The following originally appeared on Options AI

Earnings season goes into full gear this week. Here's a quick glance at a few popular stocks from the Options AI earnings calendar showing their expected moves as priced by the options market. Click the expected move links to see more historical detail.

Tuesday before the open

- Goldman Sachs Group Inc (NYSE:GS) 3.9%

- $Bank of America Corp(BAC-N)$ (NYSE:BAC) 3.8%

Tuesday after the close

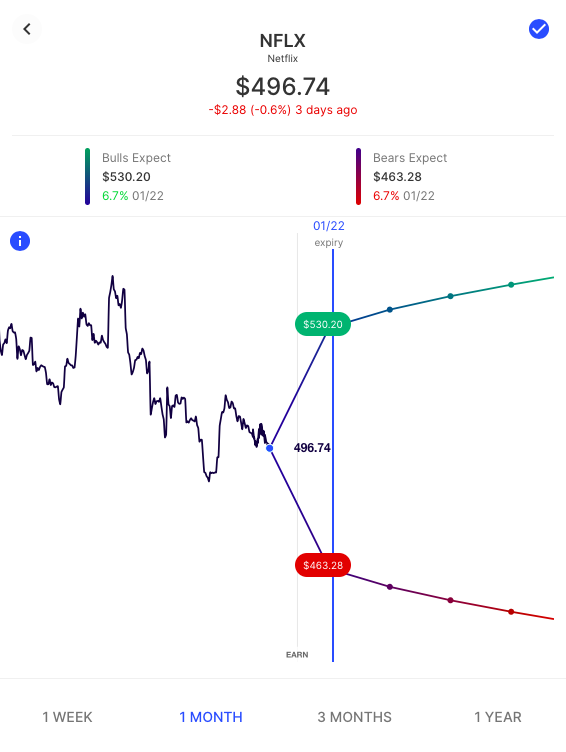

- Netflix Inc (NASDAQ:NFLX) 6.7%

- UnitedHealth Group Inc (NYSE:UNH) 3.3%

- Morgan Stanley (NYSE:MS) 3.8%

- Procter & Gamble Co (NYSE:PG) 2.7%

Wednesday before the open

- United Airlines Holdings Inc (NASDAQ:UAL) 5.2%

Thursday after the close

- Intel Corporation (NASDAQ:INTC) 5.3%

- IBM (NYSE:IBM) 4.2%

Netflix: Using the Expected Move to Help Inform Spread Trading

With option traders currently pricing a move in NFLX of approx. 6.7% up or down on earnings, the following chart from Options AI can help visualize potential trading opportunities and form a basis for more informed strike selection when using options. Here's how:

At the time of writing, with NFLX just below $500 and the expected move implying a bullish consensus around $530 and a bearish consensus near $463, an initial decision point might be whether option traders have got this right.

Source: Options AI

Starting with the view that the options market is overestimating the move in either direction, let's first look at ‘selling the move' to both the bulls and bears, with the expected move guiding strike selection.

Netflix – Using the Move for Income Generating Strategies

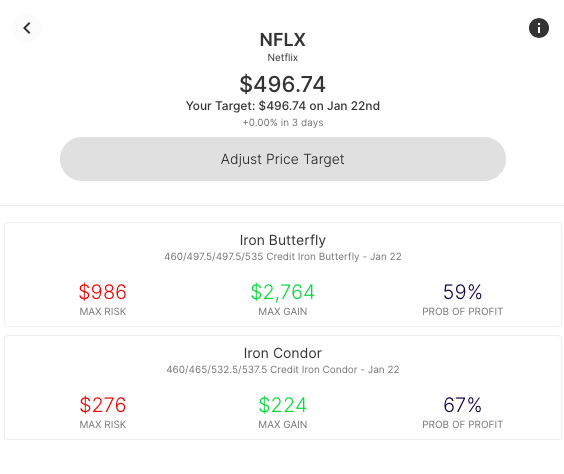

When ‘selling the move', Premium (or income) received from selling options is kept if the stock stays within a specific range. Here's a look at an Iron Condor and Iron Butterfly for this week's expiration. Both trades sell both a call spread and a put spread. The key difference is that with overlapping short strikes, the Iron Fly targets a very specific price target for achieving max gain:

