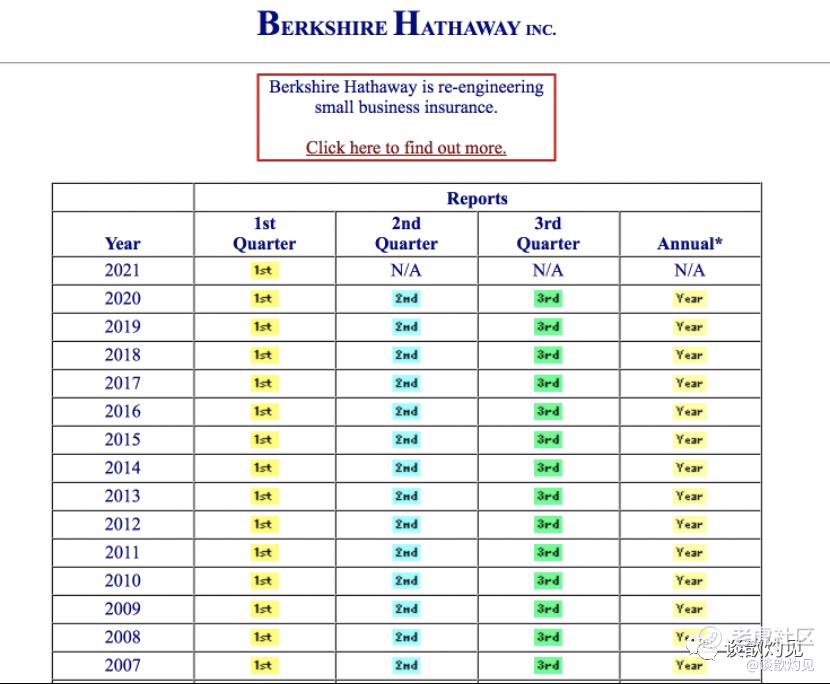

上一篇文章《巴菲特接班人争储秘闻——阿吉特篇》,我们阐述了巴菲特爱将阿吉特与阿贝尔的争储秘闻,本文摘选了从1995年至2021年伯克希尔公司的年报原文,为读者呈现巴菲特与查理芒格眼中最为真实的保险业天才阿吉特。

巴菲特曾说过,美国历史上只有8个财险和意外险保单的单笔保费超过10亿美元。全部都是BRK公司卖的,其中有些合约要求伯克希尔50年甚至更久之后赔付。当保险公司需要这种类型的赔付承诺时,BRK是唯一能够兑现的公司

以下年报节选片段,是关于阿吉特操作巨额超级灾难险的详细说明。

1995年BRK的年报

The life of Mike Tyson for a sum that is large initially and that, fight-by-fight, gradually declines to zero over the next few years; (2) Lloyd's against more than 225 of its "names" dying during the year; and (3) The launch, and a year of orbit, of two Chinese satellites. Happily, both satellites are orbiting, the Lloyd's folk avoided abnormal mortality, and if Mike Tyson looked any healthier, no one would get in the ring with him.

历史上只有8个财险和意外险保单的单笔保费超过10亿美元。没错,全部都是BRK公司卖的,其中有些合约要求我们50年甚至更久之后赔付。当保险公司需要这种类型的赔付承诺时,BRK是唯一能够兑现的公司

阿吉特对于拳王泰森,Lloyd's,还有中国两枚卫星发射进行了承保。

浮存金最高的是由Ajit Jain管理的Berkshire Hathaway Reinsurance Group。Ajit对别人不敢兴趣或是没有资本接受的风险提供保险。他的操作结合了能力、速度和果断。更重要的是,他的思维方式在保险界独一无二。然而,他从没将伯克希尔暴露在不合适我们资源的风险之中。

1997年BRK年报

Our super-cat business was developed from scratch by Ajit Jain, who has contributed to Berkshire's success in a variety of other ways as well. Ajit possesses both the discipline to walk away from business that is inadequately priced and the imagination to then find other opportunities. Quite simply, he is one of Berkshire's major assets. Ajit would have been a star in whatever career he chose; fortunately for us, he enjoys insurance.

我们的超级灾难险业务有阿吉特白手起家。他既有从不合理筹码的业务中脱身的自制力,也有找到其他商业机会的想象力。阿吉特无论从事什么行业都能成为新星,我们很幸运,他享受保险行业。

1998年BRK年报

Despite the pathetic technical skills of your Chairman, I’m delighted to report that GEICO, Borsheim’s, See’s, and The Buffalo News are now doing substantial business via the Internet. We’ve also recently begun to offer annuity products on our website. This business was developed by Ajit Jain, who over the last decade has personally accounted for a significant portion of Berkshire’s operating earnings. While Charlie and I sleep, Ajit keeps thinking of new ways to add value to Berkshire.

