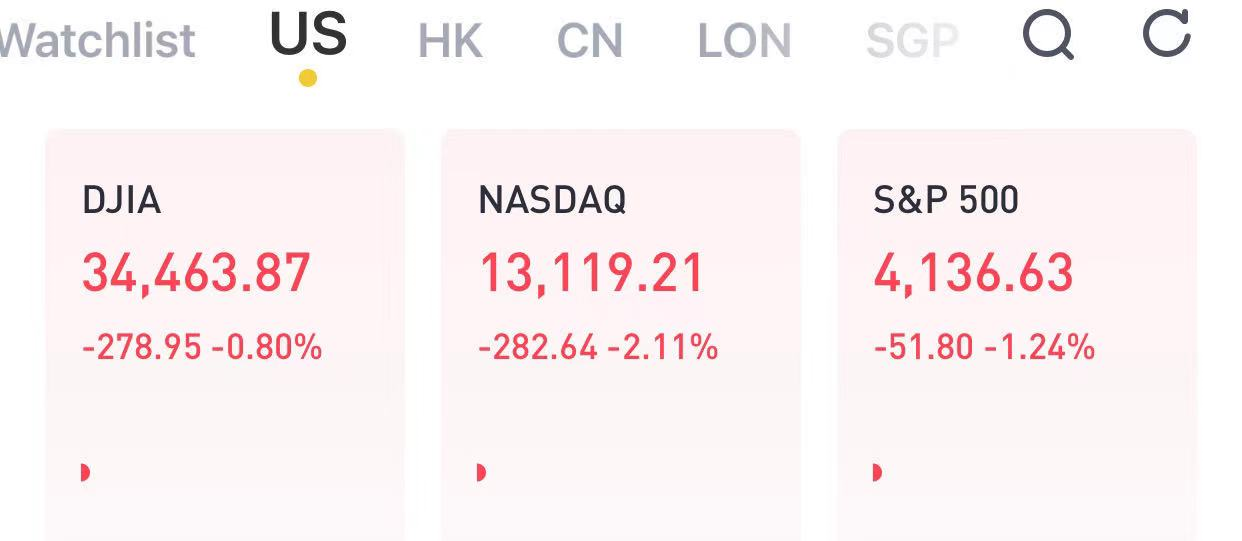

(May 11) U.S. stocks slump at Tuesday's open as inflation fears continue to buffett tech stocks. Nasdaq sheds another 2% as Big Tech sell-off intensifies, Dow drops nearly 300 points.

Tesla shares, the poster boy for growth stocks with lofty valuations and expectations, fell nearly 7% in premarket trading. A Reuters report that the electric carmaker halted plans to expand its Shanghai plant into an export hub, also aided the decline.

“It was an intensification and acceleration in money rotating towards sectors that are more exposed to 1) An economic reflation (so cyclicals) and 2) Rising inflation,” Tom Essaye, founder of Sevens Report, said in a note.

Tech shares, which were the biggest pandemic winners, fell out of favor earlier this year as fears of inflation and higher interest rates crept up. Growth-oriented companies tend to get hit hard by rising rates as they erode the value of their future earnings.

The latest headlines including a labor shortage as well as a jump in Consumer Price Index in March helped fuel inflation worries and accelerate selling of tech shares.

Big Tech got clobbered on Monday as investors exited stocks likeAppleandMicrosoft, dragging the Dow Jones Industrial Average and the S&P 500 off their record highs in the process. Both of those stocks lost at least 2% to start the week.

The Nasdaq Composite suffered the worse of the selling and fell 2.5%, finishing the day at its session low on Monday. Facebook lost more than 4%, while Amazon and Netflix both dropped over 3%.Alphabetdipped more than 2% after a downgrade by Citigroup. Cathie Wood’s Ark Innovation ETF fell 5% toits lowest level since NovemberasTesla, its top holding, shed more than 6%.

The ARK Innovation ETF was down another 4% in premarket trading Tuesday.

The market is divided in May with the Nasdaq Composite down 4% and the Dow up 2.5% as investors rotate away from growth shares with relatively high valuations into value stocks that will benefit from the economy reopening from the pandemic and higher inflation.

The Technology Select SPDR (XLK) is down 3% so far in May, the worst of any of the market sectors. The XLK was down another 1.3% in premarket trading Tuesday.

The broader S&P 500 has managed to remain barely in the green for May amid this market rotation, but it may lose that gain if the tech selling intensifies and value stocks don’t pick up the slack.

Simon Property Groupsaw its stock retreat about 3% in the premarket despite better-than-expected numbers. The real estate property manager reported first-quarter earnings of $1.36 per share on revenues of $1.15 billion.

The Labor Department will on Tuesday publish the latest results of its Job Openings and Labor Turnover Survey. Several high-ranking Federal Reserve officials, including Governor Lael Brainard and New York Fed President John Williams, are also scheduled to deliver remarks.

精彩评论