Source: Options AI

Source: Options AI

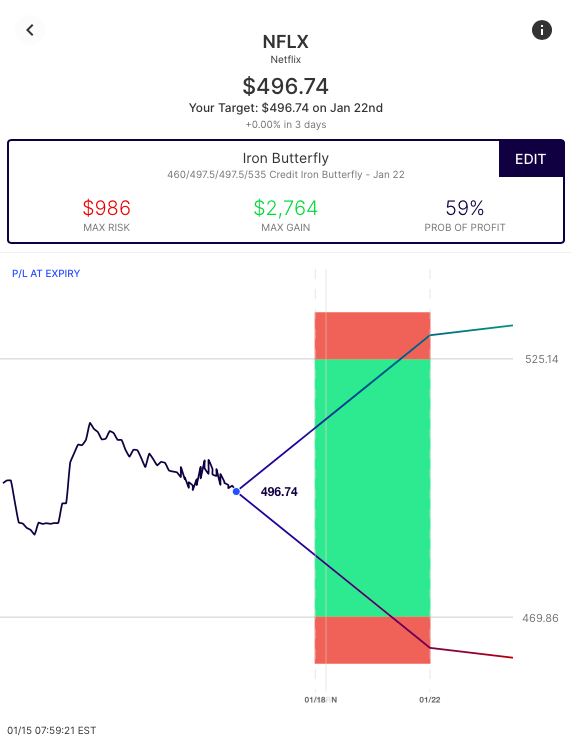

In this example, the +460p/-497.5p/-497.5c/+535c Iron Butterfly targets a stock price of $497.50. At expiry, max. profit will be realized at this price level and profits decline the further the stock moves from that point. So, the Iron Fly is a strategy that a trader might use if highly convicted on their price view. On this chart you can see the two breakevens, just inside the expected move:

Source: Options AI

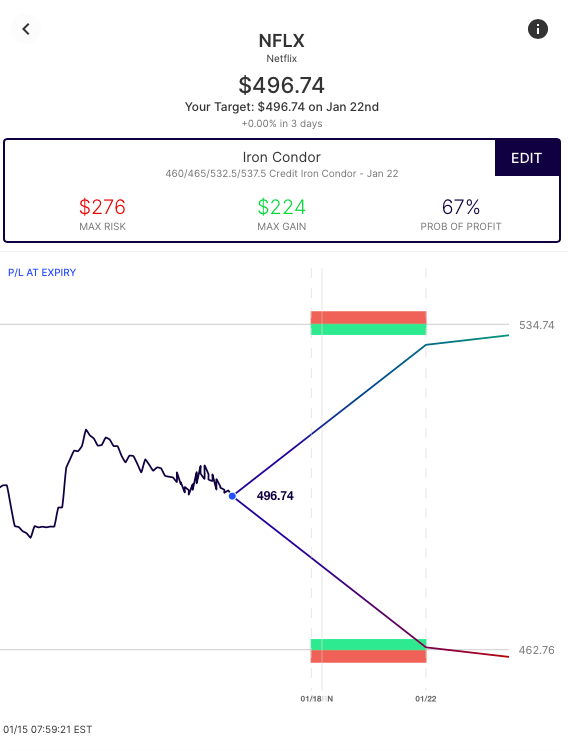

The Iron Condor is less precise, and establishes a range within which reward is the same. In this example the +460p/-465p/-532.5c/+537.5c Iron Condor results in max. gain at expiry if the stock stays anywhere between $465 and $532.50. A move outside of that range, beyond the long strikes, means max. loss.

Both an Iron Condor and Iron Butterfly have the benefit of being defined risk spread strategies. So, when selling a move, choosing between the two may come down to conviction level and willingness to trade potential reward for higher probability. While by no means the only basis for strike selection, on Options AI, both strategies can be generated in a couple of clicks, allowing for straightforward comparison.

