Recently, Bloomberg interviewed the co-founder of Coinbase.Sharing a summary and my take here.

Video source: https://youtu.be/V7qs7indOHs

Fred Ehrsam co-founded $Coinbase Global, Inc.(COIN)$ with Brian Armstrong in 2012. He had background in computer science engineering, observed first hand as forex trader in Goldman Sach how traditional banking system caused a painful Greek bail out, and an avid video game player that uses virtual currency.

He left Coinbase in 2017 to focus on investment opportunities in businesses that are built using crypto or block chain. He believes in the broader applications of crypto, including decentralised finance (DeFi). Looking at the landscape of venture capitalists, there seems to be a lack of financial backers that could provide crypto the required technical expertise. He helped set up Paradigm that helps to fund start-ups using block chain such as custodians, know-your-customers (KYC), lenders, backend infra as services.

Future and Potential of Crypto

Ehrsam shared some of his visions about cryptocurrency. Most people viewed crypto as just a new digital currency. However, he sees it as the tool to allow us reimagine how a lot of the current systems are running now. Crypto could form the foundation of new financial system and replace the existing baking system. More excitingly, crypto could open doors to broad range of internet applications using block chain technology.

In disrupting the financial systems, the crypto would allow customers can own global permission-less banking. Crypto would also solve privacy concerns.

In contrast, there is still none mainstream applications that uses block chain technology now. Therefore, Ersham feels we are in the exciting early phase of this era. He predicted that creators and users would no longer need centralised platforms such as Facebook or Google to interact, even demographic graphs of users would be captured all in the block chain.

Looking ahead 20-30 years ahead, Ersham envisioned that the crypto wallet would became our digital identity, bank account, universal log in to all internet applications, digital resume and many more. Users can also choose to switch between using real identity or pseudonym.

Myths of Cryto

Is crypto a speculative asset or worth long term investment? Ersham thinks crypto is superior than a lot of existing investment asset in terms of scarcity, portability and visibility. Furthermore, there is other real utility of crypto.

Is crypto not green? It would depends on how we assess the chain of energy used along the transactions. Ersham feels crypto is more energy efficient, while physical assets require more energy to protect physical assets. However, currently the crypto industry need to be more transparent on energy usage.

Regulations

Ershams views that US is at crossroad with crypto. Given that US is blessed with a strong US dollar that is widely acceptable and some of the most valuable companies are in US, therefore, US may still be a little reluctant to embrace this new currency. SEC has also started to consider to issue some stands on the crypto.

China has started the digital renminbi and crack down on crypto mining. This might give opportunity to other countries to fill the gap.

My take: What to Expect on Crypto?

