Here's a hint: It's not because Intel reported great news.

What happened

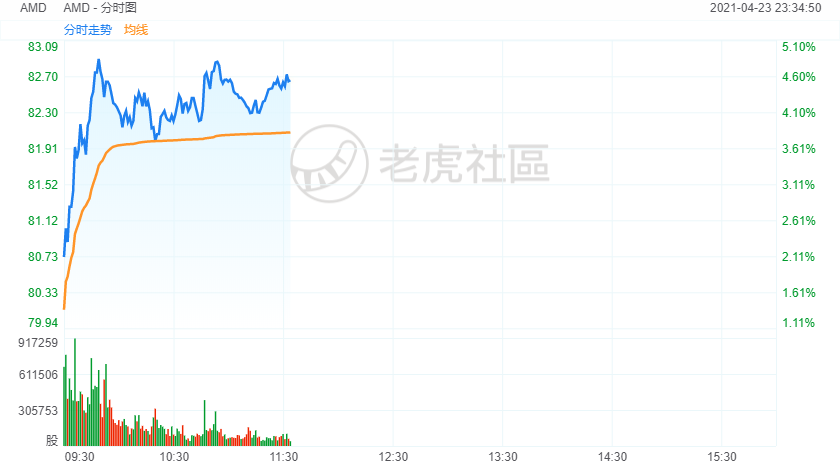

Shares of rising Intel (NASDAQ:INTC) rival and fellow semiconductors giant Advanced Micro Devices (NASDAQ:AMD) popped in early trading on the Nasdaq Friday, the first day afterIntel's disappointing Q1 2021 earnings report. AMD's shares were up 4.5% as of 11:30 a.m. EDT.

So what

Intel, if you haven't heard, actually beat on its Q1 earnings. Despite sales declining 1% year over year, the company managed to report a pro forma profit of $1.39 per share, which was ahead of analyst expectations.

Regardless, Intel reported a steep 540 basis point decline in its gross margin to 55.2%, and it saw its operating margin cut nearly in half as the company spent heavily to race to catch up to its rivals in advanced computer chips. Analysts at Citigroup commented yesterday that Intel stock appears to be close to its peak valuation and is likely to decline as investors acclimate to the new environment in which Intel is losing, not gaining, market share.

And the reason this is good news for AMD is that, according to Citi at least, it's AMD that's taking that market share away from Intel.

Now what

So what's an investor to do with all this information?

At a valuation of just 13.6 times trailing earnings, Intel stock certainly looks like a relative bargain when compared with AMD stock, which trades at 38.4 times earnings. But AMD has acash-rich balance sheet, versus Intel that's carrying $13.5 billion in net debt. And analysts see Intel's earnings growing only 10% annually over the next five years, while AMD is pegged for 29.5% annualized earnings growth, according toS&P Global Market Intelligencedata.

Intel may look like a value stockright now, but it's AMD that's gotall the momentum.

精彩评论