(Sept 23) Remitly Global, Inc. opens for trading at $53, up about 23% from IPO price.

Seattle, Washington-based Remitly was founded to develop a platform to enable people to send cross-border remittances more easily and at a lower cost than traditional banking service providers.

Management is headed by co-founder, president and CEO Matthew Oppenheimer, who has been with the firm since inception and was previously employed by Barclays PLC(NYSE:BCS), a multinational bank.

The company’s primary offerings include:

- Mobile app

- Website

- Passbook KYC and identity verification

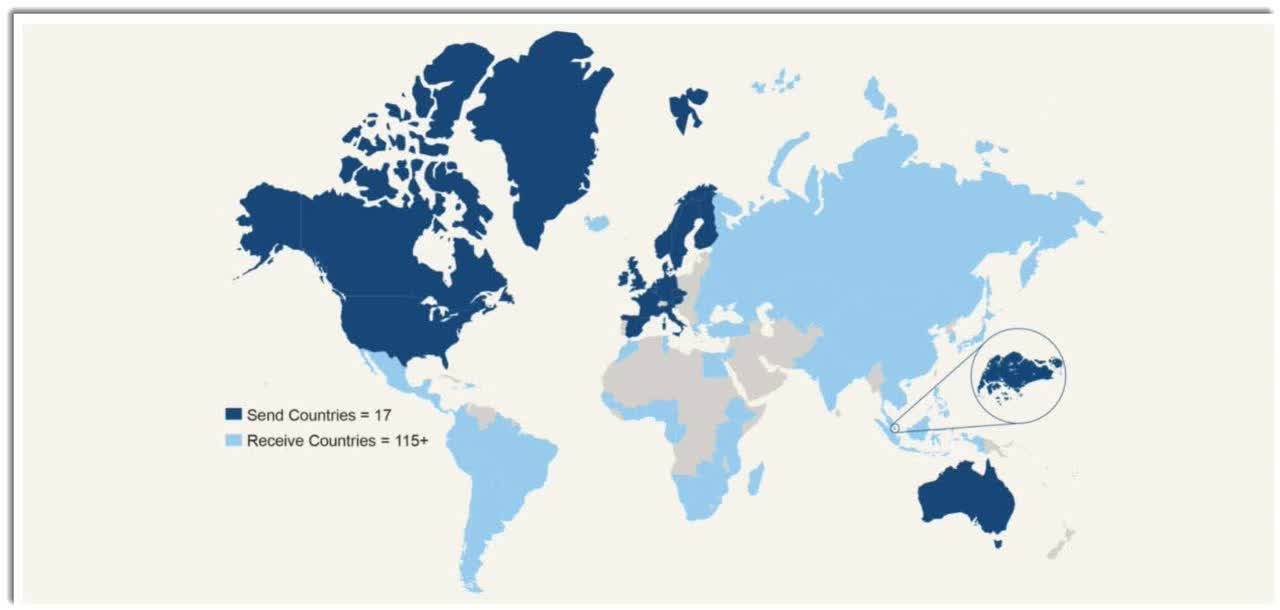

RELY's coverage map of send and receive countries is shown below:

Customer Acquisition

The firm focuses its development efforts on the over 280 million immigrants and their families who seek to send and receive money worldwide.

85% of the user base interacts primarily through its mobile application.

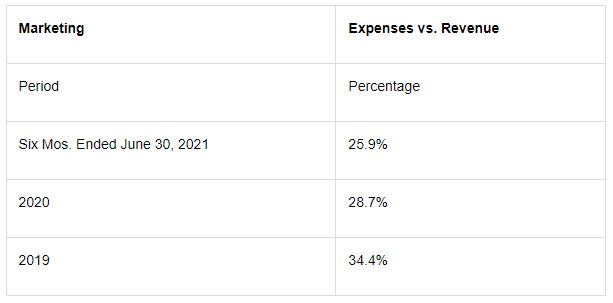

Marketing expenses as a percentage of total revenue have dropped markedly as revenues have increased, as the figures below indicate:

