Spirit Airlines Inc. on Monday said it rebuffed a $3.6 billion cash takeover bid from JetBlue Airways Corp., saying a deal likely can't be completed, and that Spirit is sticking with plans to merge with rival budget carrier Frontier Group Holdings Inc.

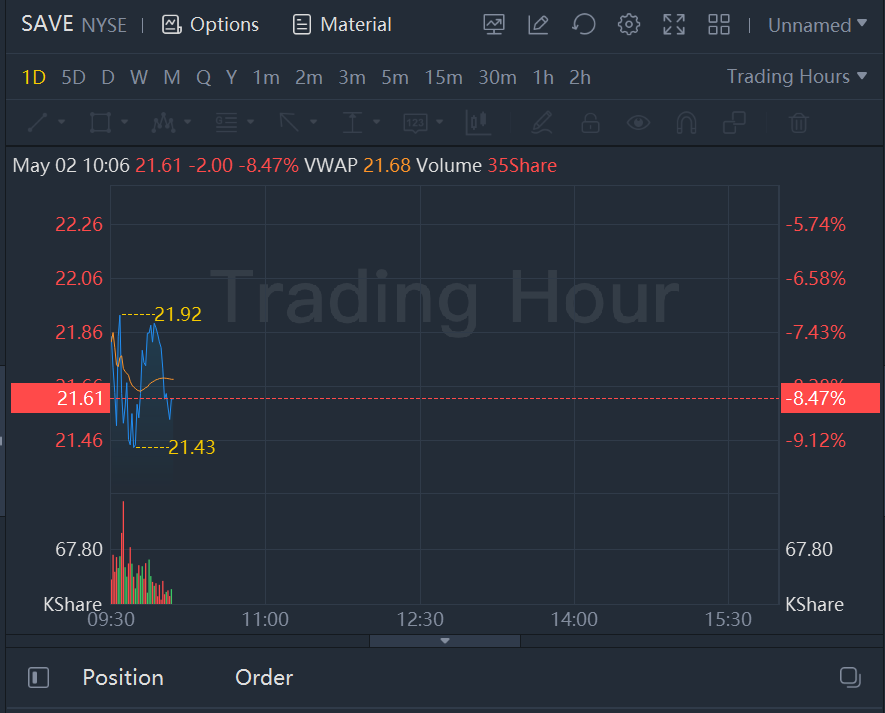

Spirit Airlines stock slumped 8.47% in morning trading.

JetBlue's offer for Spirit came with a higher price tag than Frontier's cash-and-stock offer, which was originally valued at $2.9 billion. Spirit's board said it believed there was too much risk that regulators would bar a merger with JetBlue, however, even after JetBlue pledged to shed assets to win regulatory approval and to pay a $200 million breakup fee if it was unable to complete the proposed acquisition for antitrust reasons.

"After a thorough review and extensive dialogue with JetBlue, the Board determined that the JetBlue proposal involves an unacceptable level of closing risk that would be assumed by Spirit stockholders," Spirit Chairman Mac Gardner said in a statement.

JetBlue's alliance with American Airlines Group Inc. in New York and Boston was of particular concern to Spirit, according to a letter from Mr. Gardner and Spirit Chief Executive Ted Christie to JetBlue CEO Robin Hayes. The Justice Department has challenged that arrangement and is suing to block it.

"We struggle to understand how JetBlue can believe DOJ, or a court, will be persuaded that JetBlue should be allowed to form an anticompetitive alliance that aligns its interests with a legacy carrier and then undertake an acquisition that will eliminate the largest [ultra low cost] carrier."

JetBlue said Monday that it isn't giving up and made the details of its latest offer public in an effort to win over Spirit shareholders.

"We hope the Spirit Board will now recognize that ours is clearly a superior proposal and engage with us more constructively than they have to date," JetBlue's Mr. Hayes said in a statement.

Shares of Spirit, which closed Friday at $23.61, fell 8.3% to $21.64 in premarket trading. Frontier shares fell 1.5% and JetBlue rose 1.6%.

Both JetBlue and Frontier see Spirit as key to their ambitions to create the fifth-largest U.S. airline, and take on the larger carriers that have come to dominate the industry after a series of mergers.

Frontier and Spirit are both part of a niche of fast-growing airlines that cater to budget-conscious travelers, with low base fares and fees for everything else, from bottled water to carry-on bags. They have said that their combination would create an ultra low-cost juggernaut.

JetBlue charges somewhat lower fares than its larger rivals, but also caters to higher-end business travelers and offers creature comforts such as free WiFi.

Frontier and Spirit announced their plans to merge in February -- a deal the two carriers have been discussing, on and off, for years, according to securities filings. The most recent round of discussions began in earnest last June.

精彩评论