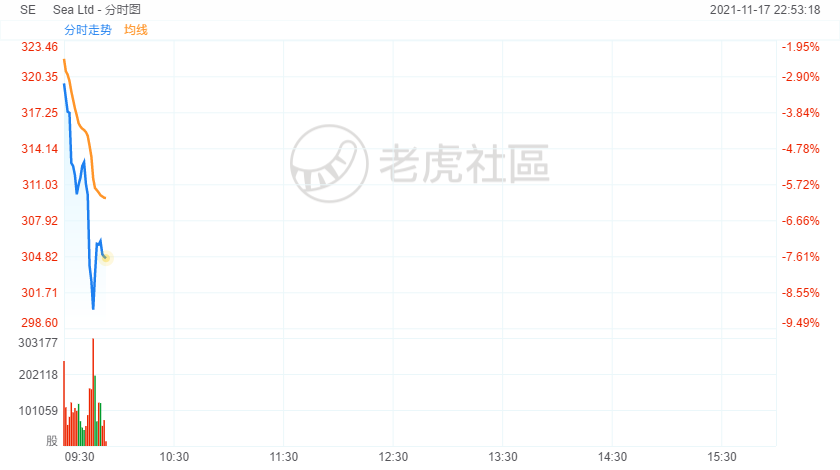

Sea shares fell more than 7% after cut to Neutral at BofA on slowing growth.

Bank of America analyst Sachin Salgaonkar downgrades the stock to a Neutral rating from a Buy.

In addition, Sea kept gaming guidance unchanged, which implies slowing growth in Q4, Salgaonkar writes in a note to clients.

The analyst sees a balanced risk/reward for the stock; shares climb 85% Y/Y.

"We cut our gaming revenue estimates to factor in a slowdown and increase e-com losses as we factor increasing cash-burn," the analyst notes.

Lowers full-year 2022 loss per share estimate to $5.72 and 2023 to $4.45 per share.

"Consensus is yet to factor in rising losses in the medium term based on expansion into new markets in Europe/India."

The Neutral rating agrees theNeutral Quant Rating, with the best factor grade in Momentum and the worst in Valuation.

However, the Neutral rating diverges from the Very BullishWall Street Analyst Rating(18 Very Bullish, 7 Bullish).

Previously, (June 10) Sea gotupgraded to Buy at BofA.

精彩评论