The quarterly scorecards for the electric vehicle manufacturers are in and despite industry-wide constraints and macroeconomic handicaps, performances for the month of March, as well as the first quarter, have been strong.

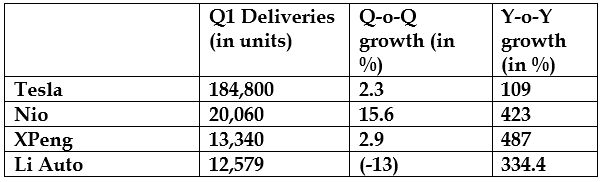

Here's a comparative take on first-quarter deliveries of Tesla, Inc.TSLA 4.43%and the Chinese EV playersLi Auto Inc.LI 1.23%,XPeng Inc.XPEV 2.57%andNIO LimitedNIO 0.87%:

Q1 EV Scorecard:Tesladelivered184,800 vehicles in the first quarter, with 99% of these being Model 3/Y vehicles. This represented a 2.3% quarterly increase and a 109% year-over-year jump.

In comparison, Nio's first-quarter deliveries jumped 423% year-over-year to 20,060 vehicles. This represented a 15.6% quarter-over-quarter increase. The company currently sells three SUV models, namely ES6, ES8 and EC6.

XPeng, which has a SUV named G3 and a sedan named P7, said its first-quarter deliveries totaled 13,340. This represents 487% year-over-year growth and a 2.9% quarter-over-quarter rise.

Li Auto, which sells Li ONE SUV, reported deliveries of 12,579 for the first quarter, a climb of 334.4% from last year. On a quarter-over-quarter basis, deliveries fell 13%.

Takeaways:Going by absolute numbers, Tesla by far is the largest player in the EV arena. Nio's first-quarter deliveries were roughly 11% of what Tesla sold in the quarter. The EV market is turning out to be a crowded field with legacy automakers, pure-play EV companies, as well as tech companies, all flexing their muscles.

Against this backdrop, the market is likely to get more fragmented than ever before, and incumbents will have a true challenge in maintaining or growing their share. The first-mover advantage has placed Tesla in a dominant position in the market, which others might find too difficult to challenge.

However, Nio stands out in terms of growth. The company managed to grow decently both on a year-over-year and quarter-over-quarter basis.

Looking Forward:Sell-side is largely bullish on the EV industry as a whole. The Biden Administration's EV commitment and brisk demand in China and Europe are likely to propel the EV sector into a "Golden Age," with a new auto supply of OEMs, battery, recycling, commercial vehicles, trucks and fleet conversions being built over the next decade, Wedbush's Daniel Ives said in a recent note.For Nio and Xpeng,quarterly performancesrepresented the biggest ever on record.

Takeaways:Going by absolute numbers, Tesla by far is the largest player in the EV arena. Nio's first-quarter deliveries were roughly 11% of what Tesla sold in the quarter. The EV market is turning out to be a crowded field with legacy automakers, pure-play EV companies, as well as tech companies, all flexing their muscles.

Against this backdrop, the market is likely to get more fragmented than ever before, and incumbents will have a true challenge in maintaining or growing their share. The first-mover advantage has placed Tesla in a dominant position in the market, which others might find too difficult to challenge.

However, Nio stands out in terms of growth. The company managed to grow decently both on a year-over-year and quarter-over-quarter basis.

Looking Forward:Sell-side is largely bullish on the EV industry as a whole. The Biden Administration's EV commitment and brisk demand in China and Europe are likely to propel the EV sector into a "Golden Age," with a new auto supply of OEMs, battery, recycling, commercial vehicles, trucks and fleet conversions being built over the next decade, Wedbush's Daniel Ives said in a recent note.

The analyst sees EV stocks moving 30-40% higher the rest of the year as the Street further digests this transformational growth on the horizon.

Those firms which pursue innovation in technology and services, are customer-centric and provide value for buyers will leave the others behind in this "hot-and-happening" market.

EV Price Action:Reacting to the quarterly numbers, Tesla shares were up 4.43% to $691.05. Nio and XPeng and Li Auto shares are lower following Thursday's upside in reaction to their numbers.

Nio was down 0.88% to $39.31, XPeng was down 2.54% to $36.01 and Li Auto was down 1.23% to $24.94.

精彩评论