但我很高兴地告诉大家, GEICO 、 Borsheim 's 、 See 's 和 the Buffalo News 现在都在通过互联网开展大量业务。我们最近也开始在网站上提供年金产品,这个业务是由阿吉特 · 杰恩 (Ajit Jain) 负责发展的。过去 10 年,他个人为伯克希尔运营收益贡献了很大一部分。当我和查理睡觉时,阿吉特一直在想为伯克希尔增加价值的新方法。

1999年BRK年报

It’s simply impossible to overstate Ajit’s value to Berkshire: He has from scratch built an outstanding reinsurance business, which during his tenure has earned an underwriting profit and now holds $6.3 billion of float.

阿吉特对伯克希尔的贡献怎么说都不为过: 他白手起家建立了一个出色的再保险业务,在他任职期间,该业务获得了承保利润,现在拥有 63 亿美元的流通资产。

In Ajit, we have an underwriter equipped with the intelligence to properly rate most risks; the realism to forget about those he can’t evaluate; the courage to write huge policies when the premium is appropriate; and the discipline to reject even the smallest risk when the premium is inadequate. It is rare to find a person possessing any one of these talents. For one person to have them all is remarkable.

因为阿吉特,我们有一个机智的的保险体系来正确地评估大多数风险。他能从现实主义出发去忘记那些他无法评价的东西,有勇气在保费合适的时候购买巨额保单,以及当保费不足时拒绝哪怕最小风险的纪律。我们很难找到一个人拥有这些才能中的任何一种。阿吉特一个人能拥有所有这些优点,这是非常了不起的。

Since Ajit specializes in super-cat reinsurance, a line in which losses are infrequent but extremely large when they occur, his business is sure to be far more volatile than most insurance operations. To date, we have benefitted from good luck on this volatile book. Even so, Ajit’s achievements are truly extraordinary.

由于阿吉特专门从事 “ 超级灾难险 ” 的再保险业务, BRK在 这一业务上 损失很少,但一旦亏损发生,损失就会非常大,因此他的业务肯定比大多数保险业务波动更大。到目前为止,我们从这个颇有风险的业务中获得了好运,阿吉特的成就确实非凡。

2000年BRK年报

Our retroactive business is almost single-handedly the work of Ajit Jain, whose praises I sing annually. It is impossible to overstate how valuable Ajit is to Berkshire. Don’t worry about my health; worry about his.

我们的追溯业务几乎是由 Ajit Jain白手起家,我每年都会高歌他。阿吉特对伯克希尔的价值怎么说都不为过。所以请大家不要担心我的健康,担心他的健康吧。

Last year, Ajit brought home a $2.4 billion reinsurance premium, perhaps the largest in history, from a policy that retroactively covers a major U.K. company. Subsequently, he wrote a large policy protecting the Texas Rangers from the possibility that Alex Rodriguez will become permanently disabled. As sports fans know, “A-Rod” was signed for $252 million, a record, and we think that our policy probably also set a record for disability insurance. We cover many other sports figures as well.

去年,阿吉特从一家英国大公司的保单中获得了 24亿美元的再保险保费,这可能是历史上价值最高的一单。随后,他写了一份大的保险保单政策,这一政策保护德州游骑兵队免受亚历克斯·罗德里格斯永久残疾的影响。体育迷们都知道, “A - Rod”以创纪录的 2.52亿美元签约,我们认为我们的保单可能也创下了残疾保险的纪录。我们也负责了许多其他体育人物。

In another example of his versatility, Ajit last fall negotiated a very interesting deal with Grab.com, an Internet company whose goal was to attract millions of people to its site and there to extract information from them that would be useful to marketers. To lure these people, Grab.com held out the possibility of a $1 billion prize (having a $170 million present value) and we insured its payment. A message on the site explained that the chance of anyone winning the prize was low, and indeed no one won. But the possibility of a win was far from nil.

他才华横溢的另一个例子是,去年秋天,阿吉特与 Grab.com达成了一项非常有趣的协议。 Grab.com是一家互联网公司,其目标是吸引数百万人访问其网站,并从中提取对营销人员有用的信息。为了吸引这些人,Grab.com提供了10亿美元奖金(现值为1.7亿美元),我们为其支付提供了保险。网站上的一条信息解释说,中奖的概率很低,实际上没有人中奖,但其可能性远非零。

如果你对本公众号的文章内容有兴趣探讨,转载或提供后续深度研究的线索材料,或者有意向加入读者粉丝群,欢迎关注“谈歆灼见”同名微信号,联系我们。添加时请备注身份,不一定会通过所有的好友申请。

《谈歆灼见》,即将与卫视和互联网平台上线国际深度访谈节目。未来2年,从投资和专业研究角度对话50位国际行业顶流、专家,将覆盖一二级市场投资、金融科技、教育文化、创新创业、人文艺术等方向。往年及即将对话嘉宾包括梅耶马斯克、理查德布兰森、巴菲特、桥水达里奥、老佛爷、西蒙佩雷斯、霍华德马克思、麦克尔刘易斯等。

精彩评论