- Stock futures extend gains after Dow's best day since March.

- Bitcoin traded above $50,000.

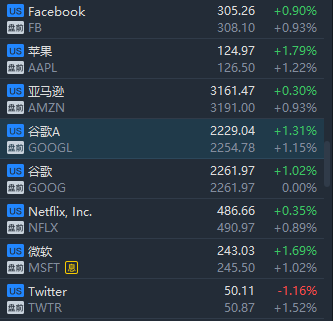

- Blockchain stocks, Tech stocks rally in premarket trading.

- Disney, DoorDash, Snowflake, Fisker & more making the biggest moves in the premarket.

- Dogecoin rallies after Elon Musk tweet, Coinbase listing.

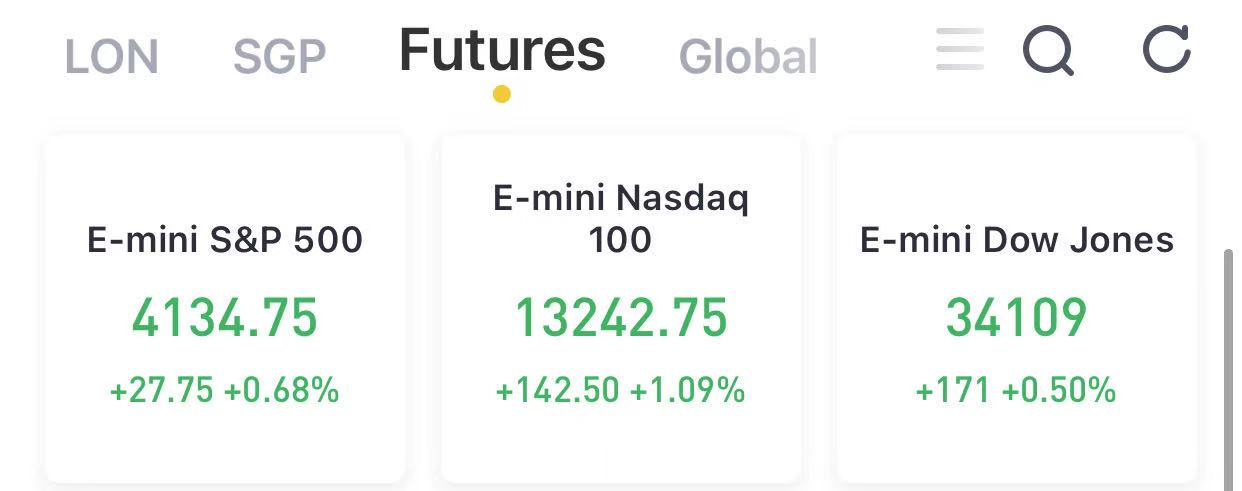

(May 14) Futures contracts tied to major stock indexesjumped in early trading Fridayas Wall Street is set to rebound for a second day after starting the week with big losses. Dow Jones Industrial Average futures climbed 150 points. S&P 500 futures gained 0.6%. Futures on the tech-heavy Nasdaq 100 Index, the relative underperformer this week, popped 1%.

All three benchmarks are still on pace to post sharp losses for the week, with the Dow down 2.2% and the S&P shedding 2.8%. Tech stocks have been hit especially hard amid hotter-than-expected inflation data, pulling the Nasdaq down 4.6% for the week.

At 8:03 a.m. ET, Dow E-minis were up 171 points, or 0.50%, S&P 500 E-minis were up 27.75 points, or 0.68% and Nasdaq 100 E-minis were up 142.50 points, or 1.09%.

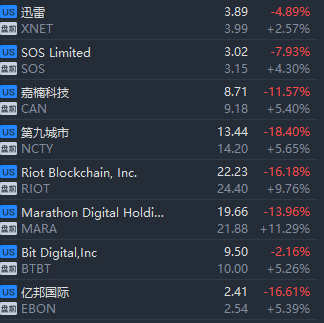

Blockchain stocks, Tech stocks rally in premarket trading.

Stocks making the biggest moves in the premarket: Disney, DoorDash, Snowflake, Fisker & more

1) Walt Disney(DIS) – Disney shares dropped 3.9% in premarket trading after growth figures for the Disney+ streaming servicefell short of Wall Street predictions. Disney reported better-than-expected profit for the first quarter, but revenue was short of analysts’ forecasts.

2) DoorDash(DASH) – DoorDash surged 8.2% in the premarket afterfirst-quarter revenue came in above analysts’ forecasts, and the food delivery service raised its annual forecast for order value. First-quarter results got a boost from stimulus checks, although the company said those same checks were responsible for drivers working fewer hours.

3) Snowflake(SNOW) – The cloud computing company was upgraded to "buy" from "neutral" at Goldman Sachs, which notes the Snowflake's strong competitive position, as well as a drop from recent highs that is much larger than its peers have experienced. Snowflake jumped 5.7% in premarket trading.

4) Airbnb(ABNB) – Airbnbposted a first-quarter loss, but it also reported better-than-expected revenue as well a 52% jump in gross bookings as more Americans received Covid-19 vaccinations and travel restrictions eased.

5) Coinbase(COIN) – Coinbasereported record profitduring the first quarter, as the cryptocurrency exchange benefited from a significant rally in bitcoin and other digital currencies. Coinbase shares rose 2.3% in premarket action.