Source: Options AI

Netflix – Using the Move for Bullish Strategies

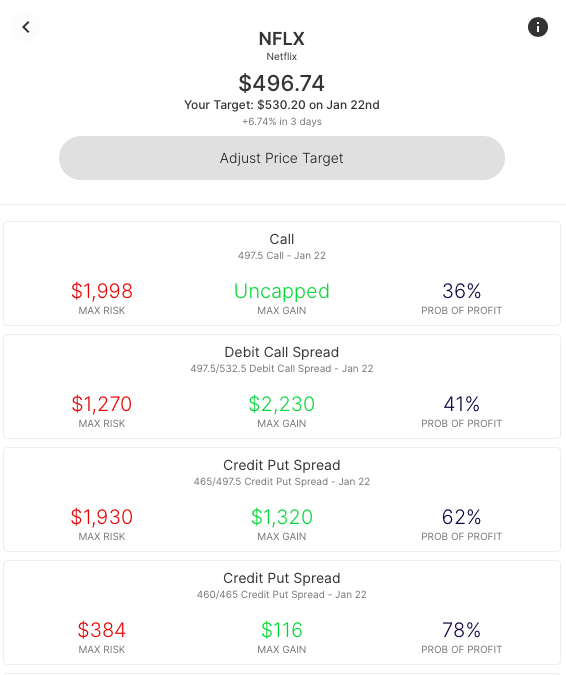

With a bullish view, a trader can consider and compare a few spread trades, again using expected move strikes. With a debit spread, a call is bought, but then a spread might be created by selling a call at the expected move. A Debit Call Spread creates a range of profitability between the trade's breakeven and its short call. It lessens the cost of the long call (and therefore increases the probability of profit by lowering the breakeven). In many cases a call spread to the expected move will have a similar price to an out of the money call, yet with a greater probability of profit.

Source: Options AI

Source: Options AI

Also available to a bullish trader is a credit spread. The trade comparison below shows two different potential credit put spreads. One at-the-money and the other out-the-money. Both are essentially ‘selling to the bears'.

Source: Options AI

Source: Options AI

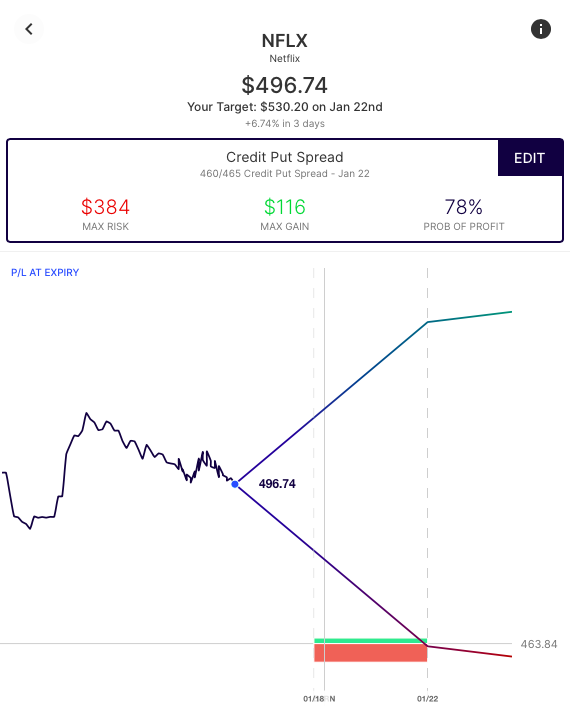

Note that a far out-the-money Credit Put Spread (the last trade shown) has the highest Probability of Profit (likelihood of the stock expiring higher than the breakeven level) but it also presents a relatively high risk to reward ratio (nearly 4 to 1). It can be thought of as selling to those that are extremely bearish.

Below is the out-the-money Bullish Credit Put Spread on the expected move chart. As you can see, there is relatively high probability of max. gain, but when it is not, it is costly compared to the reward:

Source: Options AI

Source: Options AI

Whether a trader chooses a debit or a credit spread might depend on their own level of bullishness, compared to the crowd.

Netflix – Using the Move for Bearish Strategies

The same concepts apply to spreads with a bearish view. Here's an example using the 6.7% expected move in Netflix, generating a Debit Put Spread, but also Credit Call Spreads:

Source: Options AI

Source: Options AI

And the trades can be charted, showing their profit/loss at expiration based on different stock prices. This can help highlight some differences between the debit and credit spreads:

Source: Options AI

Source: Options AI

Summary

The expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That's why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Netflix can apply to any stock and it is simply used here for illustrative purposes.

The post The Week Ahead in Options and Using the Expected Move to Spread Trade Netflix. appeared first on Options AI: Learn.

Photo by Mollie Sivaram on Unsplash

精彩评论