JPMorgan Chase & Co reported a jump in third-quarter earnings on Wednesday, as the largest U.S. bank's Wall Street arm capitalized on a global dealmaking boom.

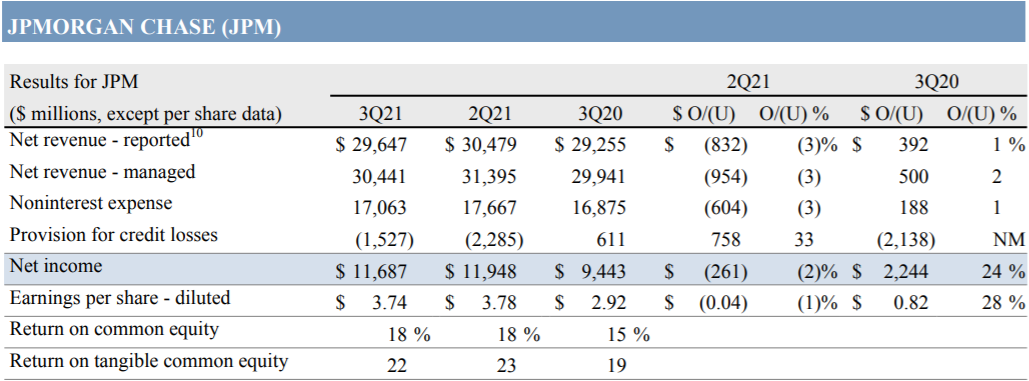

JPMorgan's net income rose to $11.7 billion, or $3.74 per share, in the quarter ended Sept. 30, compared with $9.4 billion, or $2.92 per share, a year earlier.

Analysts on average had expected earnings of $3.00 per share, according to Refinitiv.

The shares rose 0.5% in premarket trading.

THIRD-QUARTER 2021 RESULTS

- Reported revenue of $29.6 billion; managed revenue of $30.4 billion

- Credit costs net benefit of $1.5 billion included $2.1 billion of net reserve release and $524 million of net charge-offs

- Average loans up 5%; average deposits up 19%$1.6 trillion of liquidity sources, including HQLA and unencumbered marketable securities

- Average deposits up 20%; client investment assets up 29%

- Average loans down 2% YoY and up 1% QoQ; Card net charge-off rate of 1.39%

- Debit and credit card sales volume up 26%

- Active mobile customers up 10%

精彩评论