6) Kansas City Southern(KSU) – The U.S.-based rail operator acceptedCanadian National Railway’s(CNI) $33.6 billion takeover bid, casting aside the $29 billion deal it had previously agreed to withCanadian Pacific Railway(CP). Canadian Pacific has five business days to make a counter-offer for Kansas City Southern. Canadian National added 2.9% in premarket trading, while Canadian Pacific rose 1.6%.

7) Tyson Foods(TSN) – The beef and poultry producer sold its pet treats business toGeneral Mills(GIS) for $1.2 billion. The sale includes the Nudges, Top Chews and True Chews brands as well as an Iowa production facility.

8) General Electric(GE) – Citi reinstated coverage of GE with a “buy” rating, based on a “sum of the parts” valuation and better execution across GE’s portfolio of businesses. GE shares added 1.1% in premarket trading.

9) Aurora Cannabis(ACB) – Aurora Cannabis tumbled 8.7% in premarket action after it reported lower-than-expected fiscal third-quarter revenue, hit by pandemic-related restrictions in Canada. Separately, the cannabis producer announced a move in its U.S. stock listing to Nasdaq from the New York Stock Exchange, citing lower costs.

10) Fisker(FSR) – Fisker soared 14.5% in premarket trading after the electric car maker signed a deal with contract manufacturer Foxconn to co-develop electric vehicles. Plans include opening a new U.S. manufacturing plant in 2023, although a location has not yet been finalized.

11) Poly(PLT) – Poly tumbled 19.5% in the premarket after the maker of audio and video products issued a weaker than expected outlook. The company formerly known as Plantronics said it expected the global semiconductor shortage to negatively impact its supply chain. It did, however, report better-than-expected profit and revenue for its latest quarter.

12) Unity Software(U) – The 3D content creation platform company rose 3.2% in the premarket after Oppenheimer upgraded the stock to “outperform” from “perform.” Oppenheimer said the current price is an attractive entry point given Unity’s growth prospects.

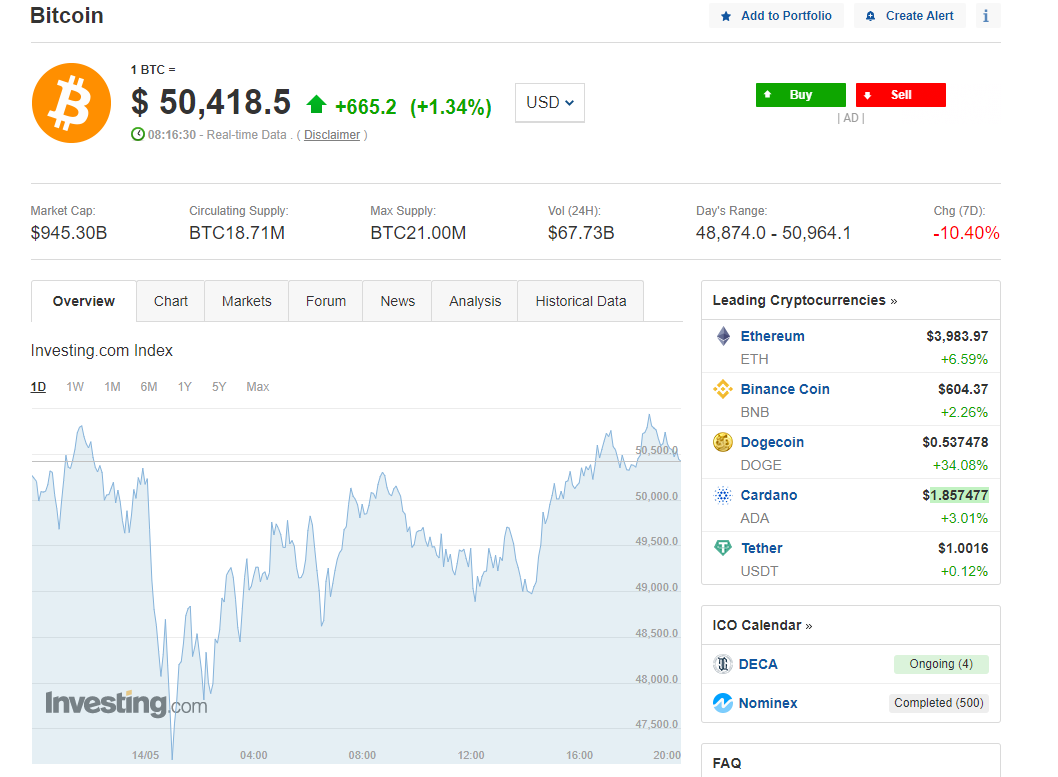

Bitcoin

Bitcoin traded above $50,000, reversing some of its slump on Tesla Inc.’s decision to suspend purchases using the digital currency.

Currencies

The Bloomberg Dollar Spot Index fell 0.3%.The euro gained 0.4% to $1.2125.The British pound increased 0.2% to $1.4085.The onshore yuan strengthened 0.2% to 6.436 per dollar.The Japanese yen strengthened 0.2% to 109.28 per dollar.

Bonds

The yield on 10-year Treasuries fell two basis points to 1.64%.The yield on two-year Treasuries decreased less than one basis point to 0.15%.Germany’s 10-year yield declined one basis point to -0.13%.Japan’s 10-year yield dipped one basis point to 0.089%.Britain’s 10-year yield decreased three basis points to 0.866%.

Commodities

West Texas Intermediate crude increased 1.1% to $64.54 a barrel.Brent crude climbed 1.2% to $67.86 a barrel.Gold strengthened 0.5% to $1,836.10 an ounce.

精彩评论