Roku gained 2.4 million new active accounts for the first quarter of 2021, showing that the pandemic-driven streaming momentum that buoyed its results in 2020 has slowed down. Meanwhile, the company smashed analyst expectations for Q1, including posting an unexpected profit.

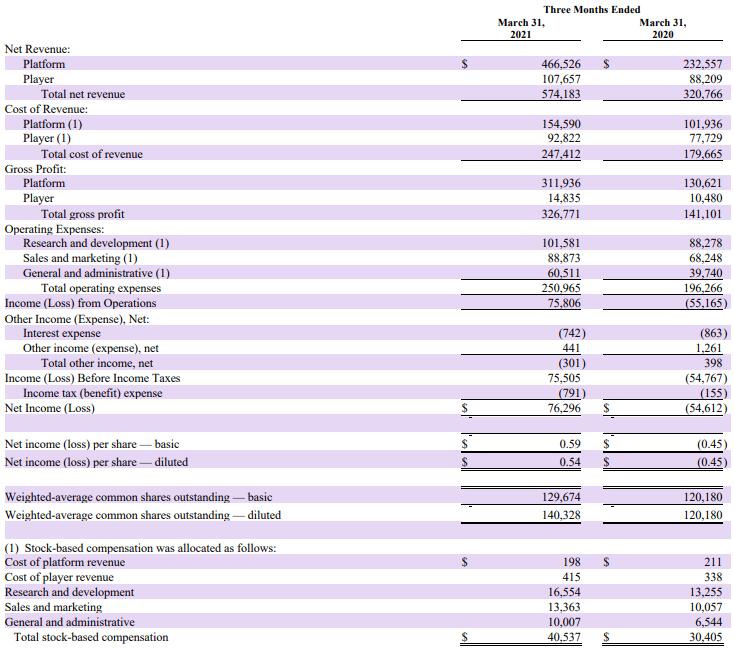

The streaming platform reported revenue of $574.2 million, up 79% year over year, and net income of $76.3 million (or 54 cents per diluted share) — after previously telling investors it was expecting a loss for Q1.

Wall Street analysts on average expected Roku to report Q1 revenue of $490.6 million and a loss of 13 cents per share.

“Though there will be difficult COVID-19-related comparisons in 2021, we believe that the shift to streaming is inevitable,” CEO Anthony Wood and CFO Steve Louden wrote in a letter to shareholders. “It will be global and will transform the way content is distributed and monetized.”

Roku’s Platform segment revenue — comprising ad sales and revenue-sharing deals with content partners — doubled in Q1, to $466.5 million. The company said streaming hours consumed on Roku devices increased by 1.4 billion hours over last quarter to 18.3 billion. In addition, Roku reported average revenue per user (ARPU) on a trailing 12-month basis hit $32.14 in Q1, up 32% year over year.

Roku’s Q1 earnings report comes after a public escalation in its fight with Google.Roku pulled YouTube TV from its channel store on April 30, alleging that Google was making anticompetitive demands for Roku to continue distribution of the core YouTube app. Google denied it was seeking any preferential treatment and claimed it was Roku that tied discussions over YouTube TV distribution with the deal to carry YouTube.

Roku’s stock price dropped more than 20% following the YouTube TV removal. In after-hours trading Thursday, shares were up as much as 8.9% on the strong Q1 earnings.

and net income of $10 million-$20 million.

The Roku Channel, the company’s free, ad-supported service that also provides access to live TV and SVOD channels, had another quarter of record growth, reaching U.S. households with an estimated 70 million people, more than doubling from Q1 2020. Another key stat: According to Roku, in the first three months of 2021, more than 85% of adults 18-49 who watched The Roku Channel were unduplicated with traditional TV.

To boost The Roku Channel’s momentum, the company has embarked on a strategy of acquiring and producing original content.

The companybought the now-defunct Quibicontent library in January — encompassing more than 75 original shows — which it isrebranding as “Roku Originals”and release them on its free-to-watch AVOD service soon. Roku Originals also will be the brand name for future original programming on The Roku Channel. And last month,Roku acquired This Old House Ventures, producer of “This Old House” and “Ask This Old House” TV shows, in a deal that included a library of more than 1,500 episodes.

“[W]e expect that our content investment will continue to be commensurate with the scale and growth trajectory of The Roku Channel,” Wood and Louden wrote.

精彩评论