- Stock futures traded sideways Friday morning.

- Treasury yields rebound but still below recent highs.

- Turkey bans crypto payments, Bitcoin slides.

- Morgan Stanley, Sunrun, Comcast and more making the biggest moves premarket.

(April 16) Stock futures traded sideways Friday morning after another record-setting day on Wall Street, with a batch of stronger-than-expected economic data and corporate earnings results helping fuel a risk rally.

At 8:04 a.m. ET, Dow E-minis were up 49 points, or 0.14%, S&P 500 E-minis were rose 5.75 points, or 0.14% and Nasdaq 100 E-minis were gained 15.50 points, or 0.11%.

Treasury yields rebound but still below recent highs. Dip in 10-year Treasury yield seems to be technically driven, strategist says.

Stocks making the biggest moves premarket: Morgan Stanley, Sunrun, Comcast and more:

1) Morgan Stanley(MS) — Morgan Stanley topped analysts expectations forfirst quarter earningson the back of better-than-expected bond trading results, sending shares up in the premarket. The major U.S. bank reported earnings of $2.19 per share on revenue of $15.72 billion.

2) Sunrun(RUN) – Shares of the residential solar company jumped 3% after Simmons Energy upgraded the stock to an "overweight" rating. In a note to clients, the firm said the company has a strong growth story ahead, and that the recent weakness presents an attractive buying opportunity.

3) Cisco(CSCO) — Cisco shares rose 1.1% in premarket trading Friday after Wolfe Research upgraded the equity to “outperform.” Analyst Jeff Kvaal wrote that “Strong IT spending should prove a tailwind to Cisco estimates” through fiscal year 2022 and said shares should climb to $63, representing a 22% upside from Thursday’s close.

4) PNC Financial(PNC) — The bank stock dipped 1.9% in premarket trading even after PNC beat estimates on the top and bottom lines for its first-quarter report. PNC reported $4.10 in earnings per share on $4.22 billion in revenue. Analysts surveyed by Refinitiv had penciled in $2.75 per share and $4.12 billion in revenue. The bank’s net interest margin declined and missed expectations, according to FactSet.

5) Comcast(CMCSA) — Shares of Comcast rose 1.2% before the opening bell after Raymond James upgraded the stock to an “outperform” rating and told clients it expects strong first-quarter earnings results from the media giant. “We believe there is future NBCU upside from HSD strength, Peacock sub growth, improved theatrical revenue, and phased theme park reopenings,” wrote analyst Frank Louthan.

6) Simon Property Group(SPG) — Shares of the real estate company rose in premarket trading after Jefferies upgraded the stock to “buy” from “hold.” The Wall Street firm said “retailer investments, pent-up consumer demand, and lower bad debt are positive catalysts” for the mall owner.

7) Bank of New York Mellon(BK) — Shares of the bank ticked up 1% in premarket trading after Bank of New York Mellon beat analyst estimates in its first quarter report. The firm earned 97 cents per share on $3.92 billion in revenue. Analysts surveyed by Refinitiv were looking for 87 cents per share and $3.85 billion in revenue.

8) United Airlines(UAL) — Shares of the United Airlines popped in premarket trading following an upgrade to “buy” from “hold” from Argus. The Wall Street firm said it likes the airline’s plans to limit capacity, reduce structural costs by $2 billion, and restore margins to pre-pandemic levels.

9) Coinbase(COIN) — Shares of the newly public cryptocurrency exchange dipped in premarket trading on Friday. The weakness came despite another vote of confidence from popular investor Cathie Wood, whose Ark Invest purchased about $110 million of the stock on Thursday.

10) QuantumScape(QS) — Shares of QuantumScape gained 0.89% in premarket trading after dropping 12% in regular trading after a new short report from Scorpion Capital on the EV battery maker.Scorpion claims that its research indicated that the the company is "no different than other recently exposed SPAC promotions and EV frauds."Scorpion alleges that many of the claims the company has made such as fast charging to 80% in under 15 minutes are false.

The QuantumScape short was also revealed on Muddy Waters zerOes.tv.

QuantumScape said in a Twitter post that QS "stands by its data, which speaks for itself. We have provided higher transparency than any other solid-state battery effort we are aware of, with details on current density, temp, cycle life, cathode thickness, depth of discharge, cell area, pressure.""As our public filings have clearly stated, we have work to do, so this will be our last comment on this topic. We will now get back to work and continue to let our execution speak for itself," QuantumScape said in the Twitter post.

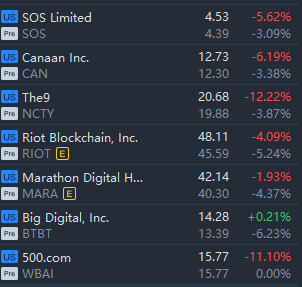

11) Most Blockchain stocks fell. Ebang surged 8%.

These are some of the main moves in financial markets:

Currencies

The Bloomberg Dollar Spot Index sank 0.1%.The euro jumped 0.2% to $1.1986.The British pound was little changed at $1.3785.The onshore yuan was little changed at 6.521 per dollar.The Japanese yen was little changed at 108.77 per dollar.

Bonds

The yield on 10-year Treasuries fell one basis point to 1.56%.The yield on two-year Treasuries climbed less than one basis point to 0.16%.Germany’s 10-year yield gained one basis point to -0.28%.Britain’s 10-year yield jumped two basis points to 0.755%.Japan’s 10-year yield increased less than one basis point to 0.093%.

Commodities

West Texas Intermediate crude declined 0.1% to $63.37 a barrel.Brent crude was little changed at $66.93 a barrel.Gold strengthened 0.7% to $1,776.66 an ounce.

Turkey bans crypto payments, Bitcoin slides

精彩评论