Jan 21 (Reuters) -U.S. equity funds faced outflows in the week to Jan. 19 on concerns over a rise in U.S. Treasury yields and a feeble start to the fourth-quarter earnings season.

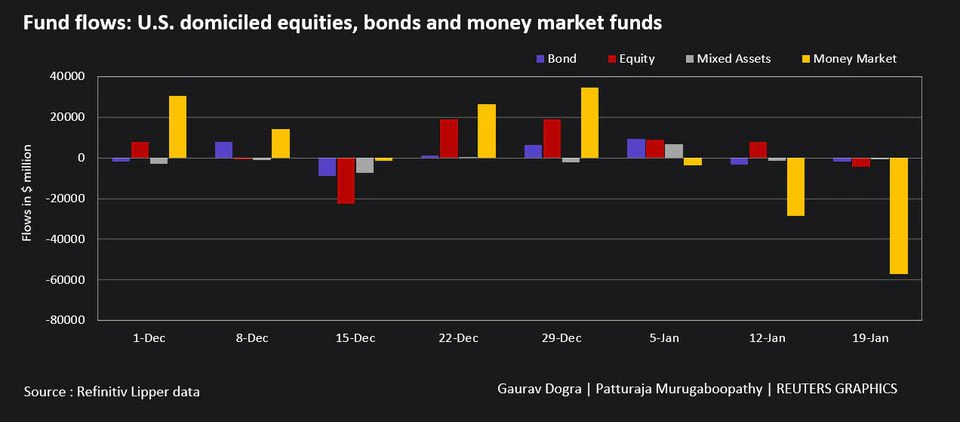

According to Refinitiv Lipper data, investors sold U.S. equity funds of $4.5 billion, marking the first weekly outflow in five weeks.

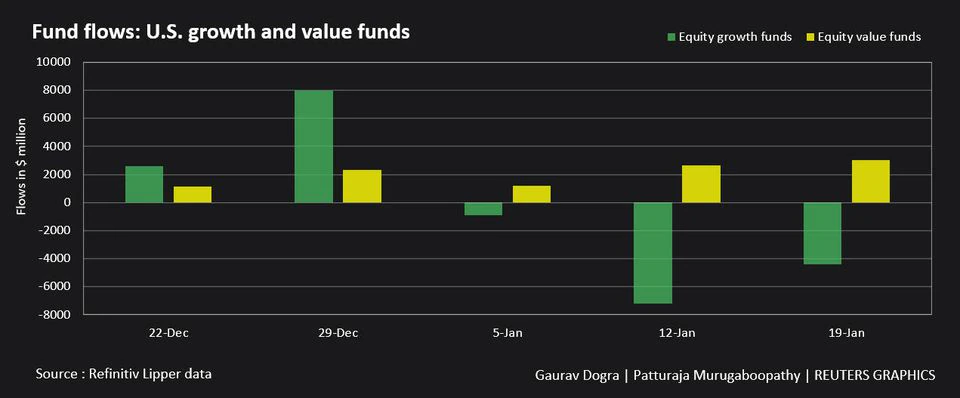

The U.S. 10-year Treasury yields jumped to two-year highs, which in turn battered growth stocks, as the companies' future cash flows would be worth less when discounted with higher interest rates.

Bank earnings didn't cheer investors during the week as Goldman Sachs missed quarterly profit expectations, while JPMorgan Chase & Co warned that its return on tangible capital equity may fall below its medium-term target of 17% this year.

U.S. growth funds saw outflow of $4.42 billion in a fourth successive week of net selling, however, investors secured value funds worth about $3 billion in their biggest weekly purchase in five months.

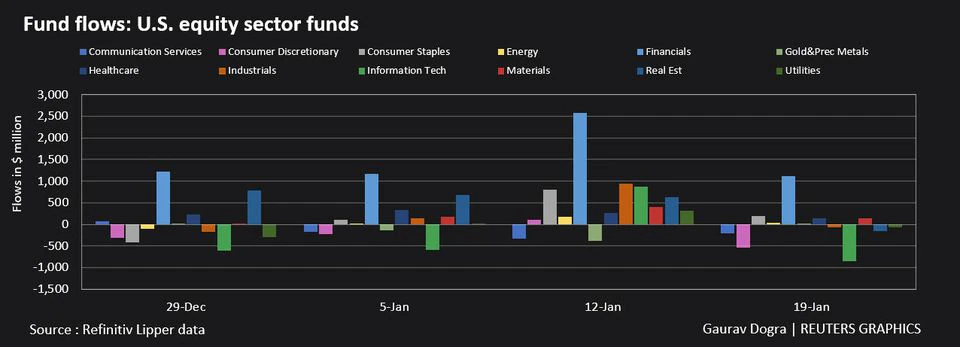

Among sector funds, financials obtained inflows of $1.12 billion, while tech and consumer discretionary sector funds saw outflows of $842 million and $543 million respectively.

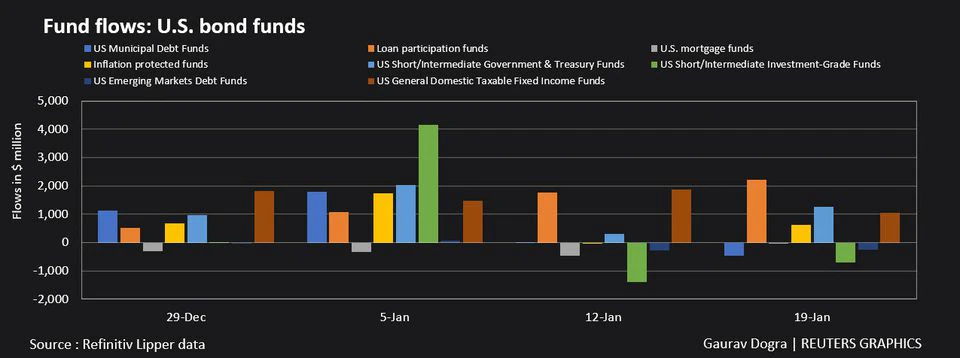

U.S. bond funds witnessed $1.69 billion worth of net selling, less than the outflows of $3.15 billion in the previous week.

Investors sold U.S. taxable bond funds of $1.39 billion, while U.S. municipal bond funds faced their first weekly net selling in six weeks, worth $466 million.

U.S. high yield, and short/intermediate investment-grade funds faced money outgo worth $2.29 billion and $702 million respectively. However, loan participation funds, and short/intermediate government & treasury funds received inflows of $2.2 billion and $1.27 billion respectively.

U.S. money market funds also faced outflow worth $57.07 billion, their biggest since mid-July 2020.

精彩评论