U.S. stock futures gained on Tuesday as major companies continued to report strong third-quarter earnings, easing concerns that persistent Covid cases and rising costs would derail corporate America’s profit recovery.

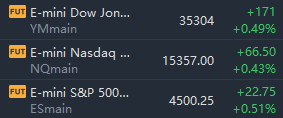

At 8:00 a.m. ET, Dow e-minis were up 171 points, or 0.49%, S&P 500 e-minis were up 22.75 points, or 0.51%, and Nasdaq 100 e-minis were up 66.50 points, or 0.43%.

Stocks making the biggest moves in the premarket:

- Crypto stocks in spotlight as Bitcoin continued its climb toward all-time highs, bolstered by optimism over the launch of the first Bitcoin futures exchange-traded fund in the U.S. on Tuesday.Hive Blockchain (HIVE US) +1.8%, Riot Blockchain (RIOT US) +2.3%, Marathon Digital (MARA US) +0.9%, Bitfarms (BITF US) +3.9%

- AgEagle Aerial Systems (UAVS US) shares rise as much as 16% in U.S. premarket after the provider of drones, sensors and software entered into a definitive agreement to buy Sensefly from Parrot at a valuation of $23m in cash and stock

- Steel Dynamics (STLD US) +1.5% in U.S. premarket trading after it reported 3Q adj. EPS above average analyst estimate

- Frontline (FRO US) jumps 6.5% in U.S. premarket trading, helped by rising oil prices

- Apple (AAPL US) marginally higher Tuesday premarket after analysts were upbeat on the company following an event where it showcased a revamp of its MacBook Pro laptops, along with new audio products

- EverQuote (EVER US) shares slipped Monday postmarket after co. cut 3Q revenue outlook

- TaskUS (TAS US) fell 6.8% Monday postmarket after holders offered shares via Goldman Sachs, JPMorgan

In FX, a downbeat session for the Dollar thus far as the index retreats further from the 94.000 mark to extend the lower bound of a two-week range. There has been little in terms of fundamental catalysts to trigger the selloff as yields remain elevated (albeit off recent highs), and market sentiment remains tentative. State-side, there is a lack of developments Capitol Hill, with US President Biden stating that he is

"right now" going to try for a deal with Moderate Democratic Senator Manchin, while it was separately reported that Senator Manchin said he does not see how a deal on Biden's agenda will happen by October 31st.

In commodities, WTI and Brent front-month futures are nursing yesterday’s wounds and prices remain elevated despite a lack of fresh catalysts and with the macro landscape little changed as of late. The themes remain a) OPEC+ supply, b) supply crunch in the natural gas, LNG, electricity, and coal markets and c) winter demand. Elsewhere, the White House said it is continuing to press OPEC members to address the oil supply issue and is also addressing logistics of supply. Furthermore, the White House will use every lever at its disposal and the FTC is also looking at possible price gouging.

精彩评论