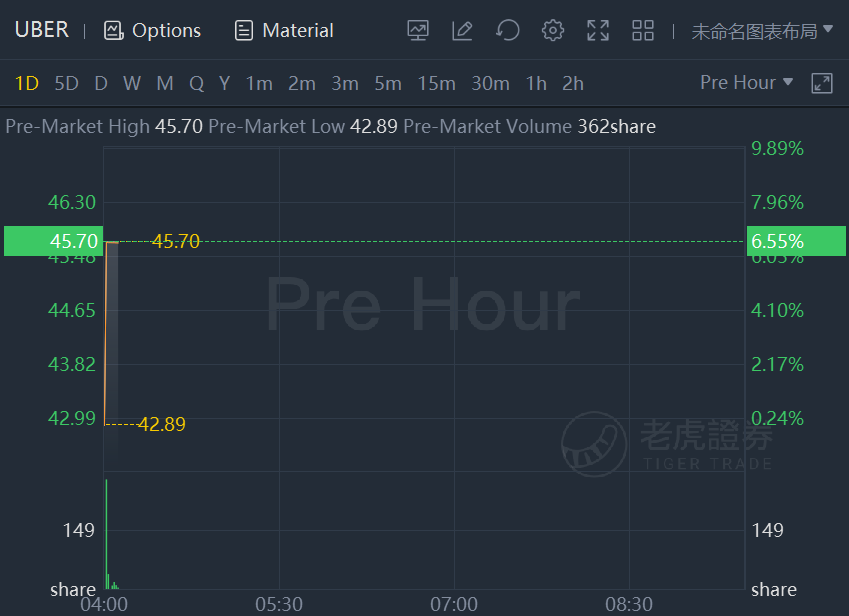

Lyft and Uber shares jumped in premarket trading after Lyft reporting outstanding quarterly results.Uber will report its third quarter earnings after hours on Thursday.

Lyft Inc. reported third-quarter revenue 73% higher than last year, boosted by demand for ride-hailing services amid improving Covid-19 conditions.

The company reported adjusted earnings before tax, depreciation and other expenses of $67.3 million, beating Wall Street estimates of $33 million, and marking Lyft’s second quarterly adjusted profit.

Revenue hit $864 million in the three months ended September 30, the San Francisco-based company said in a statement Tuesday. That beat the $862 million analysts had projected, according to data compiled by Bloomberg.

Lyft reported 18.9 million active riders, a 51% increase from the same period last year, but short of the 19.3 million analysts predicted. The company’s revenue per active rider reached a record $45.63 -- an increase driven by customers taking rides more frequently.

Lyft co-founder and President John Zimmer said airport rides, which were up threefold compared to a year earlier, coupled with a rise in weekend and evening trips, was a positive sign that customers are reverting back to pre-pandemic habits. “We feel great about rider demand,” Zimmer told Bloomberg. “And since the release of booster shots, and children’s vaccinations becoming available, I feel good about the road ahead.”

While the delta variant kept more people indoors and out of Lyfts over the summer, Covid-19 vaccination rates have continued to rise in the U.S., with President Joe Biden’s directive spurring more private employers to mandate shots or testing. Falling numbers of cases in the U.S. have boosted Lyft, which only operates in North America.

But even as riders return, Lyft and its larger rival, Uber Technologies Inc., have struggled to find enough drivers. Lyft has poured millions of dollars into incentives and bonuses to entice drivers who are hesitant to return, sometimes because they have unemployment benefits or health concerns.

Driver supply increased 45% in the third quarter versus the same period last year. “We’ve seen [driver supply] levels improve materially and see a path for less dynamic pricing as we get the marketplace balance stabilized,” Zimmer said.

Lyft has worked to become profitable, slashing costs with a wave of layoffs and budget cuts at the height of the pandemic, and agreeing to offload its self-driving division to a subsidiary of Toyota Motor Corp. in April, cutting costly autonomous car research expenses.

Lyft reported its net loss narrowed to $71.5 million, or a loss of 21 cents a share, from a loss of $459.5 million, or $1.46 a share, a year earlier.

精彩评论