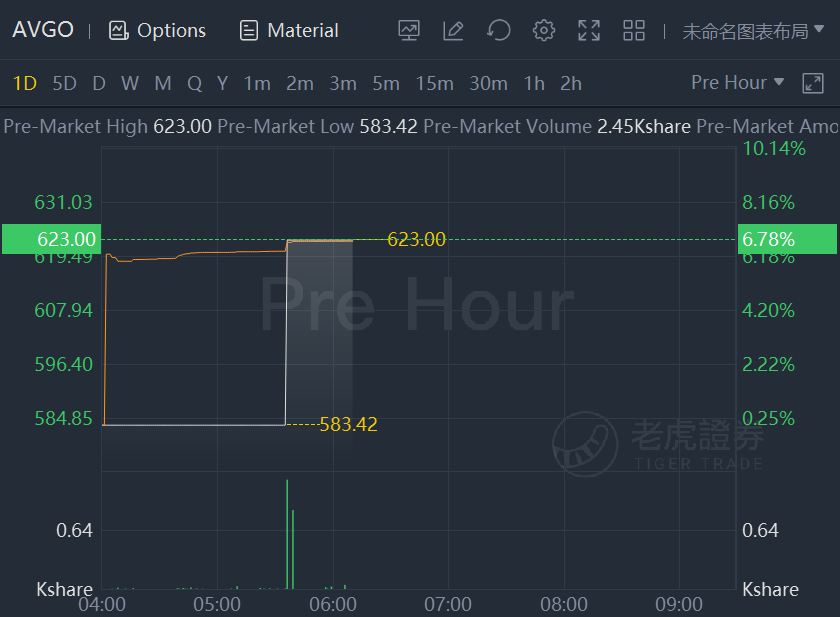

Broadcom stock jumped nearly 7% in premarket trading as the semiconductor firm saw upbeat first-quarter sales, unveiled $10 bln buyback plan.

Semiconductor firm Broadcom Inc forecast first-quarter revenue above Wall Street expectations and announced a $10 billion share buyback plan on Thursday, banking on a rebound in enterprise spending and sustained demand from cloud computing companies.

Analysts have pointed to strong near-term demand for Broadcom's radio frequency and wireless chips as telecom firms spend more to roll out 5G technology, and continued strength in its broadband division. The company counts smartphone giants Apple Inc and Samsung Electronics among major customers.

Broadcom is also poised to benefit from higher demand for its data-center and server chips, aided by a rise in hybrid working models and a rapid shift to cloud by businesses during the pandemic.

Enterprise demand rebounded sharply over 30% in the reported quarter, while revenue from semiconductor solutions is expected to grow 17% in the current quarter, Chief Executive Hock Tan said on a conference call with analysts.

The San Jose, California-based company forecast first-quarter revenue of about $7.60 billion, well above analysts' average estimate of $7.25 billion, according to Refinitiv data.

Fourth-quarter revenue rose 15% to $7.41 billion, narrowly beating estimates of $7.36 billion, while earnings per share of $7.81 was also better than expected.

Broadcom has also diversified beyond its core chip business and forayed into the lucrative software arena, at a time when the world grapples with supply chain disruptions and an industry-wide chip shortage. Its infrastructure software revenue grew 8% to $1.77 billion in the fourth quarter.

The new share repurchase program is effective until the end of next year, the company said in a separate statement.

精彩评论