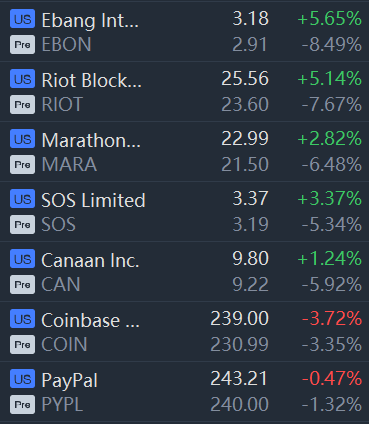

Crypto stocks tumbled in premarket trading on Bitcoin sliding below $40,000 after China's fresh crypto curbs.

Bitcoin tumbled below the $40,000 mark on Wednesday hitting a 3-1/2 month low and dragging down other digital coins after China imposed fresh curbs on transactions involving cryptocurrencies.

Bitcoin , the biggest and best-known cryptocurrency, had already been under pressure from a series of tweets from Tesla boss Elon Musk but the news from China sent it as low as $38,514, for a 9% fall.

The coin is now down 40% from a record high of $64,895 hit on April 14. It is also heading for its first monthly decline since November 2018.

Bitcoin's moves hit other crypto assets too, with Ether, the coin linked to the ethereum blockchain network, falling 15% to $2,875.36, while meme-based dogecoin tumbled 18%, according to market tracker Coingecko.

Frankfurt-listed shares in crypto exchange Coinbase slumped 6%, having already dipped below their direct listing price of $250 earlier in the week.

The crypto declines were sparked last week by Musk's reversal on Tesla accepting bitcoin as payment. His subsequent tweets caused further confusion over whether the carmaker had shed its holdings of the coin.

Selling was exacerbated by China's announcement banning financial institutions and payment companies from providing services related to cryptocurrency transactions. It also warned investors against speculative crypto trading.

Cryptowatchers predicted more losses ahead, noting the fall below $40,000 represented a breach of a key technical barrier which could set the stage for more selling.

More importantly, investors may be shifting from bitcoin back to gold, analysts at JPMorgan said, citing positioning data compiled on basis of open interest in CME bitcoin futures contracts.

This shows "the steepest and more sustained liquidation" in bitcoin futures since last October, they told clients, adding: "the bitcoin flow picture continues to deteriorate and is pointing to continued retrenchment by institutional investors."

The selloff in crypto assets precisely at a time when inflation fears are in the ascendancy dashes any suggestion of the asset class being an inflation hedge.

Instead, more traditional hedges have been gaining ground, with gold up almost 6% so far this month.

The recent selloff in bitcoin and other digital currencies has taken market capitalisation of all cryptocurrencies back under $2 trillion, down from the recent $2.5 trillion record.

精彩评论