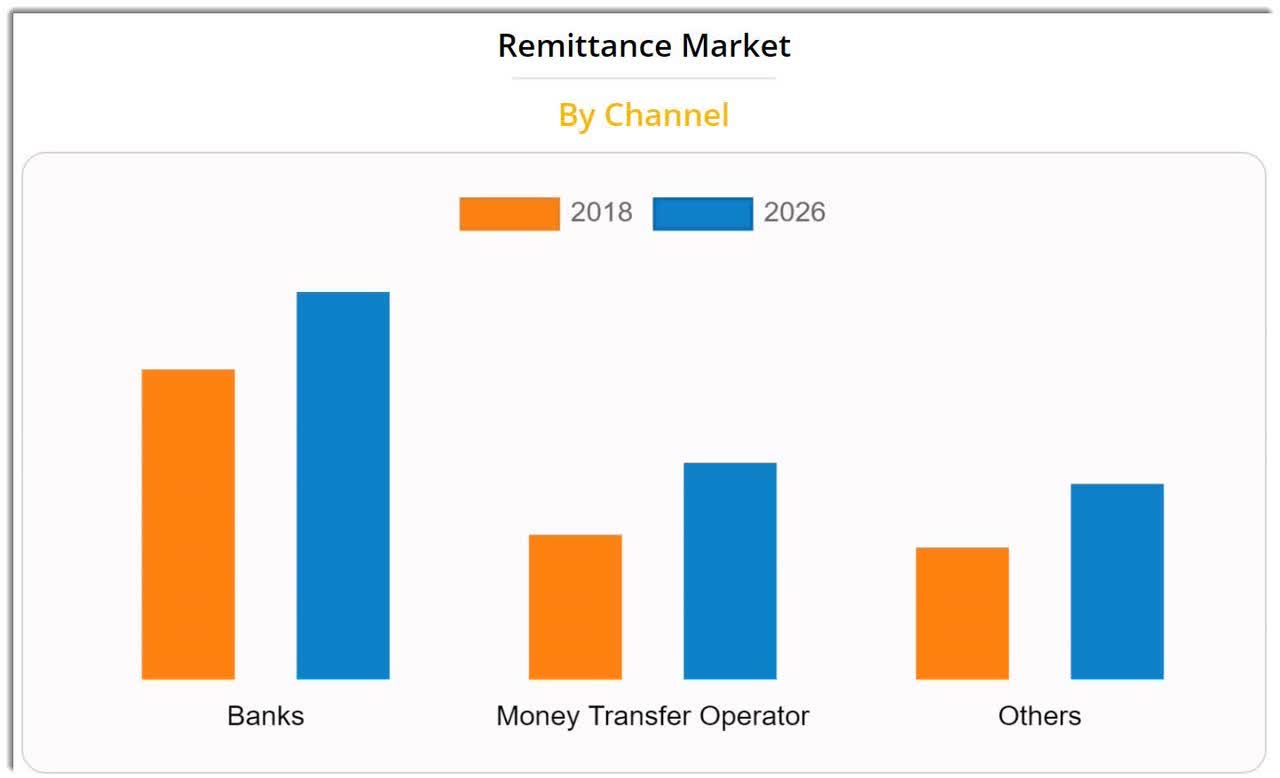

According to a 2020 marketresearch reportby Allied Market Research, the global remittance market was an estimated $683 billion in 2018 and is forecast to reach $930 billion by 2026.

This represents a forecast CAGR of 3.9% from 2019 to 2026.

The main drivers for this expected growth are an increase in population migration and growth in business remittances and more businesses producing goods and services for export.

