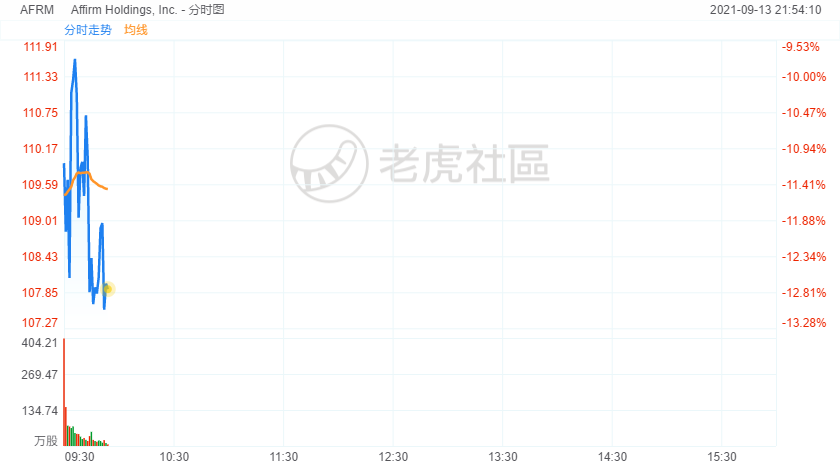

Affirm shares tumbled more than 12% in Monday morning trading.

As ecommerce trends picked up over the last year and a half, the companies that help facilitate payments also experienced a boon. Payment processing for merchants, peer lending firms, and even point-of-sale platforms benefitted from the industry’s massive rebound. From its business model of allowing customers to pay in fixed installments,Affirm Holdings, Inc.(AFRM) saw a huge spike in share price after recently reporting earnings results that were far beyond expectations.

Spelling out his neutral take on the matter is Ryan Carr of Jefferies Group, who wrote that while the firm has seen overtly positive quarterly performance, obstacles remain in the form of increased competition and a normalization of larger market forces. These forces are in reference to the state of high liquidity levels and low interest rates due to U.S. federal fiscal intervention after the 2020 recession.

Carr assigned a Hold rating on the stock, and raised his price target to $82 from $56. Despite the large raise, this target still represents a possible 12-month downside of 33.71%.

Although the company is anticipated by Carr to expand along with positive ecommerce trends, several key drivers of growth may have begun to plateau. These include “merchant discount rates, Gain on Sale margins, credit losses, and cost of funds,” and could result in a “tug-of-war on profitability” as operating leverage decelerates.

精彩评论