Today let's do a quick review on payment stocks that are listed in US exchanges. Sometimes we forget how much convenience such payment companies brought to our daily lives, be it pre- or during this pandemic.

First up, some of the first generation digital payment.

Visa $Visa(V)$

Visa is a stock that pays dividend and mainly in the credit card industry. It has rapidly moved in various digital payment gateway and is widely accepted. This stock hit 52 weeks high and all time high on 29 April at $237.50. It is now moving in a range of $228-$237.50.

Should the price stays above $228, it could break above the all time high. The nearest support would be at $220.

Mastercard

Mastercard is another credit card and digital payment company. Similar to Visa, Mastercard has also hit its all time high this year on 28 April at $401.50. The price is currently moving in a range between $356-$370.

There seems to have some rejections around $370. The price needs to break above $370 before reaching target $387. The nearest support would be either $356 or $344, depending on risk appetite.

The boom of online payment had sprouted the new generation of digital payment gateway.

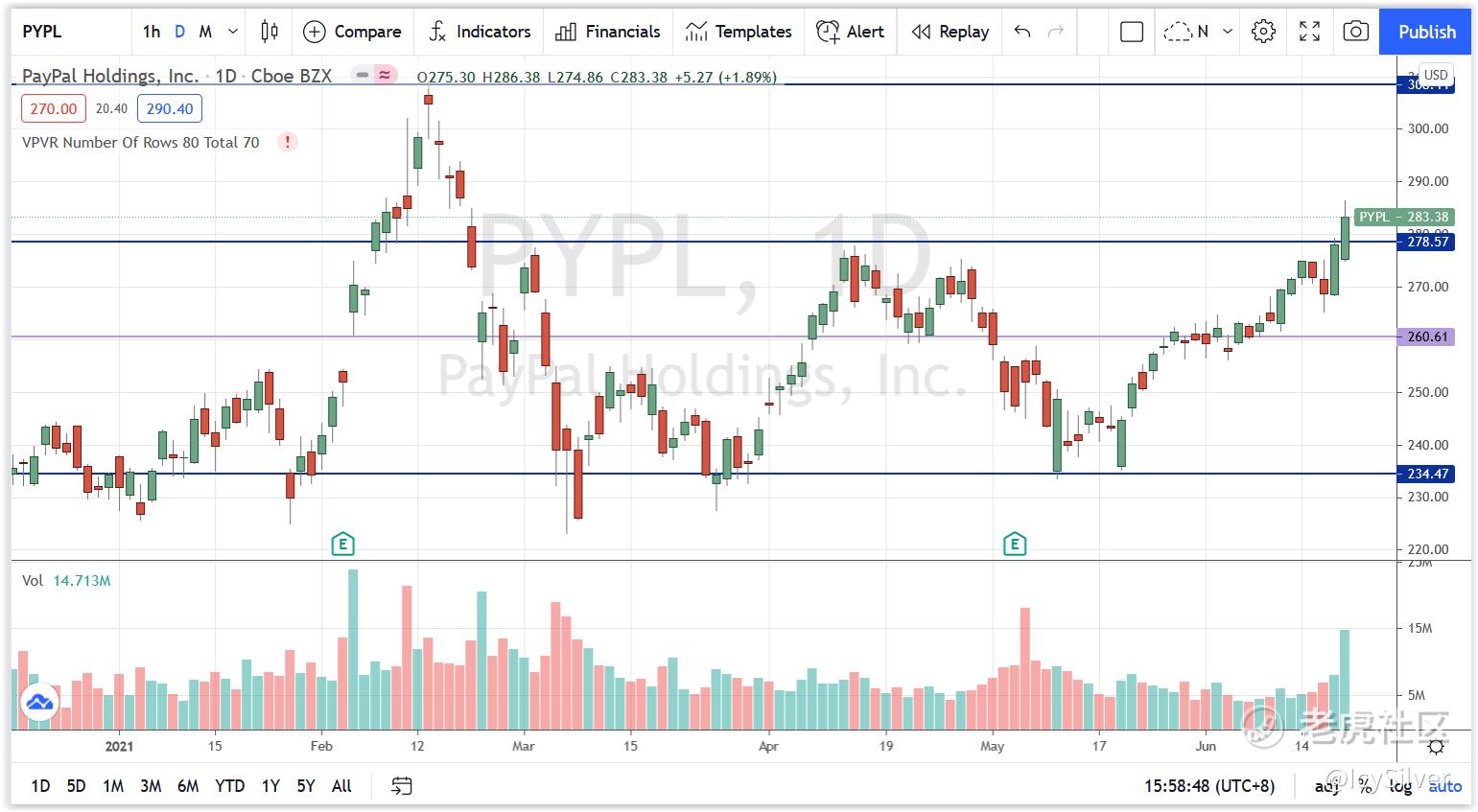

Paypal $PayPal(PYPL)$

One of it is Paypal. It made online payment feasible by allowing consumers to send and receive payments, withdraw funds to their bank accounts, and hold balances in their PayPal accounts in various currencies. It also offers gateway services that enable merchants to accept payments online with credit or debit cards, as well as digital wallets.

Its price is moving between $234 and $278. Aim to break 52 weeks and all time high at $309. The nearest support at $245 or $220, depending on risk appetite.

Square $Square, Inc(SQ)$

Square started as payment gateway to accept credit cards for seller, now also provide reporting and analytics for seller. It also helped with payment hardware.

