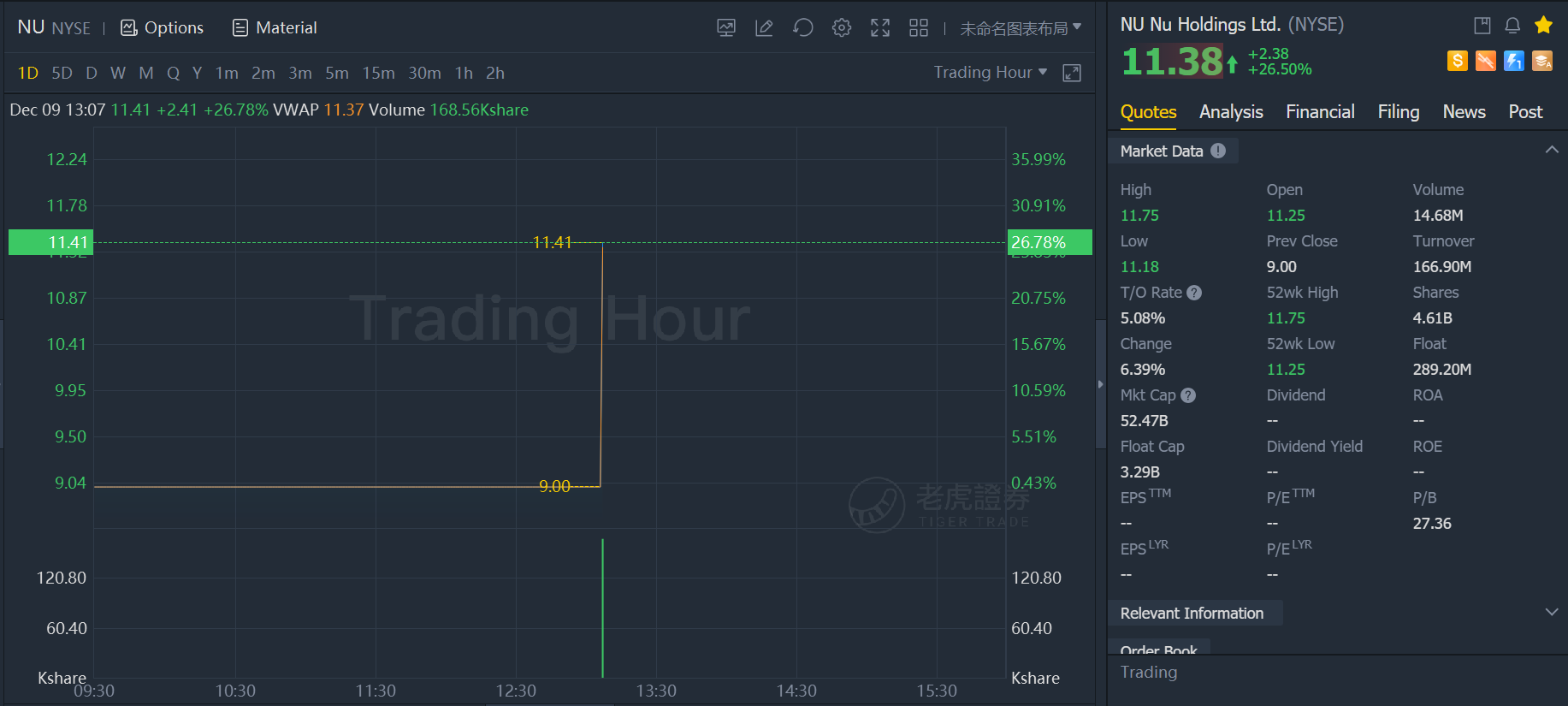

Brazilian fintech giant Nubank spikes 26% on its first day of trading.

Nu Holdings Ltd.(NU), whose backers include Warren Buffett’s Berkshire Hathaway Inc.,also known as Nubank, is headed for its public debut on the NYSE Thursday, as the Brazil-based digital banking platform's initial public offering priced overnight at the top of the expected range. The company raised $2.60 billion, as it sold 289.15 million shares in the IPO, which priced at $9, compared with the expected range of between $8 and $9 a share. With 4.61 billion shares expected after the IPO, the pricing values the company at about $41.48 billion. The stock is expected to begin trading some time after the open under the ticker symbol "NU."

Berkshire bought 10% of the shares in the offering, said a person familiar with the matter who asked not to be identified because it wasn’t public. Berkshire didn’t immediately respond to a request for comment sent to Buffett’s assistant.

Nubank’s IPO makes it the most valuable financial institution in Latin America, surpassing Itau Unibanco Holding SA, with a $38 billion market value.

Sequoia Capital, which invested $1 million in Nubank in 2013 in a seed round, now has a stake that is worth $7.1 billion at the $9 share price, based on the company’s filings. Other top shareholders include DST Global, Tencent and Tiger Global.

Berkshire’s Stake

Berkshire invested in Nubank in June, taking a $500 million stake valuing the company at $30 billion, a person familiar with the matter said at the time.

Nubank, the world’s biggest standalone digital bank, had more than 48 million customers across Brazil, Mexico and Colombia as of September. It provides easy-to-use financial products that come with relatively low fees.

Expansion Push

The company said it had a $99 million loss on revenue of $1.06 billion for the nine-month period ended Sept. 30. Interest income accounted for $607 million of that revenue, with fees and commissions making up the remainder.

Nubank warned investors to brace for “short-term profit implications” from the firm’s expansion push.

Chief Executive Officer David Velez will own a stake in the company worth about $8.9 billion at the IPO price. His co-founder, Cristina Junqueira, has a stake worth $1.1 billion.

Before creating the startup, Velez spent two years at Sequoia, trying to find an investment in Latin America. Instead he left with an idea of his own.

Velez, who’s Colombian, had a grueling experience opening a bank account in Brazil and enlisted Junqueira, fresh off a stint at Itau’s credit card unit, to help him create an alternative.

Brazil, like much of Latin America, is plagued by expensive financial services that are available to only a limited portion of the population. Century-old banks dominate the market beset by bureaucratic barriers. Still, a high percentage of the region’s 700 million people own mobile phones, making it an attractive target for digital banks.

Velez, whose Class B shares come with 20 votes each compared with one apiece for the Class A shares sold in the IPO, will hold 75% of the company’s voting power after the offering. Junqueira will control 9.3% of the voting power. Neither planned to sell shares in the offering, according to the filings.

精彩评论