Also, the chart below indicates that the bank segment will continue to dominate the global remittance market, at least through 2026:

(Source)

Major competitive or other industry participants by type include:

- Traditional providers and banks

- Digital-first cross-border providers

- Cryptocurrency systems

- Person-to-person informal channels

Financial Performance

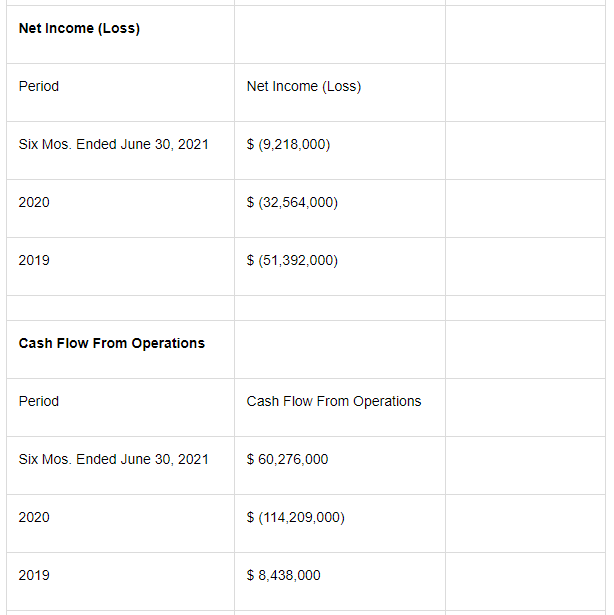

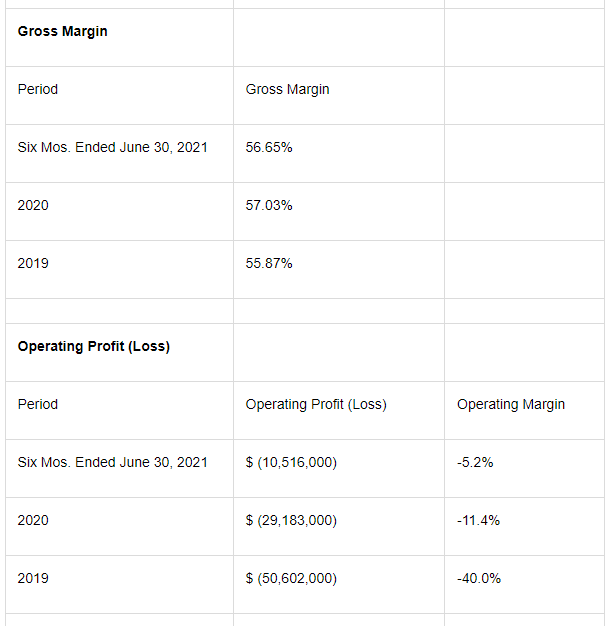

Remitly’s recent financial results can be summarized as follows:

- Sharply growing top line revenue

- Increasing gross profit

- Variable gross margin within a tight range

- Reduced operating losses and negative operating margin

- A sharp swing to positive cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

Free cash flow during the twelve months ended June 30, 2021, was negative ($10.6 million).

IPO Details

RELY intends to sell 12.2 million shares of common stock at a proposed midpoint price of $40.00 per share for gross proceeds of approximately $487 million, not including the sale of customary underwriter options.

Existing shareholder PayU Fintech has agreed to purchase shares of up to $25.0 million in a concurrent private placement at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (ex-underwriter options) would approximate $6.0 billion.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 7.53%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We currently intend to use the net proceeds we receive from this offering and the private placement for working capital and other general corporate purposes, which may include marketing, technology and product development, geographic or product expansions, general and administrative matters, and capital expenditures. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions, or businesses that complement our business. However, we do not have agreements or commitments for any acquisitions or investments outside the ordinary course of business at this time.

(Source)

Management’s presentation of the company roadshow isavailable here.

Regarding outstanding legal proceedings, management said the firm is not party to any legal or regulatory proceedings that would be material to its operations or financial condition.

Listed bookrunners of the IPO are Goldman Sachs, J.P. Morgan, and other investment banks.