Since Dec 2020, its price has been moving in a range between $202 and $250. The price reached 52 weeks and all time high at $283.19 on 16 Feb 2021. It would be interesting to monitor the price level around $250-$252. The nearest support would be $220 or $190, depending on risk appetite.

GBOX

Block chain and crypto will offer a alternative as payment in near future. GreenBox works on developing payment that facilitate, record and store tokenised assets using block chain technology.

Its price has been moving in a range between $13.50 and $15.50. The 52 weeks and all time high hit $20.78 on 7 April 2021. If the price stays above $15.50, aim to break above all time high. The nearest support is at $11.40.

Disclaimer: This is sharing for educational purposes. Please do your own due diligence in your trades.

今天让我们快速回顾一下在美国交易所上市的支付股票。有时我们会忘记这些支付公司给我们的日常生活带来了多少便利,无论是在大流行之前还是在大流行期间。

首先,一些第一代数字支付。 Visa是一种支付股息的股票,主要在信用卡行业。它在各种数字支付网关中迅速与时代更进并被广泛接受。该股在 4 月 29 日创下 52 周高点和历史高点 237.50 美元。它现在在 228-237.50 美元的范围内移动。 如果价格保持在 228 美元以上,它可能会突破历史高点。 最近的支撑位是 220 美元。 万事达卡是另一种信用卡和数字支付。

与 Visa 类似,万事达卡也在 4 月 28 日创下今年的历史新高,为 401.50 美元。目前价格在 356 美元至 370 美元之间波动。 370 美元左右似乎有一些阻力。价格需要突破 370 美元才能达到目标 387 美元。最近的支撑位是 356 美元或 344 美元,这取决于个人风险偏好。

在线支付的热潮催生了新一代数字支付服务公司。 其中之一是贝宝。它允许消费者发送和接收付款,将资金提取到他们的银行账户,并在他们的贝宝账户中以各种货币持有余额,从而使在线支付变得可行。它还提供其他服务,使商家能够使用信用卡或借记卡以及数字钱包在线接受付款。 它的价格在 234 美元到 278 美元之间波动。目标是突破 52 周和历史新高 309 美元。最近的支撑位在 245 美元或 220 美元,取决于个人风险偏好。

Square 最初是为卖家接受信用卡的支付网关,现在还为卖家提供报告和分析。它还发展各种支付硬件。 自 2020 年 12 月以来,其价格一直在 202 美元至 250 美元之间波动。价格在 2021 年 2 月 16 日达到 52 周,创历史新高,为 283.19 美元。关注 250-252 美元附近的价格水平。最近的支撑位是 220 美元或 190 美元,具体取决于个人风险偏好。

区块链和加密币将在不久的将来提供一种替代支付方式。 GreenBox 致力于开发使用区块链技术促进、记录和存储代币化资产的支付。 其价格一直在 13.50 美元至 15.50 美元之间波动。 2021 年 4 月 7 日,52 周和历史高点触及 20.78 美元。如果价格保持在 15.50 美元以上,则目标是突破历史高点。最近的支撑位在 11.40 美元。

免责声明:这是出于教育目的的共享。

精彩评论