Core Value:

Value investing in the best growth opportunities and share with our investors on the way.

What we are looking for:

1, Those with strong competition advantages, especially coming from economy of scale and customer captivity.

2, Those still have great potential to grow.

3, Those with honest, capable management.

4, Those who have not been overly priced for their future opportunities.

In short: BEDROCK seeks out undervalued stocks of growing companies we understand with honest, capable management.

Recent Thoughts:

Recently, our portfolio has seen not a small drop and we feel pledged to reiterate our investment philosophy and methodology, recent trades, and future outlooks.

Our investment philosophy and methodology:

In short, our way of investing is: Global Systematic Value investing in Growth, which means our way of selecting is systematic value, and the areas we are looking at are global growth, mostly in tech and consumers.

It is easy to say than to do. Even though many investors may say similar expressions, but what they really hold up would be huge. And we also keep learning along the way. The idea behind it is “Realistic Optimistic”, meaning we would always seek out future opportunities optimistically, but with realistic and prudent attitude. We would never go extremes, even though we understand there are always outliers exist.

That said, our philosophy is based on choosing where the world and human society would most likely to linger than trying to catch what is shining but flimsy. Yes, in mathematically meaning, we prefer consistency rather than jump. That is also our name BEDROCK mean. However, it does not necessarily mean we fear of making change and progress, it is only that we do not try to anticipate short period market’s temperaments and whims.

Also because of that our investment process is rather fixed and has nothing to do with the market recent sentiments. Our process can be divided into three steps: 1, Competition Analysis: choosing out those we believe have sustained advantages; 2, Runway Analysis: choosing out those with great potentials; 3, Valuation Analysis: Comprehensive analysis based on potential, speed, realization possibility, and valuation. We have a baseline criterion for each pick that should provide over 15% compounding return.

Overall, our investment methodology is stock picking based on standards, rather than top down, sector rotation, market benchmarking, etc.

Recent trades and tactics:

Recently, our portfolio has seen not a small drop of over 20%. Some of the drop caused by market sentiments change and others caused by misjudgments. Because our portfolio is rather concentrated, short term price movements can make our overall portfolio quite volatile.

1, Education sector has seen plunge. During last month, there are major policies changes in education sectors. The government becomes more and more stringent towards K9 education sectors and more and more open towards higher and vocational education. We have a small position in K9 and others mostly in higher education. Investors were in a panic mode, causing the whole sector plunge even though the fundamental in higher education is largely unchanged.

Considering these are some of the major social concerns needed to be addressed, we believe these harsh policies could be quite consistent, thus we made some changes to our education holdings towards only higher age and vocational areas. We believe the fears of further policy changes in the higher education sector is largely overdone and current valuation would potentially provide a satisfactory compounding return.

2, Some misjudgments:We do not feel reluctant to acknowledge that we made some misjudgments, as everybody would do. We certainly underestimate how the market would react on e-commerce sector post covid and how they see competition heating up. We also reduced our positions in Hope educations due to its bad corporate governance and lack of transparency.

Future outlooks:

Our investment choices might be very different from the trending sectors or names the market chooses, because we do not make investment decisions based on anticipating the market preference, thus our results might be significant lag the market, at least in the short term.

As always, we will less focus on the market itself, as the market is so complex and full of variables, making it almost impossible to predict accurately and with the enough certainty we ask for. The path we choose is rather slow and ingenious that we only make investment decisions based on long term valuation creation. Even though we can never isolation ourselves from the influence of the market and other investors, we should keep in mind where the foundations are.

BEDROCK chooses investment opportunities only based on the companies themselves and will not rely on the speculations on the market overall. BEDROCK would continue to invest opportunities from those who can generate economy of scale (many in internet, cloud, payment, etc.), who with strong brand and customer captivity, and who can achieve localized monopolies.

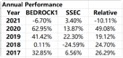

Past performance:

Recent net value/share: 2.85

Current major holdings:

Always stay with the best

It is very easy to be enticed by opportunities as short-term speculations, however BEDROCK believes that not many investors, certainly not us, can always win in a zero-sum game. BEDROCK continuously chooses to focus on the opportunities of potential great value creation by the best companies. What BEDROCK wants are stocks with satisfactory valuation that are also high quality and growing, with a high degree of certainty about the long-term outlook. BEDROCK believes that value investing in the best growth opportunities, with a global horizon, would achieve great results.

Thanks for the trust and support!

Wish you make a great progress in 2021!

BEDROCK

2021/07/01

欢迎阅读往期内容:投资思考随笔

欢迎直接订阅该话题!

2021往期文章:

2021年鼠年总结及牛年展望- 投资思考随笔

给投资者的一封信-BEDROCK

2021年中期投资思考-投资思考随笔(54)

基因、生存机器与策略的演化-投资思考随笔(52)

策略选择的科学探讨-投资思考随笔(49)

从0到1与从1到N-茶话会实录-投资思考随笔(48)

我们皆是产品经理-产品方法论读书笔记(47)

小众,出圈与投资-茶话会实录-投资思考随笔(46)

创新,变化与投资-茶话会实录-投资思考随笔(45)

精彩评论