Stocks edged lower on Friday as investors remain cautious due to a resurgent Covid virus, a Federal Reserve meeting next week and a historical tendency for September to be a weak month for equities.

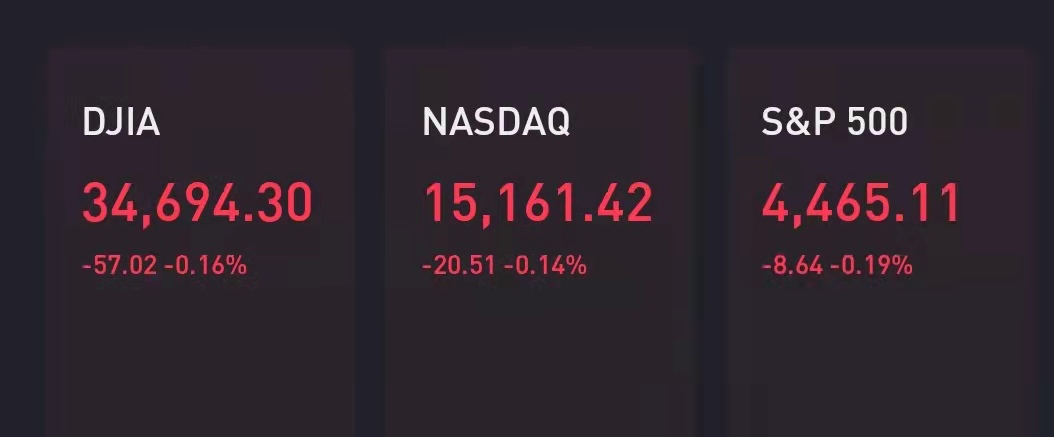

The Dow Jones Industrial Average lost about 57 points. The S&P 500 shed 0.2% and the Nasdaq Composite lost 0.1%

History is not on the market's side with the S&P 500 averaging a 0.4% decline for September, the worst of any month, according to the Stock Trader's Almanac. Friday in particular begins a historically weak period for stocks as those September losses typically come in the back half of the month.

Some of the volatility that comes during September is often surrounding so-called quadruple witching, which occurs at the close Friday. This is the expiration of stock index futures, stock index options, stock options, and single-stock futures.

"We expect volatility to increase over the next month driven by a seasonal pickup in investor uncertainty, continued virus uncertainty, and significant monetary and fiscal policy catalysts," wrote John Marshall, head of derivatives research for Goldman Sachs, in a note Friday. Marshall cited data showing S&P 500 volatility typically increased by 27% from August to October.

Still, stocks are heading into Friday with modest gains for the week. The Dow is up 0.41% and the S&P 500 is up 0.34% since Monday. The Nasdaq Composite has gained 0.44% this week. For the month, stocks are in the red. The Dow is down 1.7% in September. The S&P 500 is off by 1.1% this month but still just 1.6% from its all-time high. The Nasdaq has lost 0.5% this month.

On Thursday, the Dow Jones Industrial Average lost 63 points, after being down as much as 274 points at its low. The S&P 500 fell 0.16%. The Nasdaq Composite was the outperformer, rising 0.13% as Netflix, Microsoft and Amazon all closed in the green.

The Census Bureau reported Thursday that August's retail sales increased 0.7% for the month against the Dow Jones estimate of a decline of 0.8%. However, the retail sales beat came after the initial estimate for July was revised down sharply from a month-over-month gain of 0.5% to a decline of 1.8%.

A separate economic report showed that weekly jobless claims increased to 332,000 for the week ended Sept. 11, according to the Labor Department. The Dow Jones estimate was for 320,000.

“The economy is widely thought to be slowing under the weight of the Delta variant. Combined with a bad historic September stock market seasonality and ongoing fears of inflation, has caused investors to recently turn cautious,” said Jim Paulsen, chief investment strategist for Leuthold Group. “With economic growth unexpectedly reviving again, investors are questioning whether they have been too cautious keeping a bid under the overall stock market.”

The Federal Reserve meets for two days next week and on Wednesday is expected to give further clues as to when it may start to slow its $120 billion in monthly bond purchases that have supported the recovery, but also perhaps aided in a jump in inflation. Fed Chief Jerome Powell has said the so-called tapering could occur this year, but investors are waiting for more specifics. Some investors fear a decline in asset prices as the central bank begins to take away its easy policies.

Shares of Invesco jumped after the Wall Street Journal reported the money manager is in talks to combine with State Street’s asset-management business. Invesco, which manages about $1.5 trillion, jumped 6% in morning trading.

精彩评论