were not paying rent, we paid all the rent. And that Life Time's brand and reputation is allowing landlords come to us and make deals with us that they're completely asset-light for us, but we -- it's no different than we had built the rest of our clubs.

会员营收部分,Life Time 也面临不小压力。从 10 月 1 日起,联邦学生贷款暂停期结束,将有多达 4000 万美国人需要承担新的月度账单[4],而 Life Time 的用户构成中,有 44% 年龄低于 35 岁,58% 受过高等教育。恢复还贷之后,这部分用户在健身等可选消费的支出上可能会有所削减,导致公司营收增速进一步承压。

上面各种因素叠加,导致 Life Time 公司股价进一步大幅下挫。

下周预告

运动鞋服:V.F. Corporation、Zalando

健康餐饮料:sweetgreen、Monster Beverage、Glanbia

健身器械:Peloton、Technogym

以上,

参考资料

[1]

DECKERS BRANDS REPORTS SECOND QUARTER FISCAL 2024 FINANCIAL RESULTS: https://ir.deckers.com/news-events/press-releases/press-release/2023/DECKERS-BRANDS-REPORTS-SECOND-QUARTER-FISCAL-2024-FINANCIAL-RESULTS/default.aspx

[2]

李宁有限公司二零二三年第三季度最新运营状况: https://doc.irasia.com/listco/hk/lining/announcement/a290062-c_2023q3qtrlydisclosureann%2820231025%29final.pdf

[3]

Life Time Reports Third Quarter Fiscal 2023 Financial Results: https://ir.lifetime.life/news-events/press-releases/detail/1029/life-time-reports-third-quarter-fiscal-2023-financial

[4]

Student loan bills resume for 40 million Americans. How it could shake the economy: https://www.cnbc.com/2023/10/01/how-the-restart-of-student-loan-payments-could-shake-the-economy.html

精彩评论

国内再喜欢的服饰公司应该是安踏?

疫情之后这个赛道有大机会

有点想买海通国际的股票

李宁的衣服不错,股票比较一般