- Apple drops on concerns about iPhone demand

- Treasury prices rebound after BoE decision

- S&P 500 records largest one-day gain since Aug. 10

- Indexes: Dow +1.88%, S&P 500 +1.97%, Nasdaq +2.05%

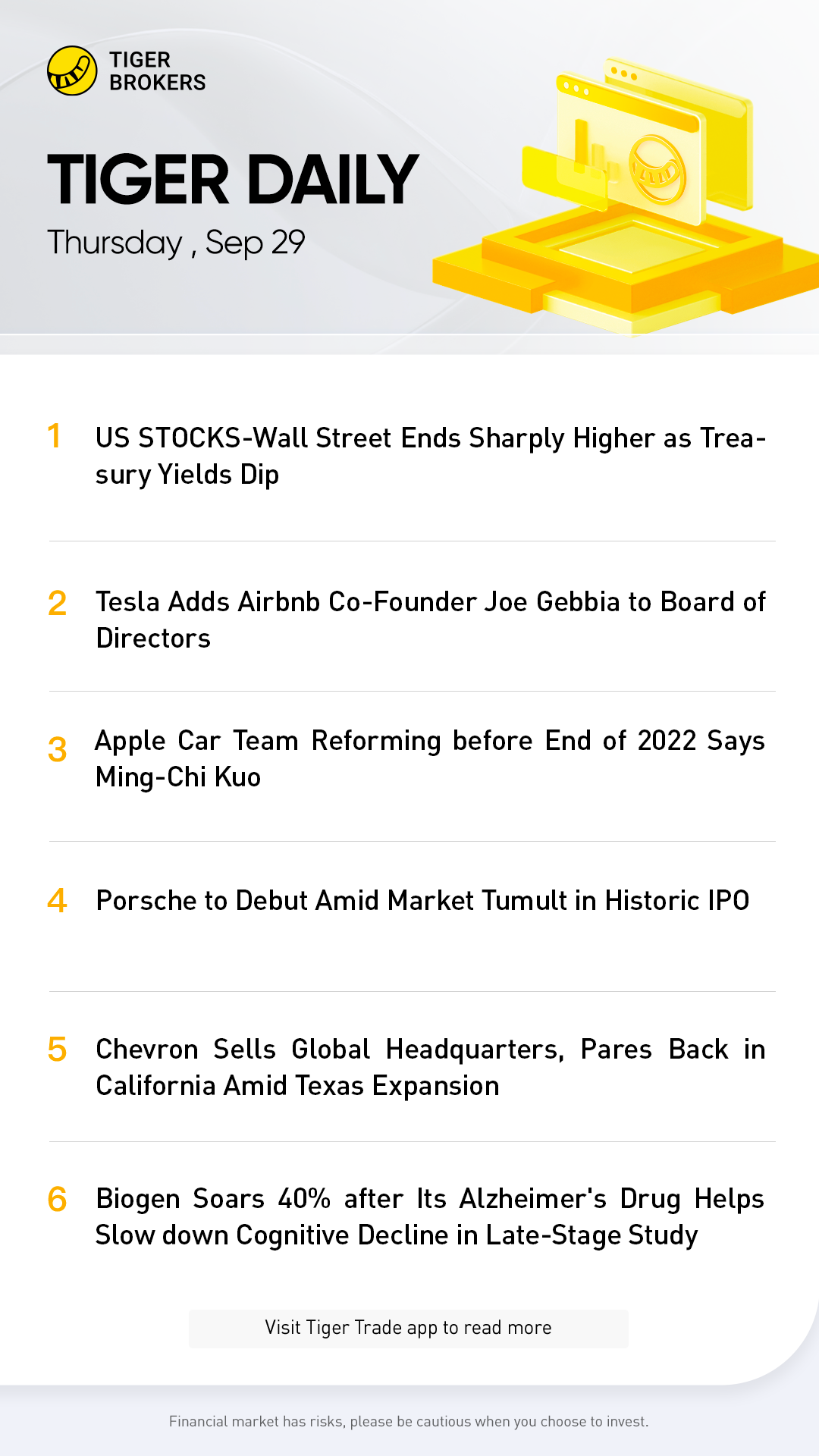

Sept 28 (Reuters) - Wall Street ended sharply higher on Wednesday following its recent sell-off, helped by falling Treasury yields, while Apple dropped on concerns about demand for iPhones.

The S&P 500 recorded its first gain in seven sessions after closing on Tuesday at its lowest since late 2020.

Interest rate-sensitive megacaps Microsoft, Amazon and Meta Platforms rallied as the yield on 10-year Treasury notes fell over 0.26 percentage point in its biggest one-day drop since 2009.

Pushing yields lower on Treasuries with maturities six months and longer, the Bank of England said it would buy long-dated British bonds in a move aimed at restoring financial stability in markets rocked globally by the fiscal policy of the new government in London.

"The yield on the two-year Treasury has gone up persistently over the course of the last several weeks, and for the first time we've seen it go down for two days in a row, and that has given equities a breather," said Art Hogan, chief market strategist at B. Riley Wealth.

Investors have been keenly listening to comments from Federal Reserve officials about the path of monetary policy, with Atlanta Fed President Raphael Bostic on Wednesday backing another 75-basis-point interest rate hike in November. The Fed will likely get borrowing costs to where they need to be by early next year, Federal Reserve Bank of Chicago President Charles Evans said.

U.S. stocks have been battered in 2022 by worries that an aggressive push by the Fed to raise borrowing costs could throw the economy into a downturn.

Apple Inc dropped 1.3% after Bloomberg reported the company is dropping plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize.

Apple has been a relative outperformer in 2022's stock market sell-off, down about 15% in the year to date, versus the S&P 500's 22% loss.

All of the 11 S&P 500 sector indexes rose, led by a 4.4% jump in energy and a 3.2% leap in communication services .

The Dow Jones Industrial Average rose 1.88% to end at 29,683.74 points, while the S&P 500 gained 1.97% to 3,719.04. It was the S&P 500's largest one-day gain since Aug. 10.

The Nasdaq Composite jumped 2.05% to 11,051.64.

Biogen Inc surged 40% after saying its experimental Alzheimer's drug, developed with Japanese partner Eisai Co Ltd , succeeded in slowing cognitive decline.

Eli Lilly & Co, which is also developing an Alzheimer's drug, jumped 7.5%, and it was among the biggest boosts to the S&P 500 index.

Advancing issues outnumbered declining ones on the NYSE by a 5.82-to-1 ratio; on Nasdaq, a 3.66-to-1 ratio favored advancers.

The S&P 500 posted one new 52-week high and 30 new lows; the Nasdaq Composite recorded 26 new highs and 224 new lows.

Volume on U.S. exchanges was 11.7 billion shares, compared with an 11.4 billion average for the full session over the last 20 trading days.

精彩评论