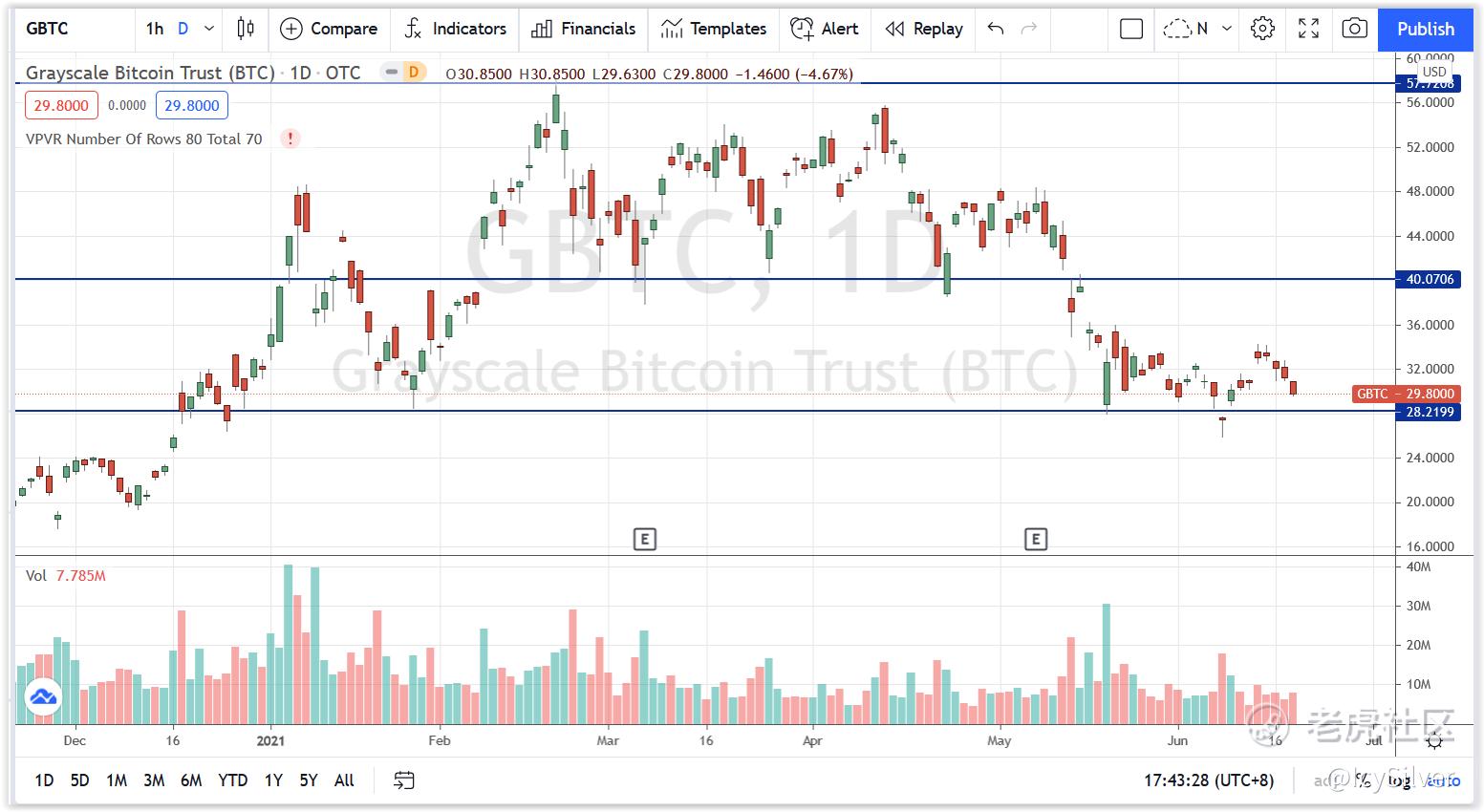

Crypto has started to gain traction with institutional investment funds and now more retail traders. It should be noted crypto is still an unregulated instrument and we need to take careful risk management. Perhaps crypto is more suitable as a long term investment. Do monitor other crypto related counters such as GBTC, Coinbase and $Riot Blockchain, Inc.(RIOT)$ .

$比特币基金(GBTC)$ looking bearish now. If able to bounce back from $26, first target around $34. Support at $24.

Disclaimer: This is sharing for educational purposes. Please do your own due diligence in your trades.

最近,彭博社采访了 Coinbase 的联合创始人。 Fred Ehrsam 于 2012 年与 Brian Armstrong 共同创立了 COINBASE。他拥有计算机科学工程背景,在高盛担任外汇交易员时亲眼目睹了传统银行系统如何导致痛苦的希腊纾困,以及一位使用虚拟货币的狂热游戏玩家。他于 2017 年离开 Coinbase,专注于使用加密或区块链构建的企业的投资机会。他相信加密的更广泛应用,包括去中心化金融(DeFi)。他意识到似乎缺乏可以为加密提供所需技术专长的资金支持者。所以他帮助建立了 Paradigm,帮助使用区块链为初创企业提供资金,例如托管人、了解你的客户 (KYC)、贷方、后端基础设施即服务。

Ehrsam 分享了他对加密货币的一些看法。大多数人认为加密只是一种新的数字货币。但是,他认为它是一种工具,可以让我们重新构想当前许多系统的运行方式。加密技术可以形成新的金融系统的基础,并取代现有的银行系统。更令人兴奋的是,加密可以使用区块链技术为广泛的互联网应用打开大门。 在颠倒金融系统的过程中,加密货币将允许客户拥有全球无需许可的银行业务。加密技术还可以解决隐私问题。

相比之下,目前还没有主流产品应用使用区块链技术。因此,Ersham 认为我们正处于这个时代令人兴奋的早期阶段。他预测,创作者和用户将不再需要 Facebook 或 Google 等中心化平台进行交互,甚至用户的统计图也将全部在区块链中获取。 展望未来 20-30 年,Ersham 设想加密钱包将成为我们的数字身份、银行账户、所有互联网应用程序的通用登录、数字简历等等。用户还可以选择在使用真实身份或化名之间切换。

加密币是投机资产还是值得长期投资? Ersham 认为加密货币在稀缺性、便携性和可见性方面优于许多现有的投资资产。此外,加密还有其他真正的用途。

加密环保吗?这将取决于我们如何评估交易中使用的能源链。 Ersham 认为加密币更节能,而实物资产需要更多的能源来保护实物资产。然而,目前加密行业需要在能源使用方面更加透明。

Ershams 认为美国正处于加密货币的十字路口。鉴于美国有幸拥有广泛接受的强势美元,并且一些最有价值的公司在美国,因此,美国可能仍然有点不愿意接受这种新货币。 SEC 也开始考虑发布一些关于加密货币的立场。 反观中国已启动数字人民币并打击加密货币挖矿。这可能会给其他国家提供填补空白的机会。

个人对加密有什么期待? 加密货币已开始受到机构投资基金和现在更多零售交易者的青睐。应该指出的是,加密币仍然是一种不受监管的工具,我们需要谨慎地进行风险管理。也许加密币更适合作为长期投资。可以留意其他与加密相关的,例如 GBTC、Coinbase 和 Riot。 GTBC 现在看起来看空。如果能够从 26 美元反弹,首先将目标定在 34 美元左右。支持 24 美元。 免责声明:这是出于教育目的的共享。请在您的交易中进行自己的尽职调查

精彩评论