Valuation Metrics

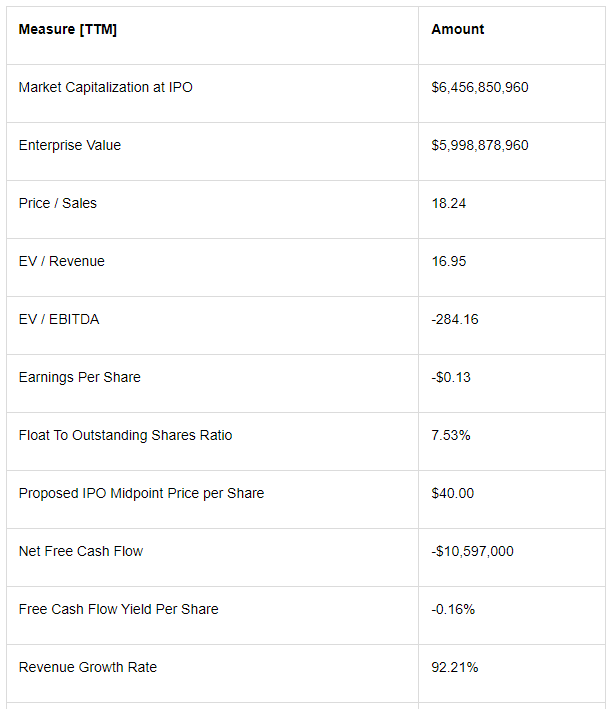

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Commentary

RELY is seeking to go public in the U.S. to provide capital for its corporate expansion plans.

The firm’s financials show strong top line revenue growth, reduced operating losses, and lowered negative operating margin and growing cash flow from operations.

Free cash flow for the twelve months ended June 30, 2021, was negative ($10.6 million).

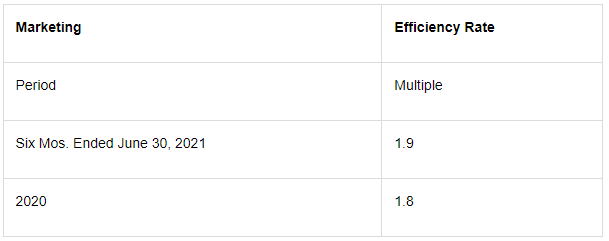

Marketing expenses as a percentage of total revenue have dropped as revenue has increased and its Marketing efficiency rate grew to 1.9x in the most recent report period.

The market opportunity for providing cross-border remittance services is very large and expected to grow as immigration continues to rise and businesses produce more goods for export.

Goldman Sachs is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 39.5% since their IPO. This is a mid-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is increased competition from cryptocurrency networks, although these networks have their own adoption hurdles and are still nascent.

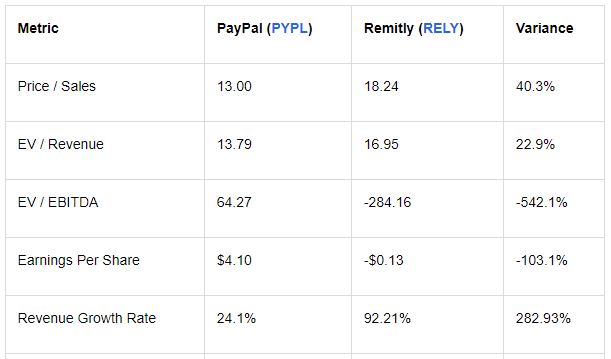

As for valuation, compared to PayPal, the firm’s revenue multiple expectation is higher, but RELY is also growing top line revenue at a much higher rate, although on a lower revenue base than PayPal.

RELY is clearly a fast-growing company that is approaching operating breakeven. However, the firm faces competition from fast-growing cryptocurrency networks which are making inroads into the traditional payment rails by companies such as Remitly.

I’m impressed by the firm’s growth but concerned as to whether that growth can continue at its present rate.

RELY is probably a fine investment opportunity, but I'll watch the IPO from the sidelines.

精彩评论