2023/8/27:

NVDA reached a historical high of $502 on 24/08/2023 after Q2 report was announced. However, it plummeted on the second day to $450, closed $460.18.

Why?

Because it has reached target , since it is not a human, it won't strive to go further once the target is met, so it fell after the target was achieved.

英伟达在第二季财报公布后创历史新高$502。然而,它在第二天跌到$450, 以$460.18收盘。

这是为什么呢?

因为它达到了上升目标,所以下跌。毕竟它不像人类,会百尽竿头,更进一步。

1 What is the target of a stock price? The answer is to reach 400% of its first movement.

股价的目标是什么呢?答案是达到第一浪的400%。

NVDA reached its 425% on 14/07/2023, dropped for one month untill 14/08/2023. It once again surged and crossed the 450% resistance level on 24/08/2023, however it was a bull trap - because it opened at its highest point but closed at its lowest point, continuing its decline on the second day.

英伟达在2023/7/14达到第一浪升幅的425%,下跌一个月时间至8月14日,再次上升于10天后到达并穿越450%阻力位,不过,这是诱多陷井,因为8月24日这天,它以最高点开盘,却以最低点收盘,第二天继续跌势。

2. Imaging you are a fund manager.

想像一下你是个基金经理。

Your buying time would be after 28/12/2023, multiple operations below$200. When NVDA reached $460 - $500, which is 400%-450% resistance level, would you take profit? of course . Other fund managers would do the same thing.

So target reached , trend reversed.

你的买入时间是在2022/12/28之后,分次买入价格在$200以下。当英伟达升至$460-$500, 也就是400%-450%位置时,你会否获利了结?那是当然的。其它基金经理也同样想法,同样操作。

所以目标达成,趋势反转。

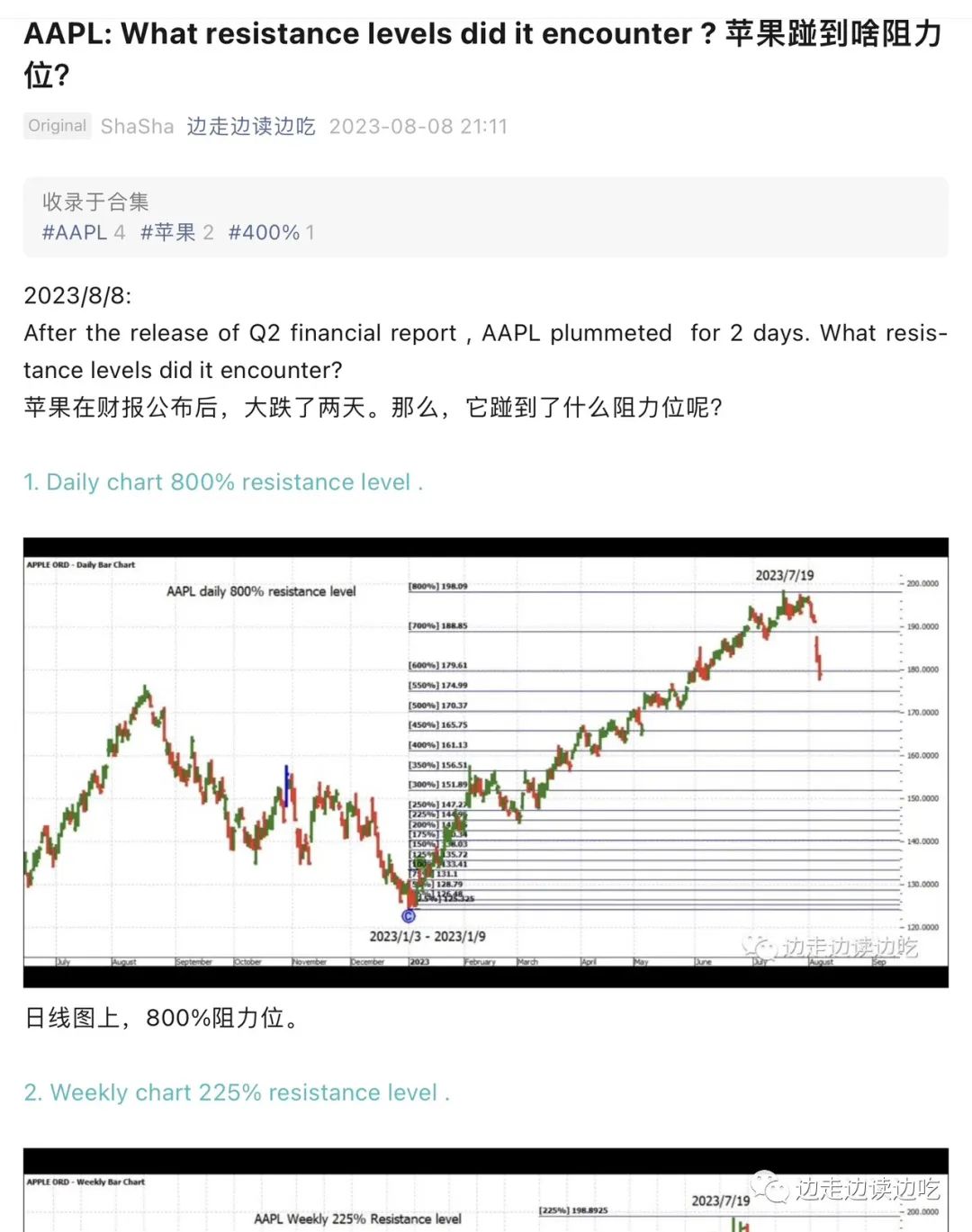

3. Same as AAPL, dropped after report was released.

跟苹果一样,财报公布后下跌。

-----

------

精彩评论

作为行业龙头,要是英伟达倒了,整个半导体板块都要倒

看K线走势,好像并没有你说的那么悲观

不要喊趋势反转,这对赚钱没好处

财报这么好,K线这么走,妥妥的套人行情

满仓英伟达,看着你的分析瑟瑟发抖

前期涨了那么多,调整一下也是正常的