A look at the day ahead from Tommy Wilkes.

Expectations for price rises are growing sharply. The latest milestone on Friday was in the euro zone where German price expectations climbed to 8-1/2 year highs as concerns grow that the European Central Bank will keep monetary policy on a dovish setting.

In the U.S. breakeven rates rose to their highest since 2012, while in Britain a record proportion -- 48% -- of the British public thinks inflation will accelerate over the next 12 months, according to data, amid ongoing energy price spikes and disruption in the supply chain.

But if the potential for self-fulfilling price rises is troubling the world's central banks as they look for ways to tame inflation without choking off economic growth, financial markets appear to be taking it all in their stride.

The S&P clocked up a new record close on Thursday, while Asian stocks -- given a boost by indebted developer Evergrande making a surprise interest payment -- rallied on Friday.

World stocks are now up 4.6% in October and just 1% off record highs as investors shrug off the spectre of higher inflation and tighter monetary policy and instead cheer another round of forecast-busting corporate earnings.

On Friday, European stocks looked mix at the open and Wall Street futures traded slightly below their record high.

Flash purchasing managers index survey data for October for the euro zone, Britain and the United States and due later will be watched closely by investors as a gauge of economic health.

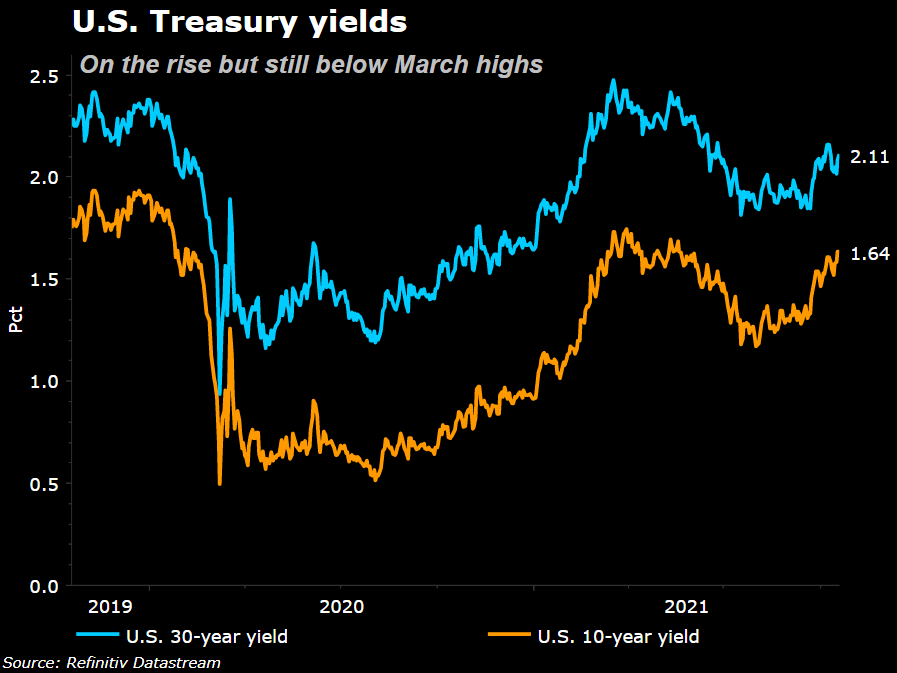

Oil prices dipped while 10-year U.S. Treasury yields flirted with 1.7%, the highest levels since May.

In company specific news, French carmaker Renault said its production losses in 2021 because of a global semiconductor chip shortage would be far larger than previously forecast but maintained its profit outlook. Drinks maker Remy Cointreau forecasted an "exceptional" current operating profit growth in the first half of its 2021/2022 fiscal year.

Key developments that should provide more direction to markets on Friday:

-Japan CPI

-Flash PMIs everywhere

-UK GfK consumer confidence/UK retail sales

-Fed speakers:Fed chair Jerome Powell, San Francisco President Mary Daly

-Emerging markets: Russia central bank meets

-European earnings: Pernod Ricard,

-U.S. earnings: American express, Schlumberger, Honeywell

精彩评论